Ah, Metaplanet. A name that, even to my ear, sounds suspiciously like a futuristic detergent. This Japanese concern, you see, is preparing to embark on yet another foray into the glittering, volatile world of Bitcoin-a world, one might add, populated by fervent believers and those who mistake exuberance for acumen. They propose to siphon off a rather substantial ¥130 billion (approximately $880 million, for those of us still clinging to conventional currencies) via a decidedly international share circus.

Metaplanet’s Bitcoin Obsession

The rather dry, typically bureaucratic language within a regulatory filing reveals the precise destination of this bounty: roughly $835 million earmarked for amassing more of the digital gold, that elusive Bitcoin. One imagines the company’s balance sheets trembling with anticipation. It’s a perfectly respectable addiction, of course, provided one possesses an inexhaustible appetite for risk and a rather flexible definition of “investment.”

To achieve this feat of financial engineering, they intend to unleash upon the market a flurry of 555 million new shares. A dilution, you say? Why, it’s practically a promotion! From a mere 722 million outstanding shares to a grand total of, oh, approximately 1.27 billion. Such delightful arithmetic! 📈

They are, naturally, hailed as “Japan’s MicroStrategy,” a moniker I suspect they find both flattering and faintly embarrassing. Indeed, Metaplanet has ascended to become a rather prominent, if somewhat eccentric, corporate accumulator of Bitcoin within the Asian landscape. CoinGecko’s meticulous calculations (one trembles at the precision!) rank them a respectable 8th among public companies in terms of BTC reserves, possessing a considerable 18,991 coins. A small fortune, really, if one believes in the inherent value of digital scarcity… or prefers counting pixels.

The funds, it must be noted, will be deployed… leisurely. Between September and October of 2025, they promise. Plenty of time, then, for the market to experience a few delightful oscillations. A further $43.9 million will be reserved for “Bitcoin-related financial operations,” a phrase delightfully vague enough to encompass anything from hiring a particularly astute numerologist to commissioning a solid-gold Bitcoin sculpture. 🏛️

This share sale, I am reliably informed, will be conducted exclusively on international avenues. Those in the United States will require the requisite qualifications to participate, satisfying the demands of Rule 144A. One must, after all, protect the unsophisticated investor from their own… enthusiasm.

Their most recent acquisition, a modest 103 BTC worth a little over $11 million, occurred earlier this week. Currently, their total Bitcoin holdings are valued around $2 billion-a sum that evokes images of vast, server-filled bunkers and furtive coding sessions. By 2027, they aspire to amass a herculean 210,000 BTC. A rather ambitious goal, wouldn’t you agree? Perhaps a touch… obsessive?

And lest we believe Metaplanet is alone in this peculiar endeavor, consider KindlyMD, a healthcare company announcing a $5 billion stock sale to further expand their own BTC reserves. David Bailey, the CEO, describes this move as “a natural next step.” Naturally. One wonders if future medical diagnoses will be rendered in satoshis.

The Great Bitcoin Scramble

Bitcoin, you see, possesses an inherent limitation: a fixed supply of 21 million coins. However, a rather unnerving number of these coins have vanished into the digital ether, residing in inaccessible wallets-a sort of digital Bermuda Triangle. This, naturally, reduces the circulating supply and fuels the accumulating frenzy.

Thus, a quiet, yet desperate race has commenced among corporations, institutions, and even, astonishingly, nation-states, to accumulate as much Bitcoin as possible before the price embarks on a truly stratospheric ascent. A Philippine congressman is even proposing a strategic Bitcoin reserve for the nation. One shudders to think of the geopolitical ramifications. 🌍

Dutch crypto firm Amdax plans a public Bitcoin treasury, while Nasdaq-listed Top Win International has secured a $10 million raise. And Marti Technologies in Turkey intends to allocate 20% of its cash reserves to Bitcoin. It appears rationality is, shall we say, taking a holiday.

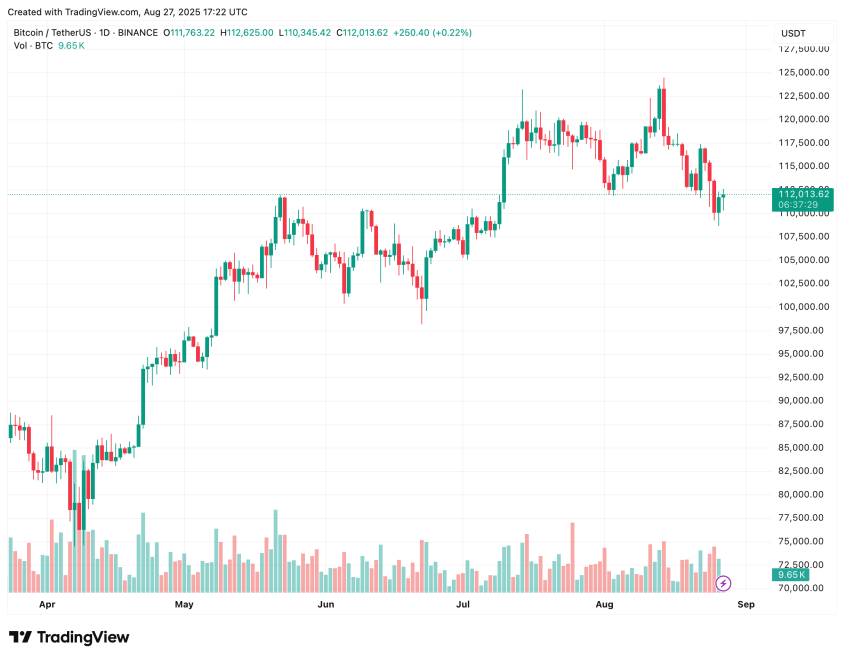

At present, Bitcoin trades at $112,013, enjoying a modest 1.9% gain in the last 24 hours. The stage, my dears, is set. The question is not if, but when. And whether this whole affair will conclude in a triumphant fanfare or a decidedly melancholic sigh.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-28 06:20