The digital shimmer, they say, continues. Bitcoin-a name that once tickled the fancy of cypherpunks and now adorns the dreams of suburban accountants-is presently exhibiting a peculiar sort of stasis, a delicate hovering above the pedestrian sum of $113,500. A consolidation, they call it. As if this blip of numerical progress requires a fancy euphemism. Dare we suggest, perhaps, it’s merely pausing for breath after a rather enthusiastic ascent?

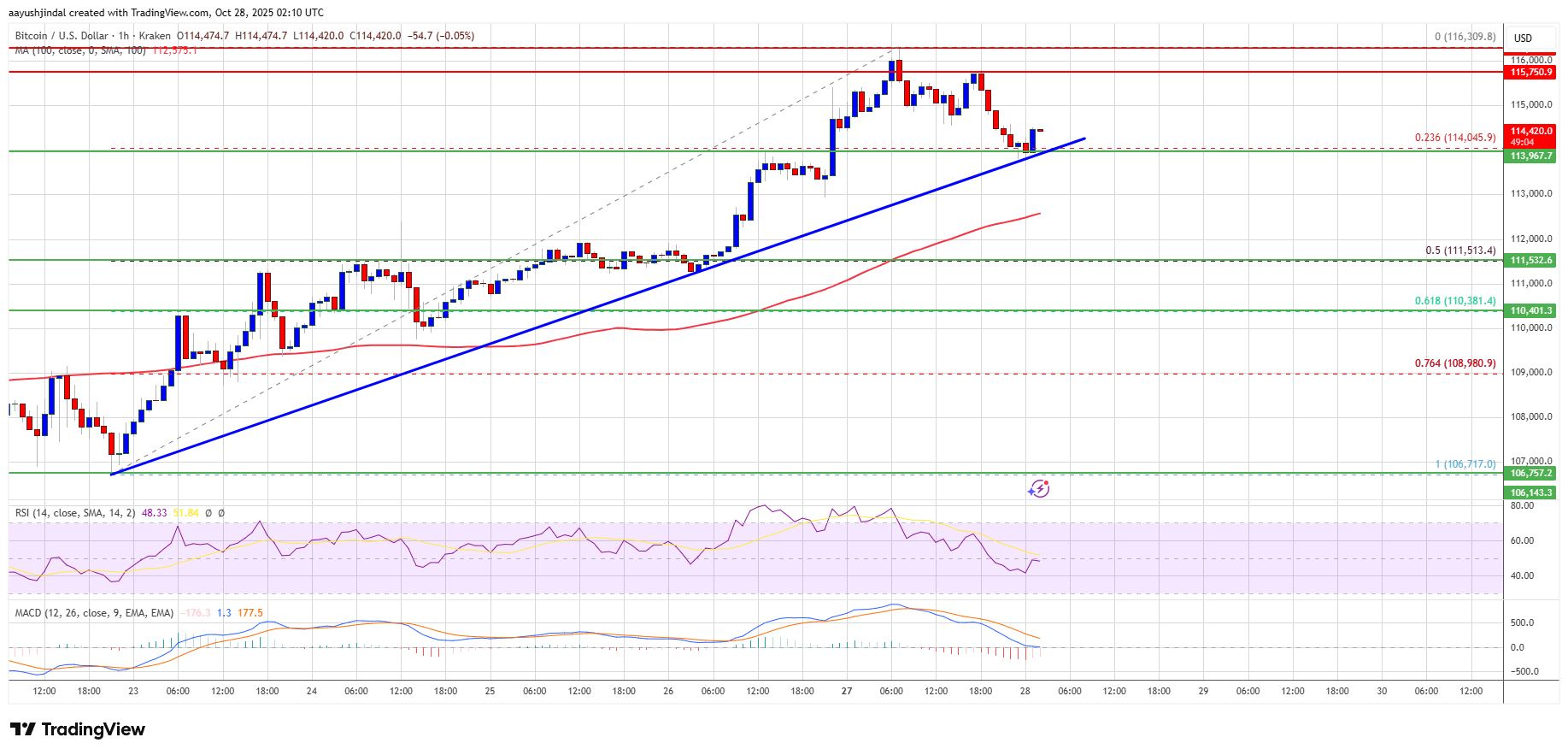

- It began, you see, with a rather pedestrian nudge upward, breaching the $114,000 mark – a number that sounds far more impressive than it feels.

- Currently, it flits above that figure – and, oh the excitement, the 100-hour Simple Moving Average! Such precision! 📊

- A “bullish trend line” is reportedly forming, a phrase guaranteed to induce narcolepsy in anyone not actively trading. It supports the price at $113,900, apparently, sourced from the oracle at Kraken.

- Should it deign to surpass the $115,750 zone – a particularly capricious number – further ascents are theoretically permissible.

A Momentary Truce in the Volatility

It established a base, this mercurial Bitcoin, and then indulged in a fresh increase, venturing north of $112,500. Gaining pace. A hurdle at $113,500 overcome – a feat worthy of a modest fanfare. This, inevitably, opened the doors to the tempting prospect of $115,000 and the aforementioned soporific Simple Moving Average.

A spike above $116,000! (One imagines a minor digital fireworks display.) Now, it’s consolidating like a particularly fussy collector of postage stamps, hovering above the 23.6% Fib retracement level-a term that, honestly, deserves a footnote of its own-calculated from a recent wave stretching between the humble $106,718 and the slightly more ambitious $116,309.

And there, lurking on the hourly chart, is that “bullish trend line,” offering support at $113,900. Bitcoin, alas, remains above $114,000. The tedium!

Next, they whisper, resistance awaits near $115,000. Then $115,500. And then…$115,750. A close above that – a true test of resolve! – might propel it further to $116,300. More gains? Perhaps a flirtation with $117,500. Before confronting the formidable barrier of $118,000. One almost feels a sense of narrative build-up. 🙄

The Ever-Present Threat of a Dip

But let us not become carried away. Should Bitcoin balk at the $115,500 mark – and Bitcoin is notoriously prone to balking – a decline is, shall we say, plausible. Support lurks near $114,000, followed by the more substantial $113,500, or the aforementioned trend line-a lifeline in a sea of numbers.

Further down, the abyss of $111,000 yawns. And beyond that, $110,500. A free-fall towards $108,500 threatens. Below that level, my dears, recovery becomes a matter for philosophers and optimists. A truly bleak prospect. 😫

As for the Technical Indicators (one shudders at the banality of the phrase):

The Hourly MACD is, apparently, gaining pace. In the “bullish zone,” naturally.

The Hourly RSI is above 50. A state of affairs that apparently signifies…something.

Major Support Levels: $114,000, and then $113,500.

Major Resistance Levels: $115,500 and $116,500. One is almost beginning to feel faint.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-10-28 05:33