- Bitcoin enters Wyckoff Phase E with a ‘golden cross,’ setting sights on $125K short-term.

- Analyst eyes $260K by August–September, citing shrinking withdrawal activity as a key driver.

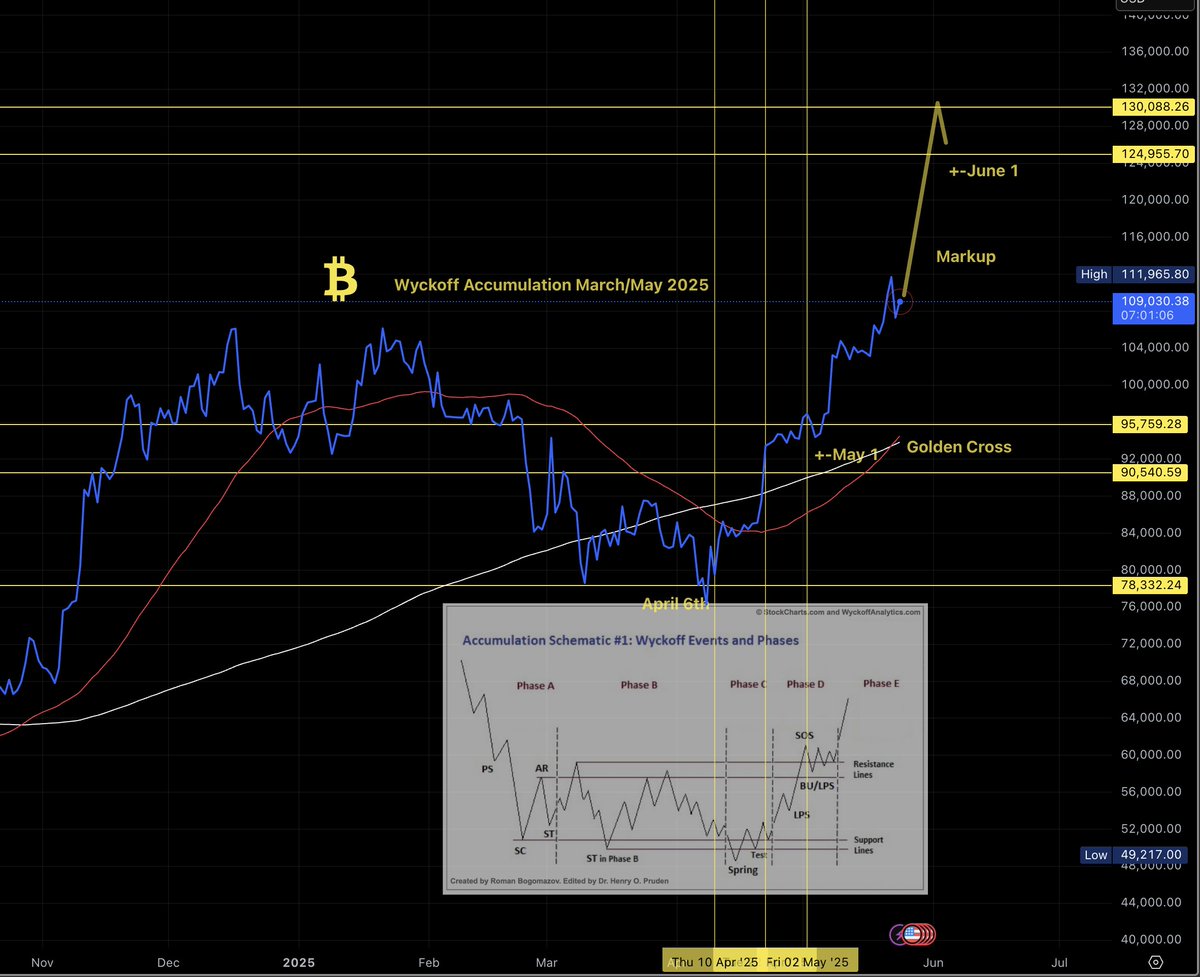

Bitcoin (BTC) has now moved into Phase E of the Wyckoff Accumulation model, which is characterized by a significant price increase following a breakout and sustained uptrend.

On May 24th, a significant technical event occurred – the 50-day Moving Average surpassed the 200-day Moving Average, creating what’s known as the ‘golden cross’ pattern in our daily chart.

The typical chart pattern is generally viewed as a positive, long-term indication for a bull market. It often signifies a change in investor feelings or attitudes.

As a researcher delving into market trends, I’ve noticed an intriguing development: several traders are aiming for the $125K benchmark – the initial significant barrier in this current price escalation phase.

The real question remains—what happens beyond that?

U.S. Senate crypto bills could initiate the next market phase

According to a well-respected financial expert’s post on Twitter, the upcoming cycle for Bitcoin might involve a period of distributing or collecting more coins, also known as a consolidation phase.

In his opinion, it’s most probable that there will be a resurgence (or re-accumulation) of cryptocurrencies, considering that the U.S. Senate is about to vote on significant crypto legislation in the near future.

Absolutely, regulatory occurrences can introduce market turbulence. Yet, they might also bolster institutional trust, particularly when there is a clear understanding of the classification of digital assets within the legal framework.

Addresses withdrawing Bitcoin are declining

On-chain metrics add fuel to the current rally.

The decrease in transactions that withdraw Bitcoin from exchanges – a crucial metric showing the frequency of Bitcoin transfers to personal wallets – might indicate that the pressure to sell could be lessening.

As I observe a downtrend, the lessening of selling force could function as a subtle catalyst for growth. This reduction in resistance above current levels might fuel the price’s forward movement.

As an analyst, I’m projecting that we might see a shift in price distribution toward approximately $260K by August or September, given the current market supply conditions remain constricted.

Policies and price action to watch

With Bitcoin firmly in Wyckoff Phase E and backed by a ‘golden cross,’ near-term momentum is firm.

Macro conditions like regulation and on-chain trends will, however, dictate what happens next.

If the market proceeds as planned, whether it’s a phase of re-accumulation or distribution will depend significantly on investor mood and the outcome of the ongoing Bitcoin legislative processes.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-05-26 00:14