Ah, the on-chain analytics firm Glassnode, in its infinite wisdom, has revealed that the investors who bought Bitcoin at its peak are not merely holding—they are clinging to their digital gold like a miser to his last kopek. Conviction, they say, not capitulation, is the name of the game. 🤑

The 3 to 6 Months Club: A Tale of Unyielding Grip

In a recent post on X, Glassnode, that oracle of blockchain data, has turned its gaze upon the “long-term holder” (LTH) cohort. These are the BTC investors who, having purchased their coins more than 155 days ago, have now entered the realm of the immovable. Statistically, the longer these coins gather dust, the less likely they are to budge. Truly, these LTHs are the stoic sentinels of the market. 🛡️

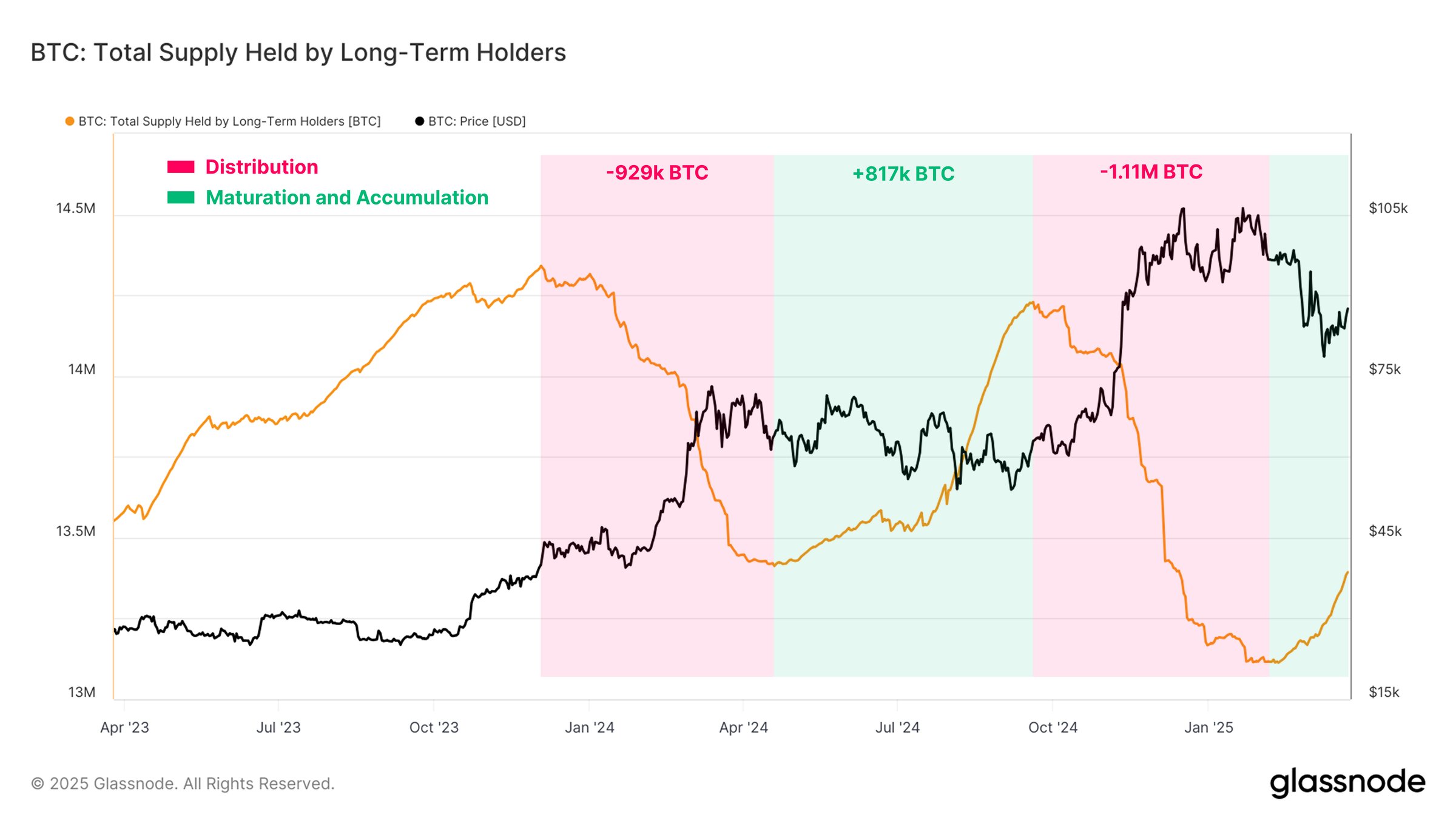

But let us not be fooled by their apparent steadfastness. These so-called ‘diamond hands’ are not above a bit of selling now and then. In fact, during two waves of selling in the current cycle alone, this group has offloaded a staggering 2 million BTC. A veritable fire sale, one might say. 🔥

From the graph above, one can see that the first LTH selloff was followed by a period of re-accumulation, bringing the group’s supply back to nearly its pre-distribution level. The second distribution phase, occurring between October 2024 and January 2025, is similarly being followed by an accumulation wave. “This cyclical balance may be stabilizing price action,” notes Glassnode, with the air of a philosopher pondering the mysteries of the universe. 🌌

It is worth noting that when the LTH supply rises, it does not signify any current buying. Rather, it indicates that some accumulation occurred 155 days ago, and those coins have now been held long enough to join the cohort. This five-month cutoff places the latest LTH acquisition point at the end of November, correlating to buying during the BTC rally to prices beyond $90,000. Many of these November buyers are now in the red, yet they hold on, earning their title as true HODLers. 🚀

But let us not forget the 3-month to 6-month group, those brave souls transitioning into the LTHs. Many of these investors bought at or near the price all-time high (ATH), and thus find themselves notably underwater today. Yet, they too have been showcasing strong conviction, as the amount of wealth held by them continues to rise despite Bitcoin’s struggles. 💪

Naturally, the weak hands who got in during the Bitcoin top would have already capitulated long ago, never maturing into the 3 to 6 months range. But it is still significant that those who remain are unshaken by the market’s volatility. Truly, they are the unsung heroes of this crypto saga. 🦸♂️

BTC Price: A Rollercoaster of Emotions

At the time of writing, Bitcoin is trading at around $84,300, down more than 3% in the last seven days. A minor dip in the grand scheme of things, but enough to send shivers down the spines of the faint-hearted. 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- M7 Pass Event Guide: All you need to know

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

2025-04-02 05:13