- BTC has, in its usual capricious manner, risen by a modest 1.37% over the past day. A mere whisper of hope in the cacophony of chaos.

- Bitcoin’s 3-6 million long-term holders, those stoic guardians of digital gold, have seen their wealth ascend sharply. A testament to their unyielding faith or perhaps their masochistic tendencies.

Over the past two months, Bitcoin [BTC] has danced on the edge of a knife, its volatility a cruel mistress to the faint-hearted. Yet, amidst this tempest, the long-term holders stand firm, their resolve unshaken, their wallets unopened.

Indeed, these paragons of patience have seen their wealth swell, defying the market’s whims. According to Glassnode, 3-6 million Bitcoin holders, particularly those transitioning into long-term holder status, have witnessed a sharp rise in their digital fortunes. A rise so sharp, it could cut through the doubts of even the most skeptical.

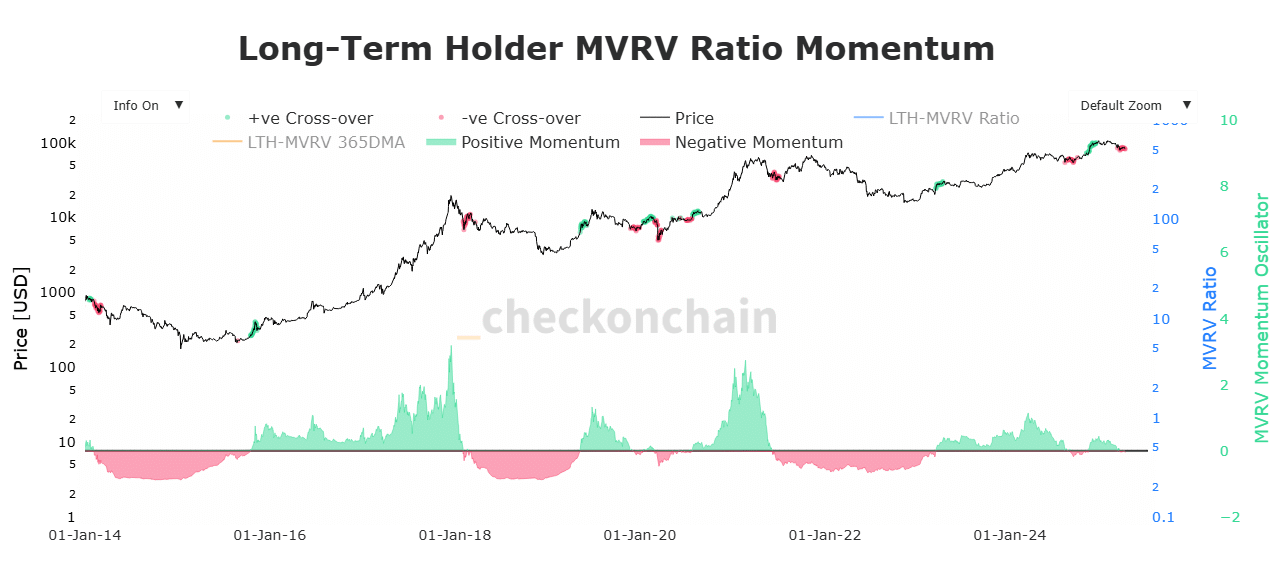

AMBCrypto, in its infinite wisdom, has identified this increasing wealth among long-term holders. The LTH MVRV ratio, that arcane metric of value, has maintained positive momentum since December 2024. A sign, perhaps, that these holders are not merely holding, but thriving.

This indicates that BTC’s value for long-term holders remains relatively high compared to its cost basis. Historically, such positive LTH MVRV momentum reflects renewed confidence among these holders. Confidence, or perhaps a stubborn refusal to admit defeat.

Although many of these coins were acquired near all-time high levels, their continued aging demonstrates conviction rather than signs of capitulation. Conviction, or perhaps a desperate hope that the market will one day validate their choices.

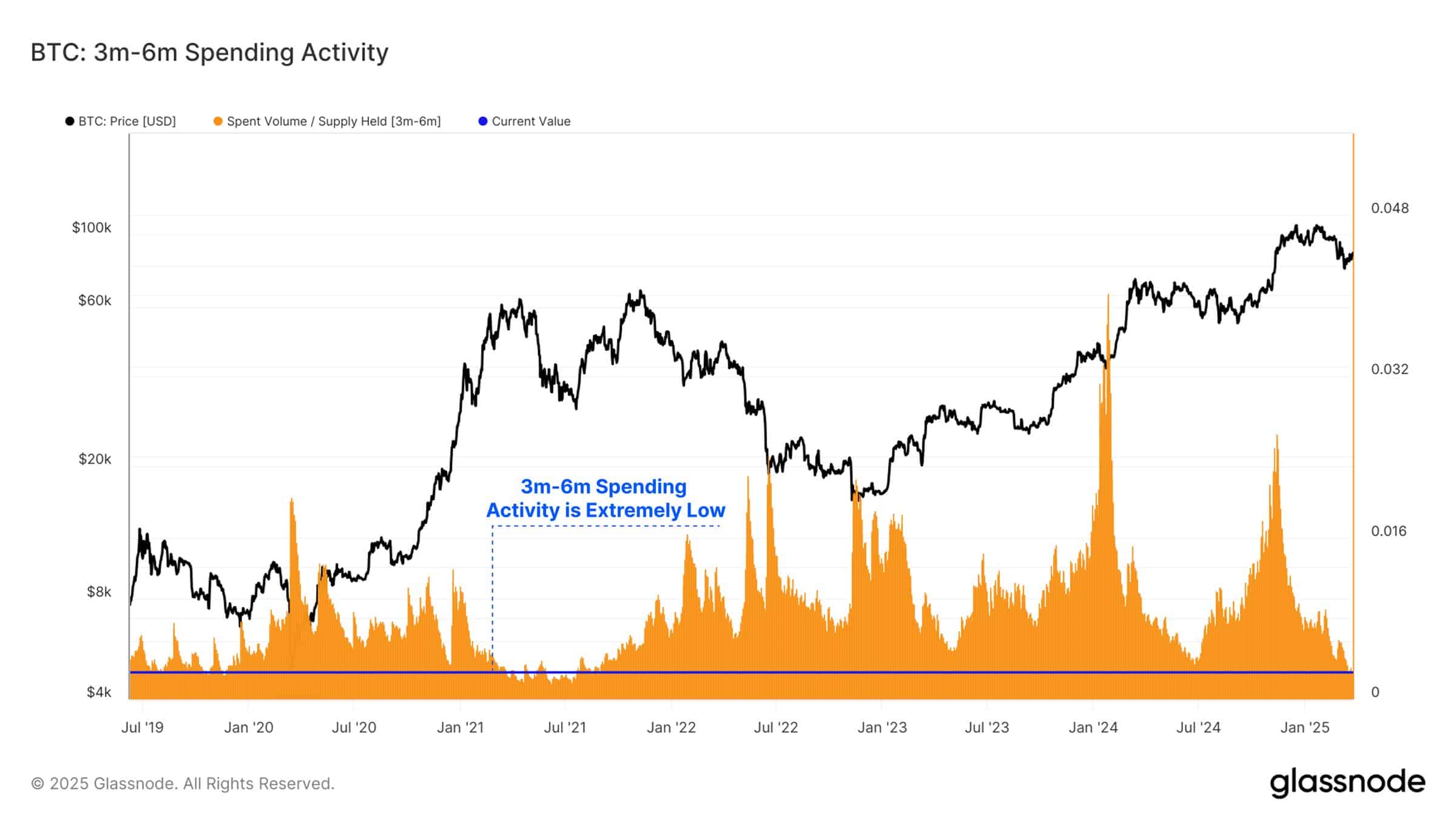

As long-term holders see their profits grow, they remain steadfast in holding their BTC. Spending activity from 3–6 million Bitcoin holders has dropped to its lowest level since mid-2021. A drop so low, it could be mistaken for a cry for help.

This reduced activity supports the notion that recent top buyers are maintaining their positions instead of selling, even amid ongoing market volatility. Maintaining their positions, or perhaps clinging to them like a life raft in a stormy sea.

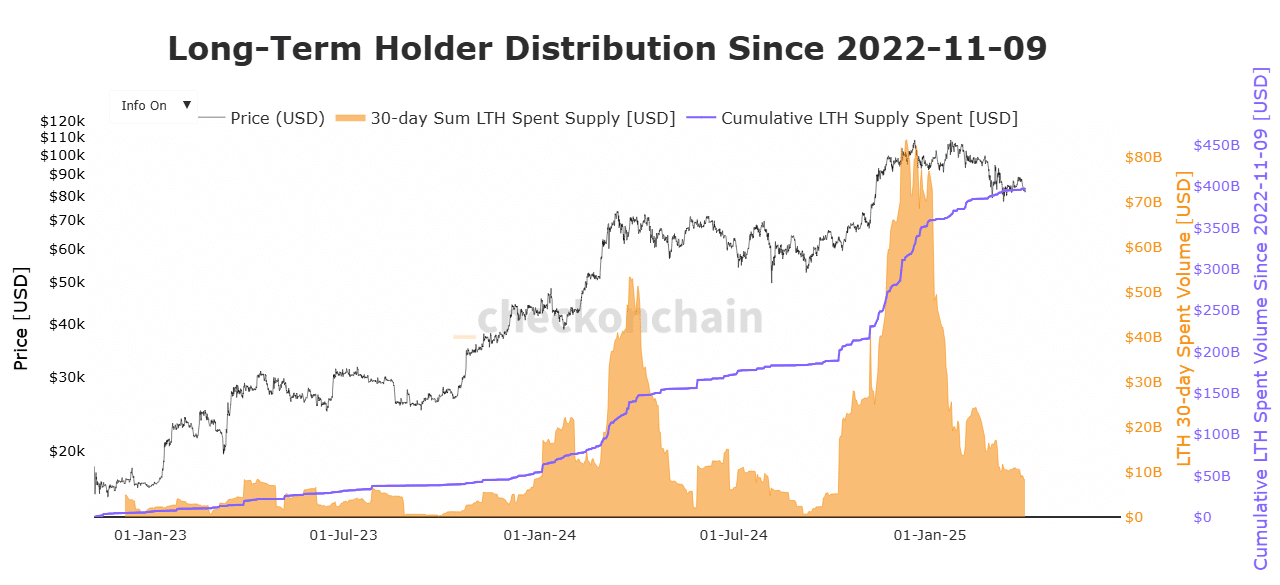

Therefore, Bitcoin’s LTH spent supply has seen a sustained decline since February 2025. As such, the amount spent has declined from a high of $18 billion to $8 billion as of the 31st of March 2025. A decline so steep, it could make a mountain jealous.

This suggests that holders are spending less and less BTC, reflecting a rising accumulation trend among LTH. With increased holding, it suggests that investors are optimistic about the long-term potential of BTC and anticipate more gains. Optimistic, or perhaps delusional.

Looking further, across the 2023-2025 cycle, long-term holders have distributed over 2 million BTC. This distribution has been followed by a strong re-accumulation, helping absorb the sell side pressure. A cycle so cyclical, it could make a Ferris wheel dizzy.

This cyclical balance has played a key role in stabilizing Bitcoin’s price action. Stabilizing, or perhaps just postponing the inevitable.

What it means for BTC

With long-term holders maintaining their optimism, Bitcoin is unlikely to face significant sell pressure, as this group continues to hold rather than sell. Hold, or perhaps hoard like a dragon with its treasure.

A reduced spending rate among long-term holders enables BTC to absorb selling pressure from short-term and speculative investors. Absorb, or perhaps endure like a martyr.

This balance between selling and accumulation suggests that Bitcoin will likely trade within a consolidation range. Consolidation, or perhaps stagnation.

The bullish sentiment among long-term holders positions Bitcoin for potential price gains. If their conviction persists, BTC is expected to hold firmly above $81k, paving the way for a possible rebound toward $87,500. A rebound, or perhaps a mirage.

As long as long-term holders continue to hold, there is room for growth. However, if their conviction falters, Bitcoin may experience a sharp decline, dropping below $80k again. A decline, or perhaps a plunge into the abyss.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- World Eternal Online promo codes and how to use them (September 2025)

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Hero Card Decks in Clash Royale

2025-04-01 14:20