Ah, Bitcoin! The digital gold that has danced its way past the illustrious mark of $121,126, a feat not seen in nearly a month. It now flirts with its all-time high of $123,091.61, making it the hottest crypto to consider for your 2025 portfolio. Who knew a mere number could evoke such passion? 💃

In a delightful twist of fate, this rally coincided with a veritable explosion of network activity, as a staggering 364,126 new Bitcoin addresses were birthed daily-an all-time high for the year! It seems the world is finally waking up to the charms of our beloved Bitcoin, as noted by the ever-astute analyst, Ali Martinez.

364,126 new Bitcoin $BTC addresses created daily, the highest in a year!

– Ali (@ali_charts) August 11, 2025

The Perfect Asset

Enter Willy Woo, the sage of the crypto realm, who has proclaimed Bitcoin to be the “perfect financial asset” destined to endure for the next millennium. Yet, in a moment of humility, he admits it still has a long way to go before it can dethrone gold or the mighty US dollar. Ah, the irony!

📊 MARKET INSIGHT: Bitcoin $BTC is the ‘perfect asset’ for the next 1,000 years, according to Willy Woo. Woo emphasizes the need for increased flows for Bitcoin to compete with the US dollar and gold.

– CryptoAlert (@SatoshiWatch) August 11, 2025

With a market cap of $2.43 trillion, Bitcoin still lags behind gold’s $23 trillion and the dollar’s $21.9 trillion. Woo warns that for Bitcoin to ascend to the throne of world reserve status, it will require a flood of capital. Perhaps a divine intervention? 🤔

Key Cautions

But wait! Not all that glitters is gold. Woo cautions that as corporations embrace Bitcoin with their treasury holdings, the lurking specter of opaque debt structures threatens to create a treasury bubble. Oh, the drama! 🎭

Moreover, the reliance on exchange-traded funds and custodial services could concentrate ownership, leaving Bitcoin vulnerable to the whims of government intervention. While these on-ramps may usher in more capital, they also carry the risk of systemic collapse if the big players don’t take the plunge into self-custody.

In a twist of fate, even Harvard University has dipped its toes into the Bitcoin pool, holding a cool $117 million in shares of BlackRock’s iShares Bitcoin ETF. Other notable backers include Metaplanet and Strategy, with companies like Mill City Ventures throwing their weight behind altcoins like SUI. What a tangled web we weave!

BTC Mirrors NASDAQ

Market analysts have observed that Bitcoin’s price movements are eerily reminiscent of traditional risk-on assets, closely shadowing the performance of NASDAQ. It’s almost as if Bitcoin is saying, “Look at me, I’m just like you!”

Bitcoin’s correlation with the Nasdaq helps explain recent price action.

When stocks dropped sharply late last week, Bitcoin followed. That’s what you expect when correlations are elevated.

Now that the Nasdaq is resuming its uptrend, Bitcoin is moving with it again.

– ecoinometrics (@ecoinometrics) August 8, 2025

This correlation, coupled with the impending macroeconomic data-like Tuesday’s US Consumer Price Index report-could send BTC into a delightful frenzy. Economists are predicting a modest rise in annual inflation to 2.8%, with softer data possibly accelerating expectations for a Federal Reserve rate cut in September. Buckle up! 🎢

Historical Cycle Analysis

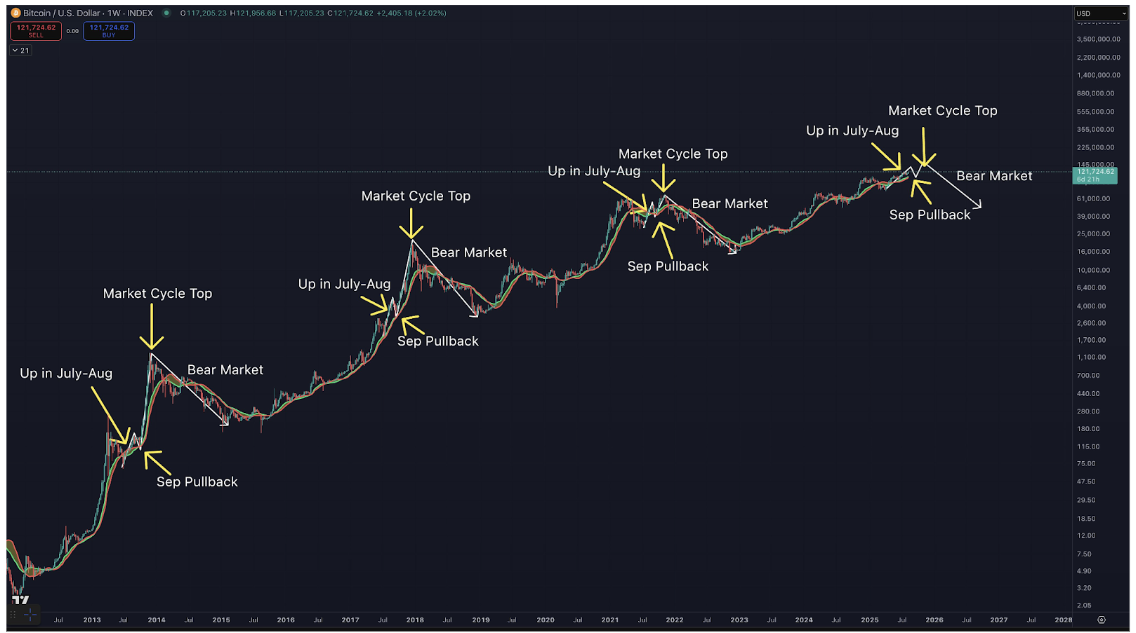

It appears Bitcoin is following its post-halving year playbook. In previous cycles, prices have risen through July and August, faced a September pullback, and then rallied toward a market cycle peak in the fourth quarter before entering a prolonged bear market. A classic tale of rise and fall! 📉

Bitcoin Historical Cycle Analysis | Source: Benjamin Cowen

According to the ever-watchful market analyst Benjamin Cowen, the current pattern seems to align perfectly with historical cycles. If history is any guide, BTC could very well rally in Q4 after a slight pullback this month. Let’s keep our fingers crossed! 🤞

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Wuthering Waves Mornye Build Guide

2025-08-11 15:55