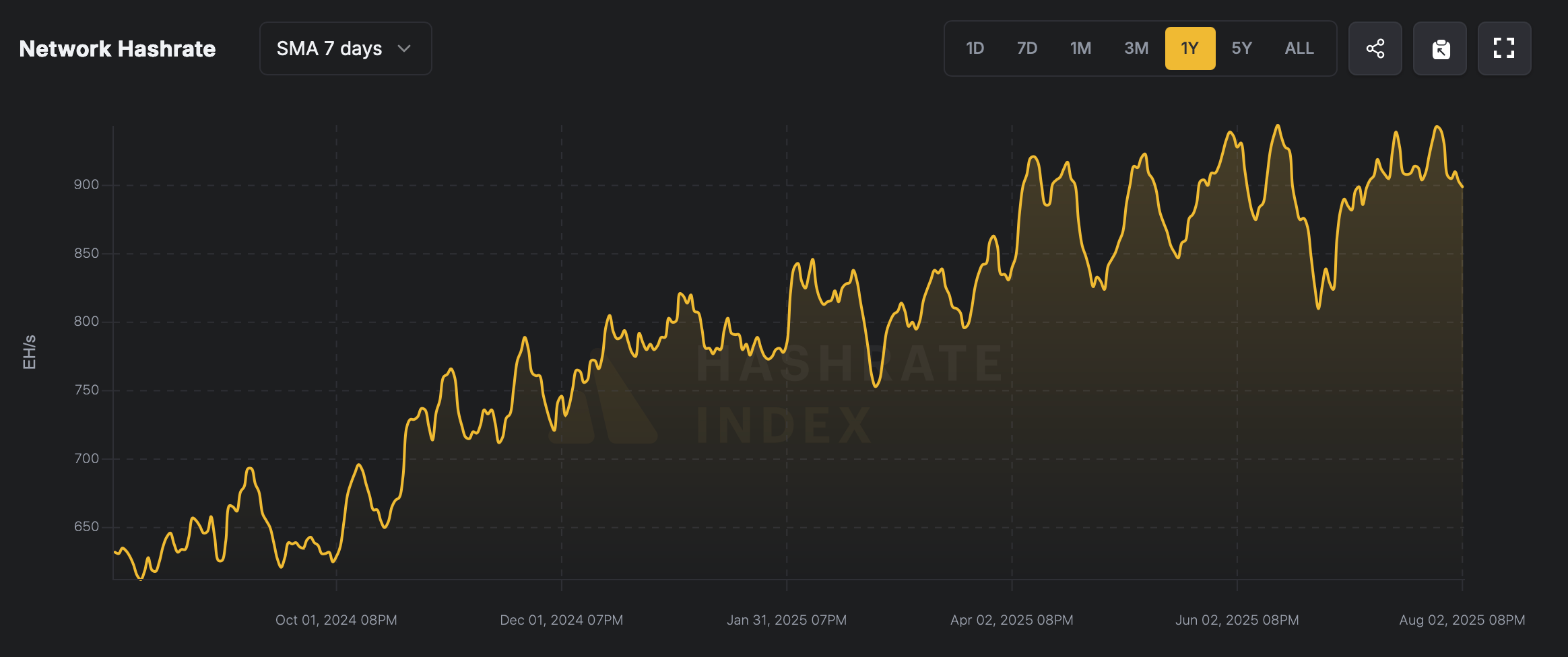

Eight days ago, the network reached a majestic peak of 943 exahash per second (EH/s). Since then, about 44.8 EH/s has disappeared faster than your last cookie in the jar. It’s like the hash gods took a rain check and left us hanging.

Bitcoin Hashprice Falls 11.65% in 30 Days — No, That’s Not a Typo! 🔻

Hashrate has dipped 4.75% in just over a week, dropping below the mystical 900 EH/s line crafted by cryptic numbers and bitcoin dreams. As of August 3rd, it’s lounging at 898.20 EH/s, down 44.8 EH/s from the good old days when everything still looked shiny and promising. Several factors played a role, including a slight difficulty bump nine days ago at block height 907200—because why shouldn’t tech upgrades feel like a sneaky dodgeball game?

At that point, the network’s difficulty nudged up by a tiny 1.07%, landing at 127.62 trillion. Meanwhile, bitcoin’s price has been sneakily drifting south—down 4.1% in the past week—like a boat trying to avoid the giant Kraken of financial trouble. This has knocked hashprice, which is basically how much your shiny mining rig would earn in a day, down to a soggy $56.74 per petahash.

Thirty days ago, on July 3rd, the hashprice was cruising at $59.26 per PH/s, only to tumble 4.25% since then—probably because everyone’s getting a little bored in the digital gold mine. It even managed to spike up to $64.22 per petahash on July 11, making today’s numbers look even more miserable. Currently, block intervals are clocking in at about 10 minutes and 11 seconds—a sign that the upcoming difficulty adjustment on August 9, 2025, might send everyone scrambling for their calculators again.

Miners are probably recalibrating their “break-even” points faster than you can say “block reward,” figuring out if their rigs are still worth the electricity bill. With hashprice falling and difficulty looming like an unwanted hero at a party, only the most efficient machine-ists and energy strategists will stay afloat in this digital gold rush of ours.

As things tighten up, the little guys—those running on a shoestring, a prayer, and a good Wi-Fi signal—might find themselves in a crunch, while the big players stay the course, probably laughing all the way to the blockchain bank. If market magic doesn’t turn itself around soon, expect this sector to be more consolidated than a burrito at a vegan potluck — because who doesn’t love a good pile of the big fish gobbling up all the snacks?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-03 23:07