Markets

What to know:

- So, Bitcoin decided to take a nosedive below $112,000 because, why not? Apparently, China’s trade threats are the new stress ball for global markets. Who needs therapy when you have this? 🙄

- Asian stocks are feeling the brunt of it too, the Nikkei is having a meltdown like me after a bad meal. It’s the worst it’s been in two months, and equity futures in the U.S. and Europe are following suit. Joy! 🎉

- The crypto markets? Oh boy! Bitcoin’s down 3%, total liquidations reached $630 million. It’s like watching a slow-motion train wreck; you can’t look away! 🚂💥

So here’s the scoop: Bitcoin fell below $112K – and what spawned this crisis? China’s latest trade measures, of course! It’s like they’re having a trade war, and we’re just the unfortunate bystanders. 😱

According to Bloomberg, China just slapped sanctions on U.S. units of South Korean shipbuilder Hanwha Ocean. Remember when both sides tried to be civil? Yeah, me neither. 🙄

Meanwhile, stocks in Asia are crashing down, equity futures in the U.S. and Europe are also following along. It’s like a conga line of despair! 💃

And don’t even get me started on the S&P 500-it’s down 0.7%, and on the Nasdaq 100, it’s lost 1%. The Nikkei? It took a 3% dive. It’s terrible!

The yen is actually strong against the dollar now. Gold and silver lost their sparkle after heavy selling, and 10-year Treasury yields are near 4.03%. Classic investor moves, right? 🙈

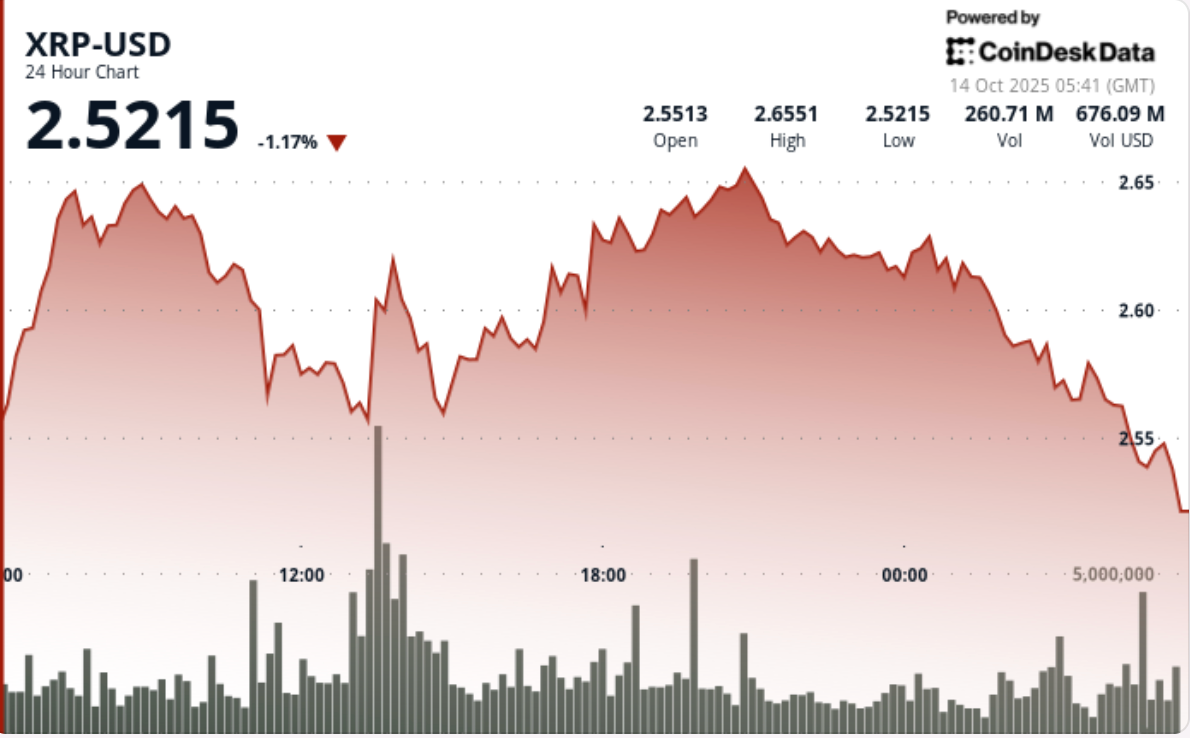

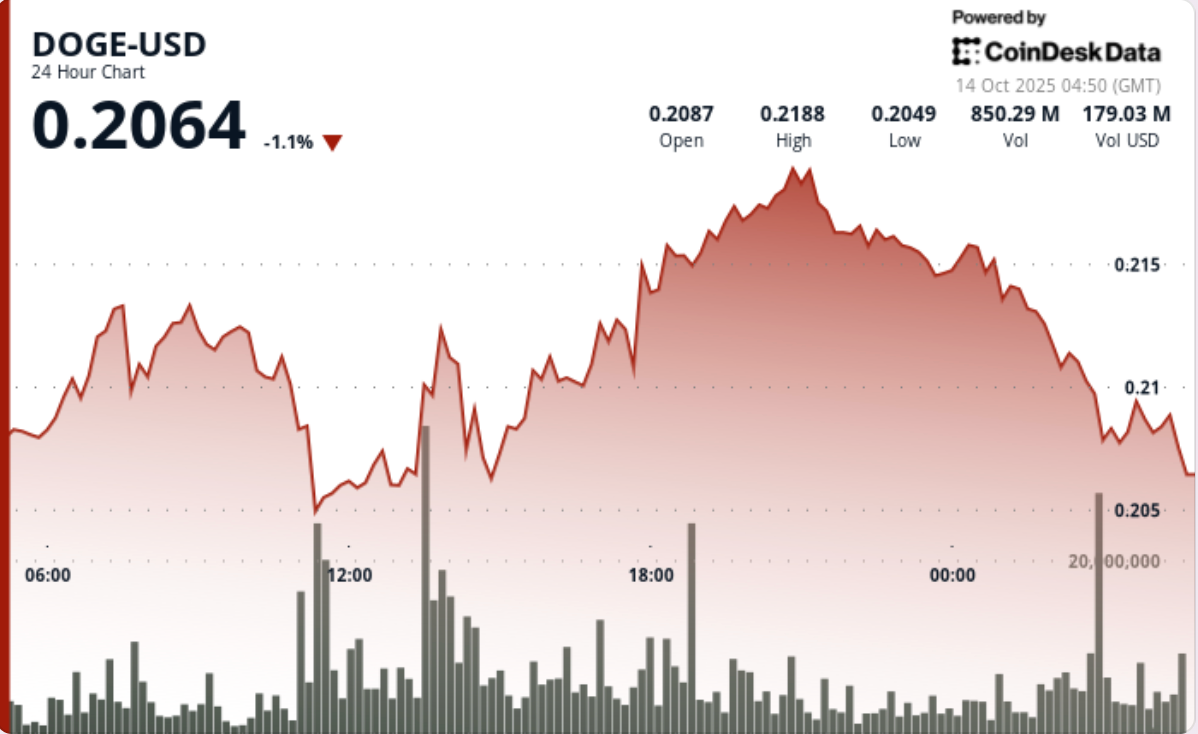

Crypto is tracking risk like a dog on a leash. Bitcoin down 3% to $111,869, Ethereum down 4% around $4,000, and BNB? It plummeted over 10%. XRP, Solana, and Dogecoin are dancing between 5% and 6% lower. Where’s the party? 🎈

Liquidations hit a staggering $630 million, with long positions making up two-thirds of that wipeout. CoinGlass must be partying hard with this data. 🥳

And what about the volatility? Oh, it’s like the weather in New York! Remember last week when Donald Trump threatened a 100% tariff on Chinese imports? That was fun, right? It triggered the largest-ever liquidation event in crypto history. 💡

In just 24 hours, nearly $20 billion was obliterated across derivatives markets, only to have a pathetic little rebound over the weekend. We all need a bit of hope, but this isn’t it! 🌧️

Societe Generale-FORGE and Bitpanda Expand Partnership to Bring Regulated Stablecoins to DeFi

53 minutes ago

Bullish Bitcoin Traders Eye Chart Patterns From 2020 and 2024 After Weekend’s $20B Liquidations

1 hour ago

XRP Fades Below $2.60 as $63M Whale Sales Hit Binance

2 hours ago

DOGE Faces Rejection at $0.22 as Dogecoin Treasury Firm Eyes Public Listing

2 hours ago

Asia Morning Briefing: China Renaissance’s BNB Treasury Highlights a Shift in Asia’s Crypto Playbook

6 hours ago

Bitcoin Miners Lead Crypto Stock Bounce as OpenAI-Broadcom Deal Fuels AI Trade

12 hours ago

Trader Who Made $192M Shorting the Crypto Crash is Betting Against Bitcoin Again

Oct 13, 2025

Bitcoin May Tank to $100K as Friday’s BTC Crash Reinforced 2017-21 Trendline Resistance

Oct 13, 2025

Binance to Compensate Users Affected by Crash in wBETH, BNSOL, and Ethena’s USDe

Oct 12, 2025

Friday’s $20B Crypto Market Meltdown: A Bitwise Portfolio Manager’s Postmortem Analysis

Oct 11, 2025

How Auto-Deleveraging on Crypto Perp Trading Platforms Can Shock and Anger Even Advanced Traders

Oct 11, 2025

Ethena’s USDe Briefly Loses Peg During $19B Crypto Liquidation Cascade

Oct 11, 2025

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-10-14 11:07