Tomorrow, the money masters at the Federal Open Market Committee take the stage—and let’s be honest, nobody’s sure if we’re watching a press conference or a rerun of “Who Wants to Be a Millionaire?” 🎤

Chair Jerome “Don’t-Call-Me-Soft” Powell is expected to keep interest rates stuck between 4.25 and 4.50 percent. According to the CME’s so-called FedWatch tool (which has apparently never been wrong except when it is), there’s a 98.2% chance of nothing happening. That’s basically the odds your uncle gives about beating the stock market after three beers. 🍺

Meanwhile, ex-president Donald Trump and Treasury Secretary Scott “Not the Guy from Seinfeld” Bessent are screaming for lower rates like they’re at a Black Friday sale. Powell keeps repeating, “It’s wait-and-see,” which is economist-speak for, “I have no clue, but I’ll look cool saying it.” According to Jerome, the labor market is “in decent shape”—which means it’s not dead, just mostly dead. But don’t worry, he’s here to “keep inflation anchored,” like the captain of the Titanic (pre-iceberg).

Bitcoin’s FOMC Circus 🎪

For Bitcoin? The real question is not IF Powell blinks, but how many traders will get whiplash trying to follow his eyebrows. Josh Rager, aka “Captain Volatility,” warns his fans on X (formerly known as Twitter, formerly known as birds): “Expect chop chop until FOMC. Then after the rate-cut announcement, expect volatility. Then a reversal! My playbook: helmet required.” So basically, it’s like crypto musical chairs—don’t be caught without a seat, or pants.

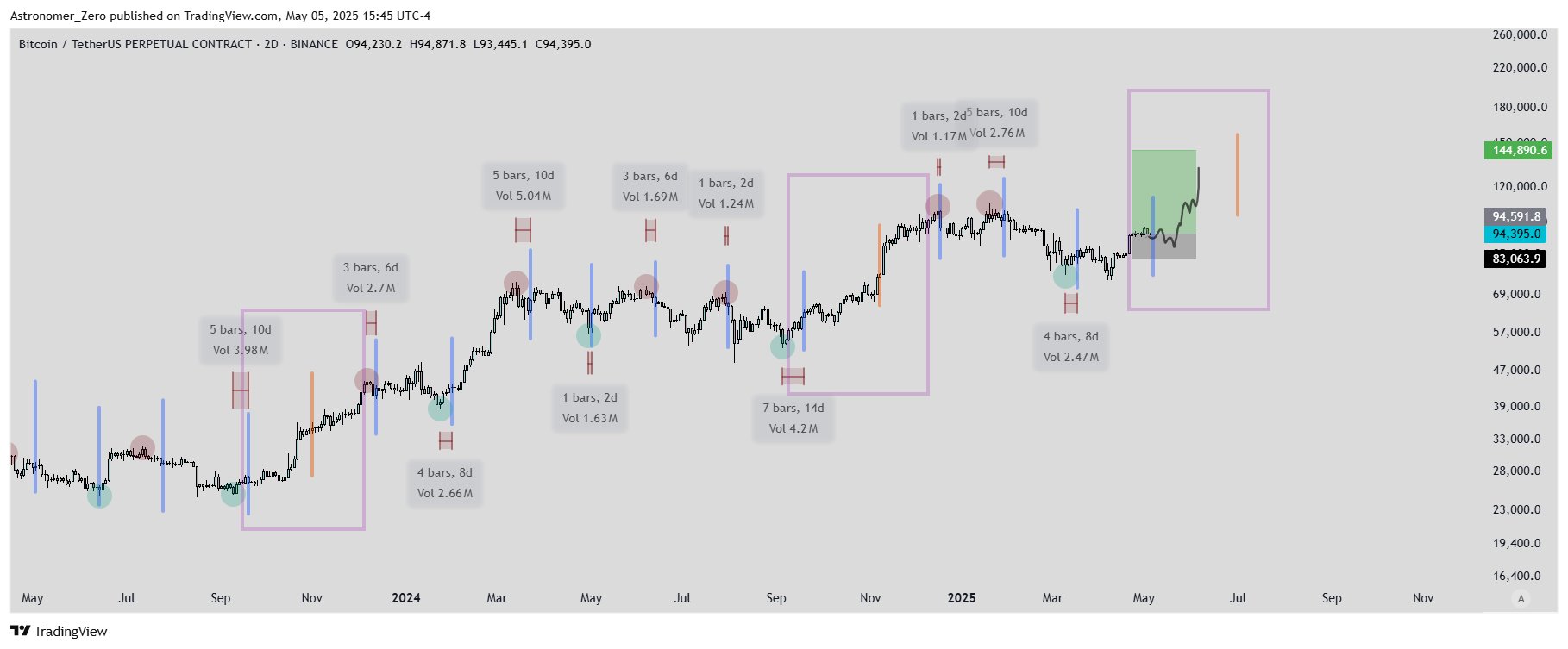

Our friend Astronomer is running a “trademarked reversal model” that’s allegedly right 85% of the time, which is about 84.9% better than my weather guy. He thinks we’ve probably “topped out” already, but wait! There’s always a catch. Since Bitcoin only goes up (unless it doesn’t), maybe the trend blunts the reversal. Translation: “I have a model, and the model says, who knows?”

Statistically, Astronomer sees a 76% chance we go up (brave call in a bull market!) and a 24% chance of a gentle pullback. In other words, heads it goes up, tails you’re down a little. That’s the kind of analytic precision I aspire to.

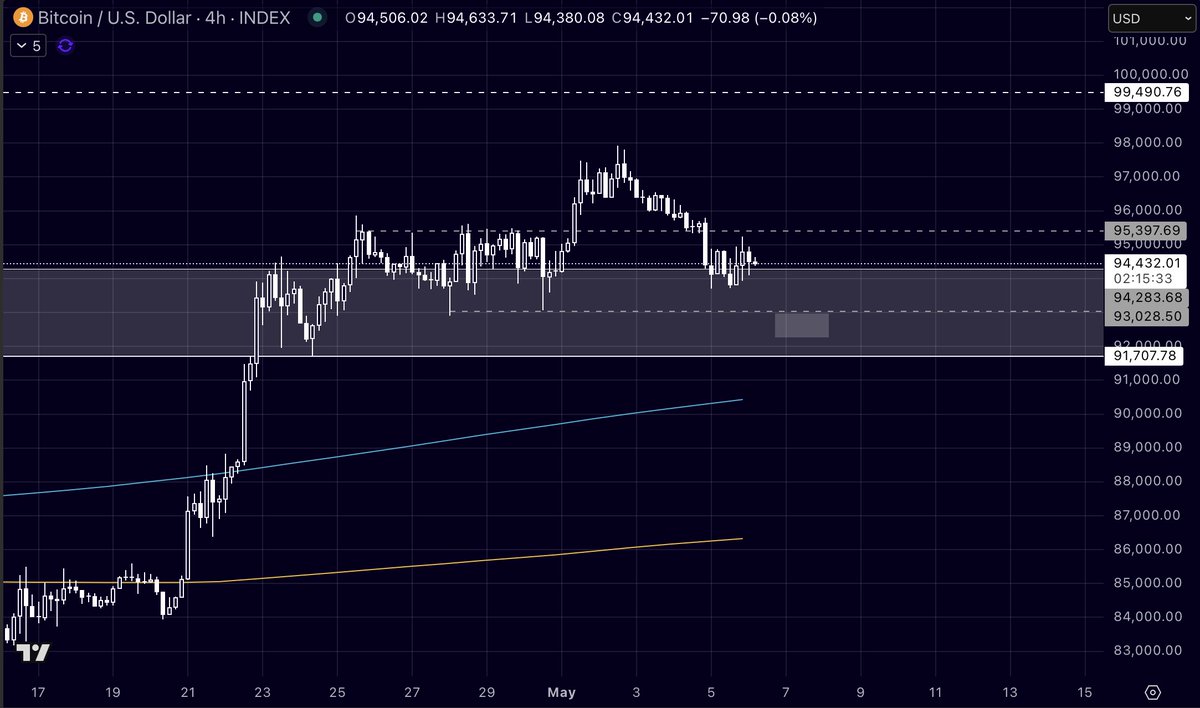

Columbus, who probably isn’t lost at sea, is pawing through heat-maps and Fibonacci charts. He’s looking for a “wick into the box”—which I think is also a complicated dance move. If Powell goes hawkish, Columbus expects the price to fall, possibly below $90k. But the trend is up! Don’t forget the trend. If the Titanic had only followed the trend…

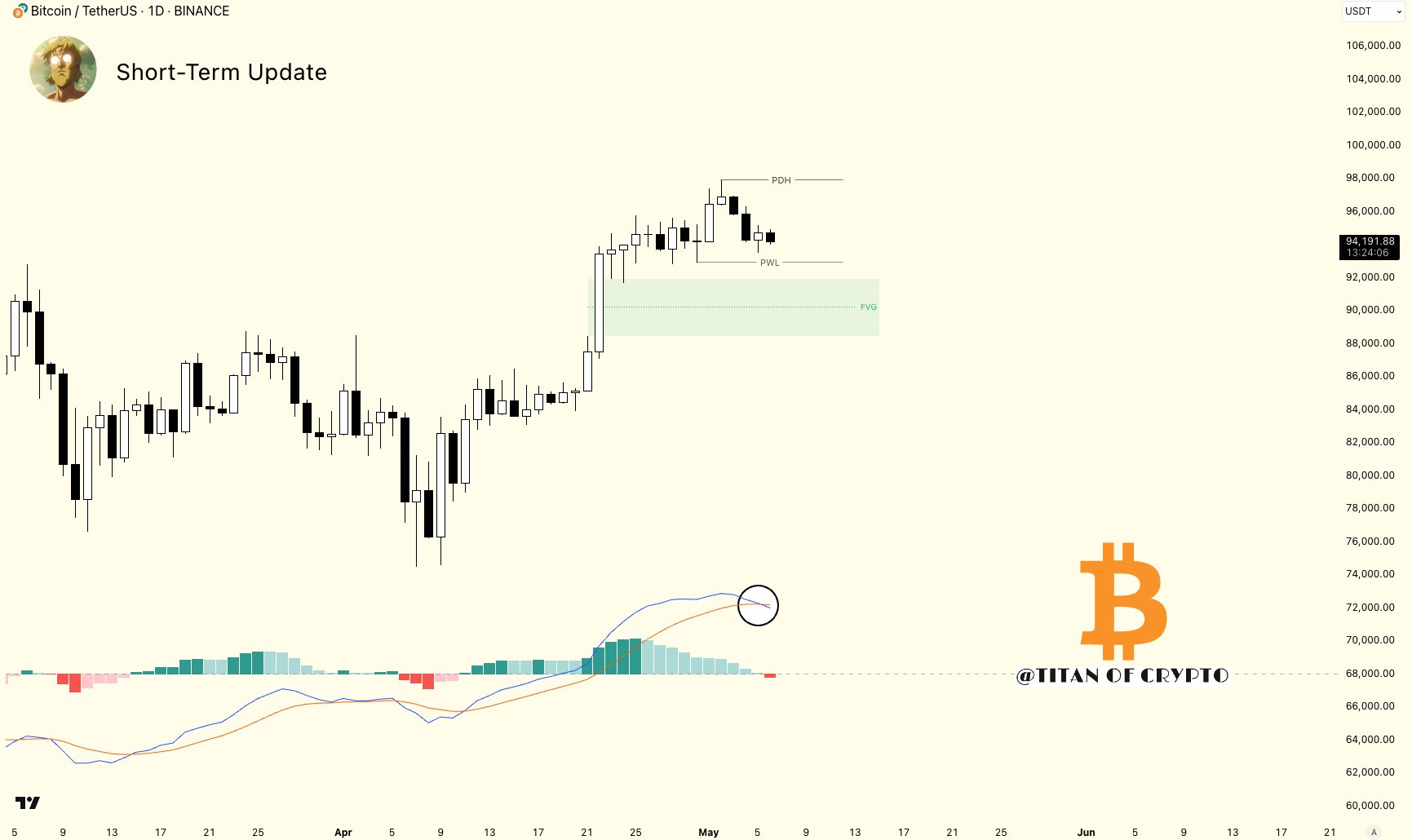

Titan of Crypto joins in, declaring Bitcoin “is consolidating,” which is how every trader says, “I have no idea what happens next, but it sounds smart.” The MACD is crossing bearish, so watch out! Or don’t. The consolidation means everyone is staring at their screens, refreshing every three seconds, pretending this will enlighten them.

The upshot? Tomorrow’s decision is binary, which on Wall Street means “flip a coin, shout loudly, then look wise.” If Powell whispers “June cut,” the bulls may finally get their summer barbecue. But if he talks tough on inflation, it’s time for the bears to start mauling liquidity below $92k. The $100,000 options crowd still dreams big, and the tension is so thick you could cut it with a blockchain.

Current price: $94,097. Check back tomorrow when half these predictions will look like Nostradamus, and the other half like your horoscope. 🍀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-05-07 05:53