In a plot twist worthy of a daytime soap opera, Bitcoin ETFs have managed to pull off a second consecutive week of inflows, raking in a staggering $196 million. This is despite a dramatic Friday outflow that could make even the most stoic investor clutch their pearls. Blackrock’s IBIT and Fidelity’s FBTC are the stars of this financial drama, while ether ETFs are left in the dust, losing a cool $8.64 million for the fifth week in a row. Talk about a rough patch!

Bitcoin ETFs: The Comeback Kid, While Ether ETFs Keep Losing Their Cool

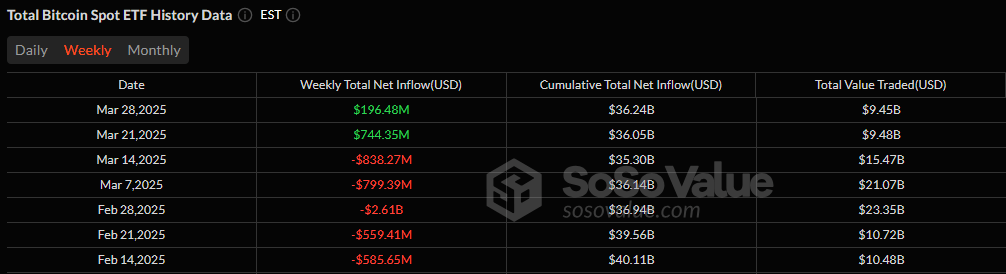

It seems the tides have turned for Bitcoin ETFs, which have wrapped up their second consecutive week of net inflows, adding a jaw-dropping $196.48 million. Yes, you read that right! The overall trend is looking as sunny as a beach vacation, despite a sharp $93.16 million outflow on Friday, March 28. Because who doesn’t love a little drama on a Friday?

The highlight of the week came on Wednesday, March 26, when Bitcoin ETFs saw their biggest single-day inflow of $89.57 million. It’s like they threw a party and everyone showed up! Blackrock’s IBIT was the life of the party, dominating the week with a $171.95 million inflow, while Fidelity’s FBTC added a respectable $86.84 million. Vaneck’s HODL, bless its heart, contributed a modest $5 million—like the friend who brings chips to a potluck.

But not all funds are basking in the glow of success. Ark 21shares’ ARKB saw the largest weekly outflow at $40.97 million, while Wisdomtree’s BTCW, Bitwise’s BITB, and Invesco’s BTCO lost $10.22 million, $9.15 million, and $6.95 million, respectively. Ouch! It’s like watching your friends get dumped one by one at a party.

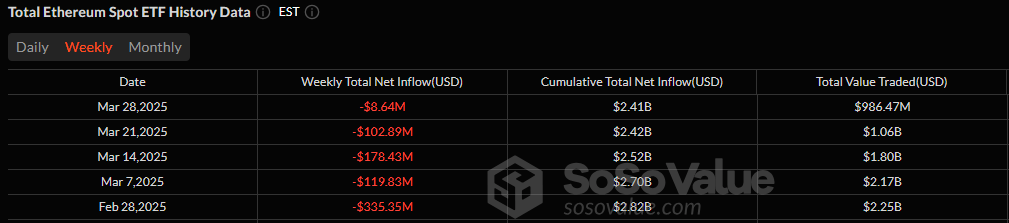

Meanwhile, Ether ETFs are still struggling, marking their fifth consecutive week of outflows. Investors pulled $8.64 million over the week, with the most significant outflow occurring on Wednesday ($5.89 million). It’s like they’re the last ones picked for the team, and it’s getting awkward.

Grayscale’s Mini ETH Trust led the losses with a $6.66 million exit—yes, you read that right, $6.66 million, which sounds like a bad omen. Fidelity’s FETH followed with a $3 million loss, Vaneck’s ETHV lost $2.21 million, and Invesco’s QETH took a hit of $1.45 million. The lone bright spot was Grayscale’s ETHE, which bucked the trend with a $4.68 million inflow. It’s like the kid who actually studies for the test while everyone else is cramming.

In the end, Bitcoin ETFs remain the shining stars of institutional investment, solidifying their momentum despite the Friday setback. Meanwhile, Ether ETFs are still trying to figure out how to get invited to the party. Better luck next week, folks! 🎉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-03-31 22:00