What to know:

- U.S. spot bitcoin ETFs saw a staggering $667.4 million in net inflows on May 19, the highest since May 2, with the iShares Bitcoin Trust gobbling up a hefty $306 million. 🤑

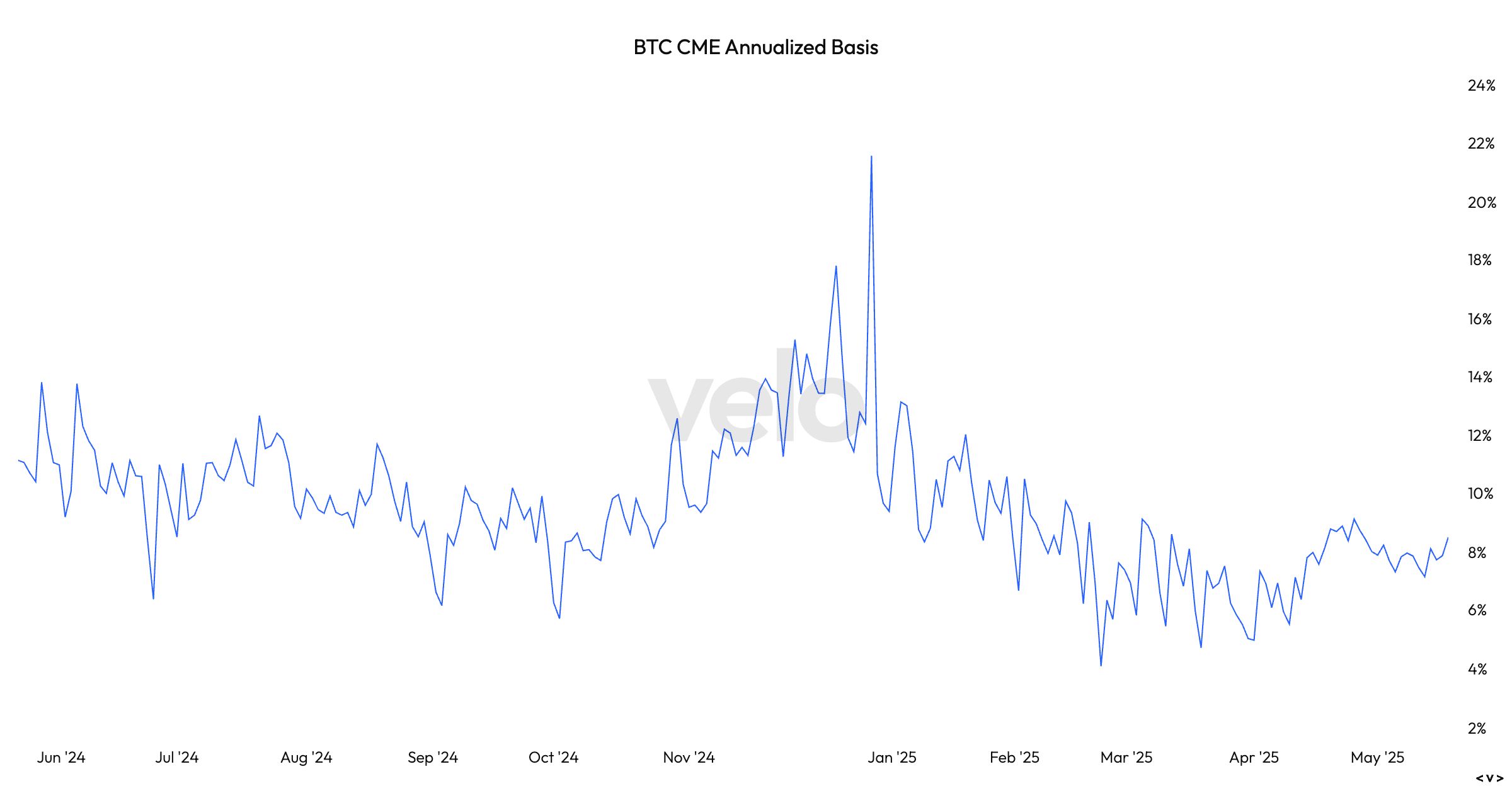

- Investor interest, it seems, is being fueled by bitcoin’s stubborn refusal to drop below $100,000 and the basis trade yield creeping up to a tantalizing 9%. 📈

The U.S.-listed spot bitcoin exchange-traded funds (ETFs) recorded a monumental $667.4 million in net inflows on May 19, the largest single-day total since May 2, signaling a renewed wave of institutional interest. Nearly half of these inflows, a cool $306 million, found their way into the iShares Bitcoin Trust (IBIT), now boasting a net inflow of $45.9 billion, according to the ever-reliable Farside Investors. 📊

The renewed demand follows bitcoin’s impressive price performance, having traded above $100,000 for 11 consecutive days, which has done wonders for market confidence. 🌟

Moreover, the annualized basis trade, a strategy where investors go long on the spot ETF and simultaneously short bitcoin futures contracts on the CME, has become increasingly alluring with yields approaching 9%, almost double what was seen in April. 🎯

According to Velo data, this has sparked a modest uptick in basis trade activity, as evidenced by an increase in trading activity in the CME futures. On Monday, CME futures volumes hit a whopping $8.4 billion (roughly 80,000 BTC), the highest since April 23. Meanwhile, open interest stood at 158,000 BTC, up over 30,000 BTC contracts from April’s lows, further underscoring the growing appetite for leveraged and arbitrage strategies. 📈

That said, both futures volume and open interest remain well below the levels seen when bitcoin reached an all-time high of $109,000 in January, indicating there’s still significant headroom for further growth. 🚀

The upswing in the basis suggests the growth may be already happening, bringing back players that left the market early this year when the basis dropped to under 5%. Recent 13F filings revealed that the Wisconsin State Pension Board exited its ETF position in the first quarter, likely in response to a then-less favorable basis trade environment. However, given that 13F data lags by a quarter and the basis spread has since widened from 5% to nearly 10%, it is plausible that it reentered the market in the second quarter to capitalize on the improved arbitrage opportunity. 🤔

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Wuthering Waves Mornye Build Guide

- All Brawl Stars Brawliday Rewards For 2025

2025-05-20 11:32