Well, well, well… Bitcoin ETFs are having a bit of a meltdown with a sharp $278 million outflow, while Ether ETFs are basking in glory, extending their winning streak to 14 days with a nifty $11.26 million inflow. Guess who’s winning this battle? Spoiler: it’s not Bitcoin. 🙄

Bitcoin ETFs Slide With $278 Million Outflow But Ether ETFs Hold Strong With $11 Million Inflow

So here’s the story: Bitcoin ETFs, after a brief and unimpressive comeback, were hit with a brutal $278.44 million outflow. The market is shaking its head, signaling that investors are once again hitting the brakes. Maybe they got bored. 🤷♂️

Out of 12 U.S. bitcoin ETFs, seven saw capital exit stage left. Ark 21shares’ ARKB was the drama queen of the day, losing a whopping $102.03 million. Fidelity’s FBTC followed closely, shedding $80.17 million like a bad habit.

Other ETFs weren’t immune. Bitwise’s BITB lost $36.73 million, Grayscale’s GBTC dropped $24.09 million, and even Grayscale’s Bitcoin Mini Trust was feeling the heat, with $16.70 million fleeing the scene. Invesco’s BTCO and Vaneck’s HODL saw exits of $12.20 million and $6.51 million, respectively. It was a bloodbath. Not a single ETF in the group saw any inflows. Can we say ‘ouch’? 💔

To add salt to the wound, trading volume spiked to $4.47 billion, but net assets for bitcoin ETFs dropped to $122.98 billion. It’s like a party where everyone left early. 🕺🏻

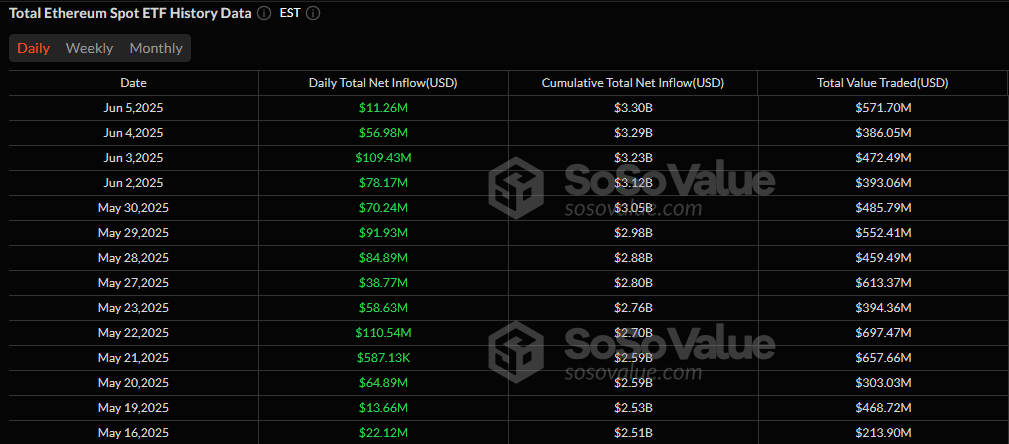

Now, on the other side of the fence, we have Ether ETFs, cruising through the crypto skies with their 14th consecutive day of inflows, adding a solid $11.26 million to their growing pile. Blackrock’s ETHA was the MVP, bringing in $34.65 million, though Fidelity’s FETH did its best to ruin the party with a $23.40 million outflow. But don’t worry—nothing could stop the streak! 😎

Ether ETF trading volume hit $571.70 million, and net assets rose to $9.55 billion. Seems like institutional confidence in ETH is alive and well. Look at those numbers! Can’t say the same for Bitcoin. 👀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-06-07 01:29