The crypto ETF party hit a speed bump, and Bitcoin’s inflow streak? Poof! Gone faster than my gym membership after New Year’s. Ether barely kept its spark alive, while XRP and Solana slouched into the couch like they’d been told to “just sit here and process this.”

Crypto ETFs Mixed as Bitcoin Slides and Ether Clings to Inflows

The week ended with investors collectively saying, “You know what? I’m just going to sit this out,” as they pulled back from bitcoin after a few days of pretending they knew what they were doing. Risk appetite? It’s softer than my couch cushion after a decade of sitting on it. Some assets floated, but the whole vibe was “meh.”

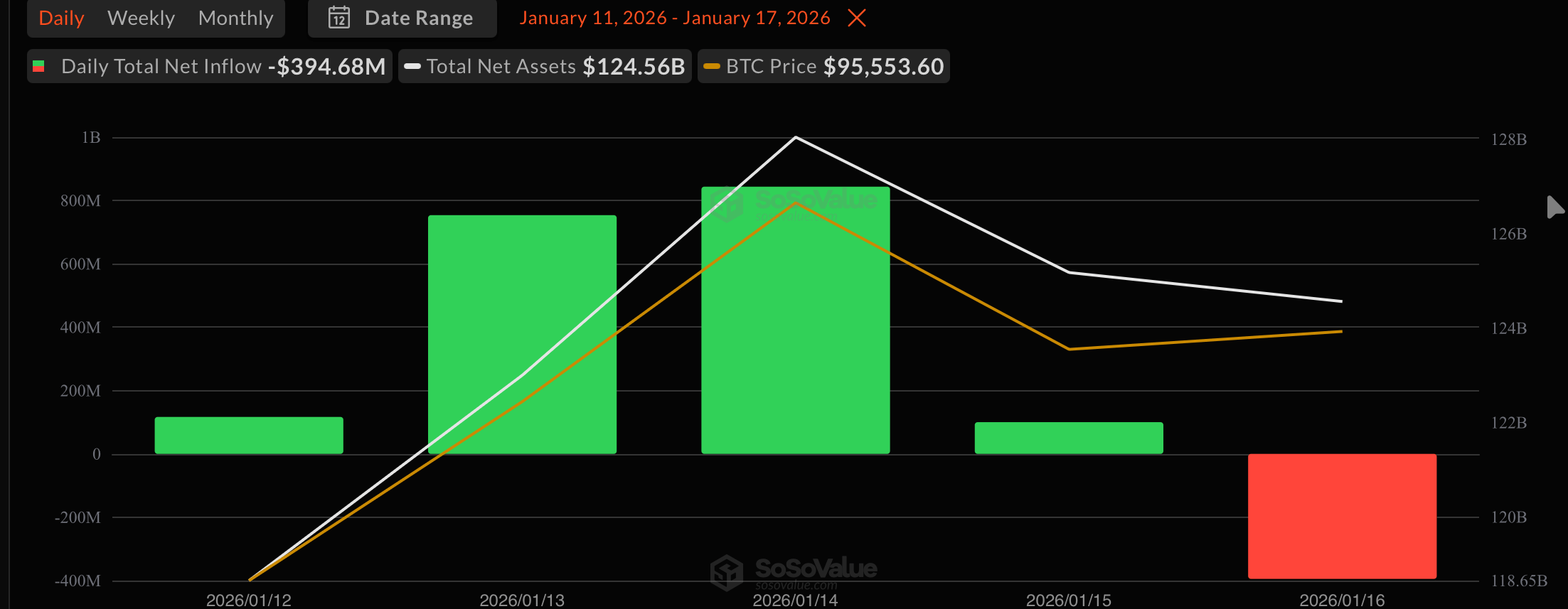

Bitcoin ETFs lost $394.68 million-ouch! Fidelity’s FBTC led the exodus like the biggest chicken in the crypto coop, followed by Bitwise’s BITB and Ark & 21Shares’ ARKB. Grayscale’s GBTC? It’s shedding cash like I shed New Year’s resolutions. Blackrock’s IBIT tried to be the hero with $15.09 million, but even Superman can’t fix this. Total value traded? $3.60 billion. Net assets? Still around $124.56 billion. Congrats, no one won.

Ether ETFs clung to life with a $4.64 million inflow-barely enough to buy a latte, but hey, it’s a start! Blackrock’s ETHA saved the day with $14.87 million, while Grayscale’s ETHE coughed up $10.22 million. Trading volume? $1.19 billion. Net assets? Still $20.42 billion. Yawn.

XRP ETFs? Moving slower than my internet on a bad day, with a mere $1.12 million inflow. Franklin’s XRPZ got all the attention, while the rest of the crowd said, “Nah.” Total value traded? $14.08 million. Net assets? $1.52 billion. Basic, baby.

Solana ETFs slipped into a $2.22 million outflow. Grayscale’s GSOL led the charge like a contestant on a reality show finale, while 21Shares’ TSOL followed. Fidelity’s FSOL tried to rally with $425,000, but it’s like trying to cheer up a funeral with a kazoo. Trading activity? $34.58 million. Net assets? Still $1.21 billion. Whatever.

//www.binance.com/en/price/bitcoin”>Bitcoin

got hit hardest, Ether stayed upright, and XRP and Solana? They’re just here for the snacks and vibes. Next week? Who knows. Maybe we’ll all just nap.

FAQ 📊

- Why did Bitcoin ETF inflows reverse on Friday?

Investors took a breather after a wild ride, sending $394.68 million fleeing faster than my ex’s texts after I mentioned my new dating app. - Did Ether ETFs remain resilient despite broader weakness?

Resilient? Sure. But let’s be real-it’s the financial equivalent of surviving on caffeine and sheer willpower. - What happened to XRP and Solana ETFs at week’s end?

They’re moving at the pace of a sloth on a Sunday, with XRP barely breathing and Solana slipping into a slump. - What does this mean for near-term crypto market sentiment?

It’s the market’s way of saying, “Let’s all take a time-out and watch Netflix.”

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2026-01-17 21:13