Bitcoin exchange-traded funds (ETFs) continued their red-hot streak with a $602 million inflow, led by heavy activity in Fidelity’s and Blackrock’s funds. Ether ETFs also bounced back with $148.57 million in net inflows, riding high on renewed investor confidence.

Bitcoin and Ether Funds Rack Up $750 Million in Inflows on Strong Institutional Demand

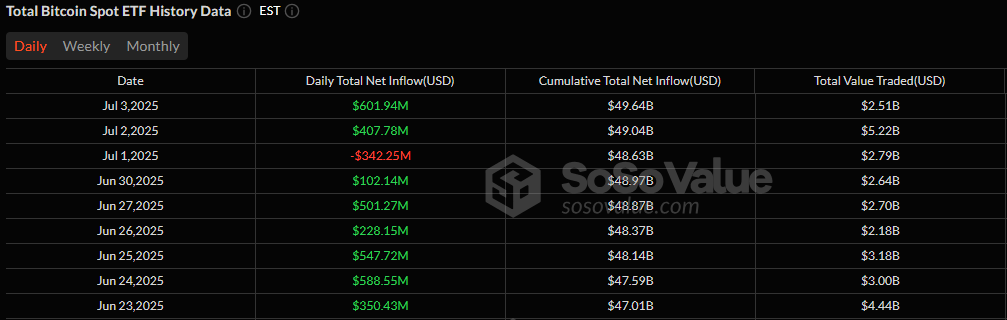

Momentum doesn’t sleep, even ahead of a holiday weekend. U.S. spot bitcoin ETFs piled on another $601.94 million in net inflows on Thursday, July 3, marking yet another day of assertive institutional appetite for digital assets. It’s like the market’s on a never-ending bender, and the hangover just ain’t coming.

Fidelity’s FBTC took the spotlight with a massive $237.13 million inflow, while Blackrock’s IBIT was close behind, attracting $224.53 million. Ark 21Shares’ ARKB held its own with $114.25 million, showing that the buying was broadly spread. It’s like a digital gold rush, but with less pickaxes and more spreadsheets.

Supporting inflows came from Bitwise’s BITB ($15.53 million), Grayscale’s Bitcoin Mini Trust ($5.84 million), and Vaneck’s HODL ($4.66 million). Total value traded stood at $2.51 billion, and net assets climbed to $137.60 billion, reinforcing the strength of the trend. It’s a small fortune, but hey, who’s counting? 🤑

Ether ETFs weren’t left behind either. A solid $148.57 million flowed into the group. Blackrock’s ETHA saw the largest haul with $85.38 million, followed by Fidelity’s FETH with $64.65 million. It’s like the digital equivalent of a cattle drive, but with more zeros and less dust.

Grayscale’s Ether Mini Trust added another $3.90 million. While Grayscale’s ETHE posted a modest $5.35 million outflow, it wasn’t enough to dent the overall bullish tilt. Total ether ETF value traded hit $481.44 million, and net assets closed at $10.83 billion. It’s a small price to pay for a digital revolution, wouldn’t you say? 🚀

As inflows deepen and trading volume holds strong, both bitcoin and ether ETFs appear to be ending the week on a celebratory note, one investors will be watching closely post-holiday. It’s a holiday weekend, but the market’s not taking a day off. 🎉

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-04 18:57