Egad, what a to-do in the crypto sphere! Bitcoin ETFs, those plucky chaps, have staged a comeback so roaring it’d make a lion blush, raking in over half a billion quid. Meanwhile, Ether ETFs are having a bit of a sobfest, and Solana, the quiet sort, just keeps pottering along, collecting dosh like a chap at a tea party. 🍵

Crypto ETFs Diverge: Bitcoin Surges, Ether Retreats, Solana Keeps Winning

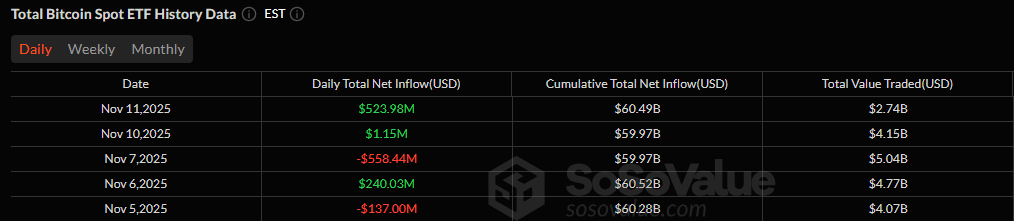

Well, I say, after a Monday as sluggish as a sloth on a Sunday, the crypto exchange-traded funds (ETFs) decided to put on a bit of a show on Tuesday, November 11th. Stark contrasts, old bean! Bitcoin ETFs came charging back like a cavalry officer late to dinner, with more than $524 million in inflows. Ether funds, poor dears, bled over $100 million in redemptions. And Solana, ever the steady Eddie, quietly posted fresh gains. Quite the drama, what? 🎭

Bitcoin ETFs were the bees’ knees of the day. A whopping $523.98 million in inflows surged across five major funds, reigniting investor enthusiasm after weeks of “Is it on? Is it off?” Blackrock’s IBIT led the charge, pulling in $224.22 million, followed by Fidelity’s FBTC with $165.86 million and Ark & 21Shares’ ARKB with $102.53 million. Not too shabby, eh? 🏆

Smaller inflows trickled in from Grayscale’s Bitcoin Mini Trust with $24.10 million and Bitwise’s BITB with $7.27 million. Daily trading volume hit $2.74 billion, while net assets climbed to $137.83 billion. Institutional chaps seem to be back in the saddle, what? 🐎

Now, the picture for ether ETFs was as rosy as a rainy Tuesday in November. A sharp $107.18 million in net outflows across five funds. Grayscale’s Ether Mini Trust led the exodus with $75.75 million in redemptions, followed by Blackrock’s ETHA at $19.78 million. Smaller losses came from Bitwise’s ETHW ($4.44 million), Vaneck’s ETHV ($3.78 million), and Fidelity’s FETH ($3.43 million). Still, trading activity held steady at $1.13 billion, with net assets at $22.48 billion. Not all doom and gloom, but hardly a day at the races. 🌧️

Solana ETFs, meanwhile, kept their noses clean and their momentum up. Bitwise’s BSOL added $2.05 million, while Grayscale’s GSOL brought in $5.93 million, totaling $7.98 million in new capital. The segment’s total trading volume stood at $23.52 million, with net assets steady at $568.35 million. Quietly impressive, like a chap who wins the raffle without making a fuss. 🙃

Tuesday’s action painted a vivid picture of shifting sentiment: bitcoin roared back to dominance, ether struggled to find its footing, and solana quietly continued to build strength. A reminder, old bean, that in the fast-changing ETF market, every day’s a new chapter in the saga. 📈

FAQ🚀

- What drove the big move in bitcoin ETFs?

Bitcoin ETFs surged with $524 million in inflows, led by Blackrock’s IBIT and Fidelity’s FBTC. Quite the rally, what? 🏇 - Why did ether ETFs struggle?

Ether funds saw $107 million in redemptions, with Grayscale’s Ether Mini Trust leading the outflows. A bit of a rough patch, old chap. 😢 - How did solana ETFs perform amid the volatility?

Solana ETFs added $7.98 million in new capital, extending their consistent streak of inflows. Steady as she goes! ⚓ - What does this divergence signal for crypto markets?

Investors are rotating back into bitcoin while staying cautious on ether, keeping solana quietly in play. Quite the dance, eh? 💃

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-11-12 16:03