In what could only be described as a financial soap opera, Bitcoin ETFs took a three-day nap, shedding a staggering $286 million—apparently too hot to handle, or perhaps just allergic to gains. Blackrock’s IBIT led the mass exodus, with funds fleeing faster than a cat from a bath. Meanwhile, Ether ETFs, showing zdecydowanie more staying power, celebrated their 11th day of gains, adding a cool $78.17 million—as if investors finally remembered where the Smaug-sized pot of gold was hidden. 🤑

Bitcoin ETFs See Third Straight Day of Outflows as Ether ETFs Extend Green Run

The once-mighty bitcoin ETF rally appears to have hit an invisible brick wall—perhaps the crypto gods have run out of patience, or maybe investors just got tired of waiting for the moon. On Monday, June 2 (or what the finance world now calls the Day Investors Fell Asleep), a tidal wave of $286 million parted ways with Bitcoin ETFs, making it the third consecutive day of mass withdrawals, as if everyone suddenly remembered they’d left the stove on at Satoshi’s crypt.

The biggest culprit? Blackrock’s IBIT, which secretly wished it could disappear faster than a magician’s rabbit, saw $130.44 million vanish into thin air. Following closely behind were Ark 21Shares’ ARKB (-$73.91 million) and Fidelity’s FBTC (-$50.11 million). Even the grayscale monster, GBTC, shed a few coins—$16.47 million, because who needs all that money anyway? The only ETF with a heartbeat was Bitwise’s BITB, which managed a tiny $3.41 million dip—proof that not all hope is lost, just mostly.

The total trading value across Bitcoin ETFs still clocked in at a solid $2.33 billion—because apparently, buying things you don’t own is the new hobby—but the overall net assets dipped to $125.47 billion, hinting that investors are about as confident as a cat in a room full of rocking chairs.

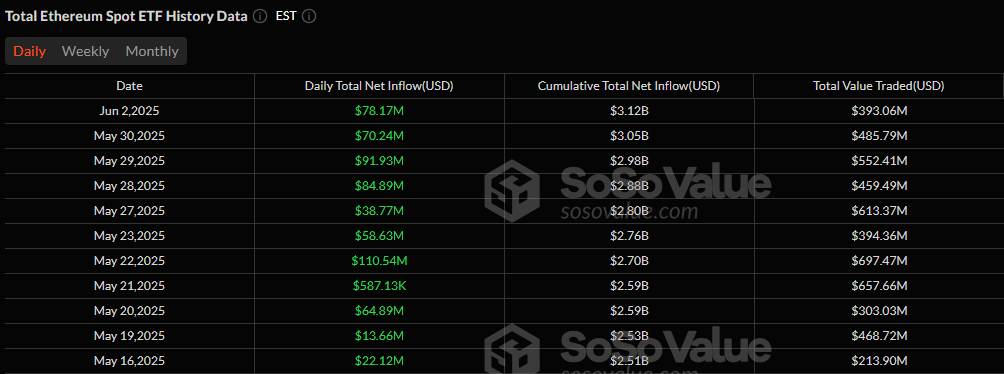

Meanwhile, across the crypto playground, Ether ETFs continued to party like it was 2099, racking up their 11th straight day of inflows—$78.17 million worth of investor love. Blackrock’s ETHA led the charge with $48.40 million, probably dreaming of turning into the digital version of Scrooge McDuck. Fidelity’s FETH followed with $29.78 million, happily splashing around without a care. Not a single Ether ETF was seen crying over spilled milk or outflows—perhaps it’s the new crypto motto: “Green days are here again.” 🥳

As Ether continues its relentless charm offensive and Bitcoin plays the role of the reluctant hero, the financial sages are quietly clutching their coffee cups, whispering about a rotation—think of it as the Wall Street version of musical chairs but with more zeros. Who will sit where when the music stops? Only time, and perhaps a few very confused hedge fund managers, will tell.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-06-03 15:57