Ah, friends, gather near as I recount the curious tale of Bitcoin’s ever elusive ascent—our morning chronicle from the wild, unpredictable bazaar of crypto.

Pour yourself a steaming cup of bitterness—no, coffee!—to digest the peculiar statistics guiding our hopes: Bitcoin dancing above what some might call “max pain,” as options contracts expire like fleeting promises at 8:00 UTC on Deribit’s stage.

Whispers of a $100,000 Bitcoin Mirage

In the very dawn of the eastern horizon, over eight billion dollars in Bitcoin and Ethereum options vaporized like morning dew. Among these ghosts, Bitcoin claimed the lion’s share—more than seven billion in sheer theoretical value.

Oddly enough, Bitcoin did not bow to the “max pain” price of $86,000 as is customary in these ritual expirations. No, it flirted with $93,471 just minutes before the curtain fell, then coyly climbed to $94,581—a tease to all who watch with baited breath.

One dared to ask the soothsayers at Bitfinex what fate might hold for this mercurial beast of finance. Their verdict? After navigating past option resistance, Bitcoin might ascend further, albeit with the caution of a cat stalking a firefly.

“Now that the $90,000 barricade lies in our dust, the market’s mood flickers with cautious optimism,” murmured Bitfinex analysts.

These market adepts noticed many ambitious players rolling their dice toward higher stakes—$95,000 and $100,000 calls peeked like moths attracted to a candle’s flame, sighing for the end of April and the arrival of May.

Yet, beware—the analysts warned of turbulent times ahead, a short-term chop where fortunes may sway like leaves in a spring breeze.

Deribit concurs, noting the highest Bitcoin options interest around $100,000—a beacon for traders who dream big or delude themselves with bravado.

Reportedly, they peddle cash-secured put options, hoping to snap up Bitcoin at bargain prices while collecting the premiums like jaded merchants gathering tolls.

Cumulative delta, a cryptic signal crossing nine billion dollars, suggests rising flows and ETF demand tiptoe behind these maneuvers.

“If spot flows and ETF hunger persist, $90,000 may yet hold as a fortress for Bitcoin,” Bitfinex’s sages added.

All told, bullish murmurs swell in the market halls, echoing the previous omens with greater zeal.

But not all prophets wear rose-tinted glasses. Innokenty Isers, the Chief at Paybis, advises a healthy dose of skepticism—reminding us that the tariff wars cloud sentiment, and many investors flee volatile shores like wary gazelles.

“The market’s current whisper warns of stout resistance, and these recent months have sewn a patchwork of unease among those craving stability,” Isers confided.

Still, beneath the veil of uncertainty, whales and institutions quietly hoard Bitcoin as if it were the last bread in a famine.

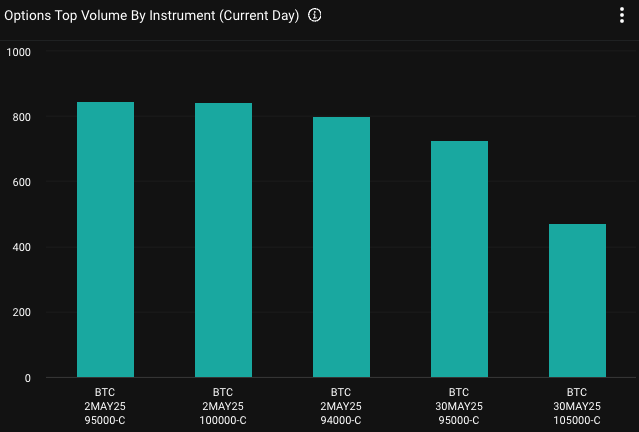

The Chart of the Day

The graph reveals a strange tale: the highest trading volume lies in calls striking at $95,000 and the lofty $100,000—bait for gamblers before the May 2 expiry clock tolls.

Crypto Equities Pre-Market Theater

| Company | At the Close of April 24 | Pre-Market Overview |

| Strategy (MSTR) | $350.34 | $348.54 (-0.51%) |

| Coinbase Global (COIN) | $203.87 | $203.80 (-0.03%) |

| Galaxy Digital Holdings (GLXY.TO) | $20.68 | $23.48 (+13.56%) |

| MARA Holdings (MARA) | $14.01 | $13.98 (-0.21%) |

| Riot Platforms (RIOT) | $7.79 | $7.72 (-0.90%) |

| Core Scientific (CORZ) | $7.53 | $7.48 (-0.66%) |

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-04-25 16:38