So, Bitcoin is strutting around at a cool $108,972 on May 28, 2025, with a market cap that could buy you a small country—$2.16 trillion, to be exact. And let’s not forget the 24-hour trading volume of $33.16 billion, which is more than my entire life savings (not that it’s hard). The price has been playing a game of hopscotch between $108,568 and $110,407, proving that indecision is the new black in the crypto world.

Bitcoin

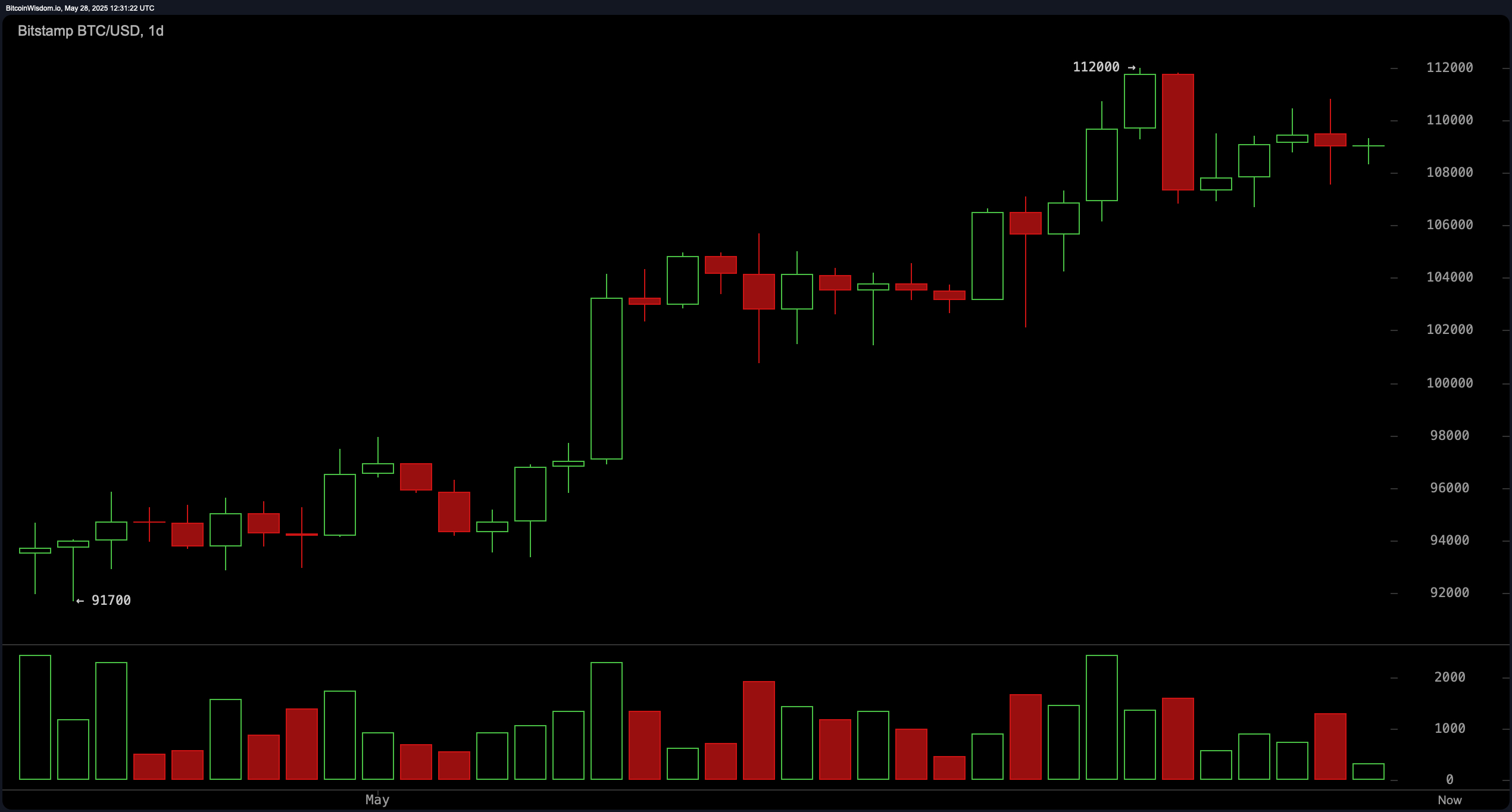

On the daily chart, bitcoin is still flexing its bullish muscles, even after a little retreat from the $112,000 level. Support is hanging out around $106,000 to $107,000, like that friend who always shows up with snacks. The sellers? Not so much. They’re like that one friend who says they’ll come but never does. The key resistance is still at $112,000, and if we break through that with some serious volume, we might just be on our way to the moon! 🚀

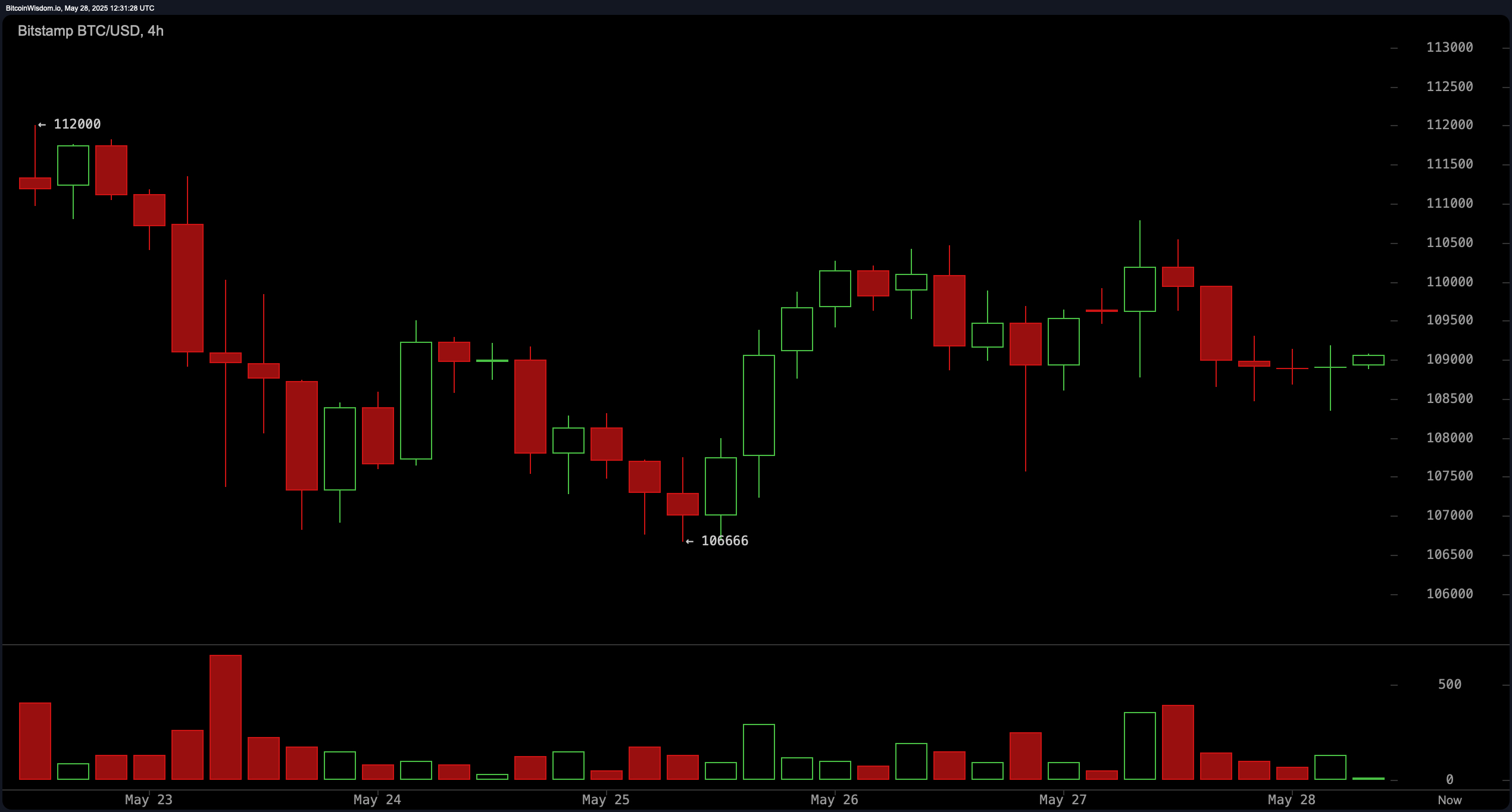

The 4-hour bitcoin chart is showing a bit of a downtrend after hitting that $112,000 peak. It’s like the market is taking a coffee break. Support at $106,666 (yes, really) has been defended like a prized trophy, while resistance in the $110,500 to $111,000 range is capping our upward dreams. The bearish volume during the sell-off has calmed down, which is like a sigh of relief. If you’re looking to jump in, keep an eye on $108,000 for some tactical entries. Just remember, profit-taking is always a good idea when the market is playing hard to get.

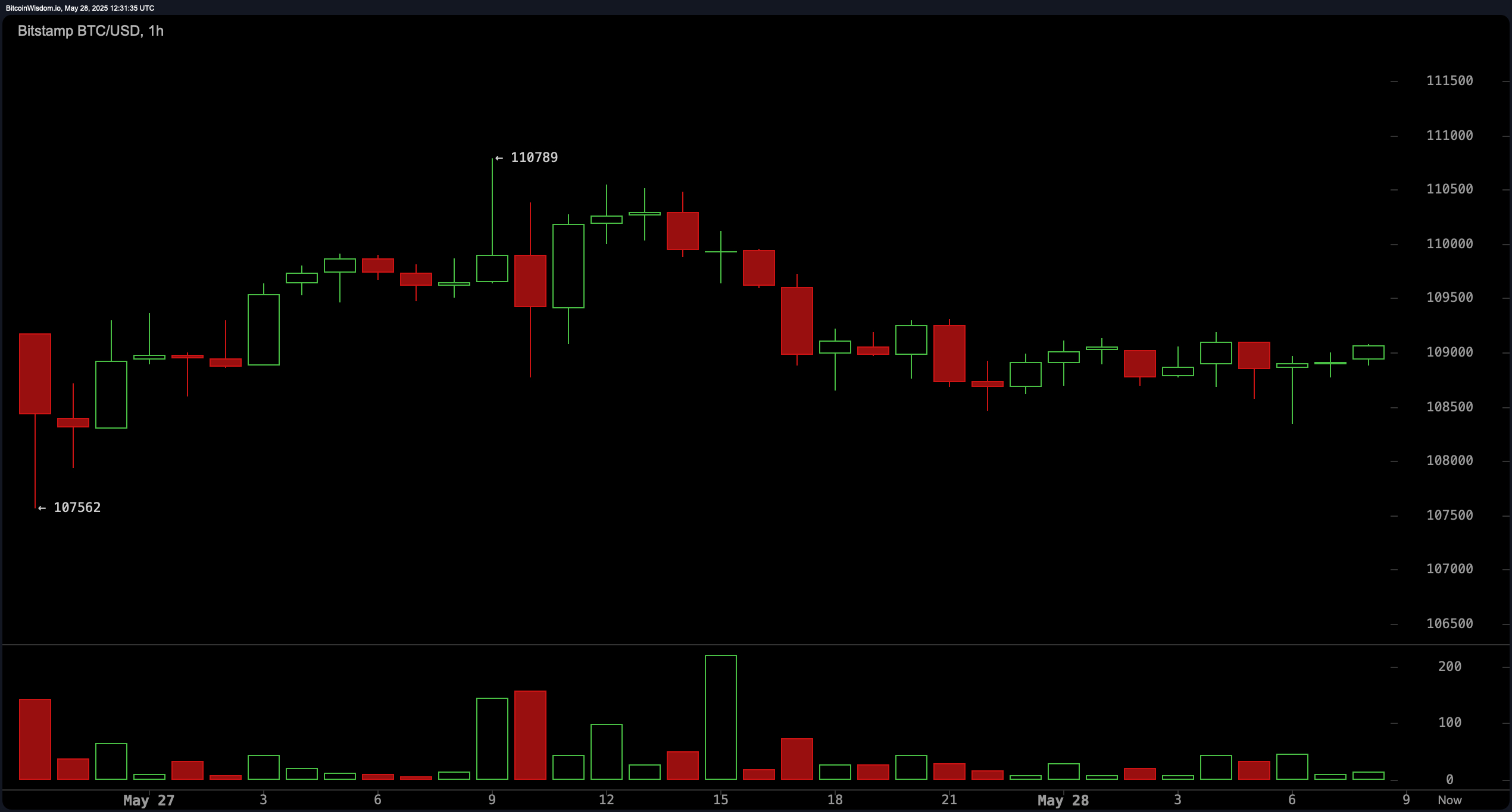

Bitcoin’s 1-hour chart is like a rollercoaster ride—up and down, but mostly just stuck in a loop. Price action is finding support around $108,000 and resistance near $110,000, which is basically the market saying, “I can’t decide!” Volume is light, so it’s like waiting for your favorite show to come back from a commercial break. Scalping opportunities are lurking for those brave enough to trade between $108,000 and $110,000. Just keep your eyes peeled!

Technical oscillators are sending mixed signals, which is basically the market’s way of saying, “I’m not sure how I feel about this.” The relative strength index (RSI) is at 65, the Stochastic is at 73, and the commodity channel index (CCI) is at 79. It’s like a party where everyone is neutral. But wait! Momentum at 2,545 and the MACD at 3,510 are waving red flags, indicating some selling pressure. So, let’s hold onto those support levels, shall we?

On the flip side, moving averages are still feeling pretty bullish across the board. The 10-, 20-, 30-, 50-, 100-, and 200-period EMAs and SMAs are all giving us the thumbs up. For instance, the 10-period EMA and SMA are at $108,082 and $108,561, respectively, both below the current price, which is like a safety net. The longer-term 200-period EMA at $90,251 and SMA at $94,466 are like the wise old sages of the market, reminding us to stay above those averages for a happy bullish life.

Bull Verdict:

Bitcoin’s price structure is like a well-built house, standing strong above key support zones, with all moving averages pointing up like they just won the lottery. As long as $106,000 holds and we can reclaim $110,000 with some volume, we’re likely headed toward or beyond $112,000. Fingers crossed! 🤞

Bear Verdict:

But hold your horses! Despite those bullish moving averages, the selling signals from momentum and MACD are like a dark cloud on a sunny day. A breakdown below $106,000 could send us spiraling down, invalidating the bullish trend and opening the door for a deeper correction. Yikes! 😱

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-28 16:28