Oh, look at that—Bitcoin‘s price is chilling at around $114K today. Isn’t that adorable? Investors and traders everywhere are holding their breath, praying that BTC can stick to its game plan and keep up the drama. With talk of spot ETFs, whale wallets bulking up, and miners barely selling off, it seems like this week could be the episode where everything either falls apart or… gets juicier. 💸📉

Bitcoin’s Rollercoaster Ride: Tech Talk and Sassy Chart Signals

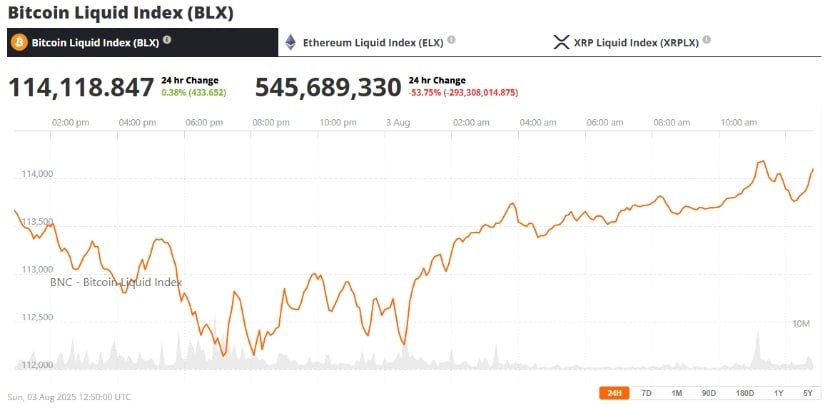

As of today, Bitcoin is like that one person at the party who won’t stop talking about their 0.38% gains—currently sitting at $114,118. The price is bouncing off that $112K support zone like it’s a trampoline (so graceful, really). The 20-day EMA is in on the action, and BTC is hanging out in a lovely parallel channel on the 4H chart.

Now, let’s talk about the Relative Strength Index (RSI)—oh, the drama. It’s just neutral at 54, like that person who refuses to pick sides. So, there’s room for more upward excitement! We’ve seen a bit of a cool-off since the BTC high of $123,500 in July, but a little dip never killed anyone, right? 😏

If BTC decides to pump it back up past $116,000, we might see $120K next, with a grand finale at $123K. But, should things take a dark turn (oh no), losing that sweet $112K support could send BTC down to $108,800. So much suspense!

Bitcoin Gossip Today: ETF Drama, Whale Alerts, and ‘The Halving’ Plot Twist

The big talk of the town? Bitcoin ETFs! Spot ETFs are back in the limelight after a little break in mid-July. Net inflows are surging again, like a plot twist that no one saw coming. Institutional players are definitely still playing the game—who would’ve guessed?

Meanwhile, Bitcoin whale alerts are buzzing like never before. Apparently, wallets with over 1,000 BTC have been stacking up 45,000 BTC over the last two weeks. That’s a lot of fish in a very small pond. 🐋

Oh, and did we mention the halving drama coming up in 2025? Yeah, just 8 months away. Buckle up because Bitcoin usually gets all moody and accumulates a ton of energy 6–12 months before the halving. Historically, this has been the lead-up to some serious action. 👀

Bitcoin and Inflation: Still the Coolest Kid in Class?

So, is Bitcoin still the “I’m-so-cool-I-can-handle-this” inflation hedge? Analysts are still all in. Bitcoin’s been strutting its stuff as a reliable hedge, especially when global growth slows down and sovereign debt makes everyone uneasy. Classic Bitcoin, always acting like it knows what’s up. 😎

In their Q3 crypto report, JP Morgan kinda hinted that BTC is owning ETH this quarter, mostly thanks to its stable monetary policy and all the ETF love it’s been getting. Plus, the fabulous Larry Fink from BlackRock is really pushing Bitcoin as digital gold. Who knew a currency could be this glamorous?

And let’s not forget about Bitcoin’s tech upgrades—Taproot and the Lightning Network—making it smoother than your favorite smoothie. Even with declining miner revenue, the case for BTC just keeps getting stronger. 🍹

Looking Ahead: BTC’s Next Big Move or a Bitter Breakup?

If Bitcoin’s bulls manage to keep it above $112,000, don’t be surprised if we see it strutting up to $120K, and who knows—maybe even $123K. A breakout above that could mean a new high for 2025, and maybe BTC will even hit $130K before Q3 says goodbye. 🔥

On the grand stage, all this ETF chatter, halving excitement, and institutional backing could help Bitcoin solidify its place as a long-term store of value. But, hey, if the drama gets real, we might just witness a twist no one saw coming. 🎭

So, this week’s key moment? The $112K zone. Will it hold, or will Bitcoin’s fans be left crying into their wallets? Stay tuned, folks. 🧐

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-03 19:37