So you want to understand Bitcoin’s relationship with central bank liquidity, huh? 🤔 Good luck. It’s like trying to figure out why your cat hates you-there’s no simple answer, but we’ll give it a shot anyway.

Sure, analyzing macroeconomic data sounds about as fun as alphabetizing your spice rack, but here’s the twist: instead of obsessing over global M2 money supply (yawn), experts suggest keeping an eye on central bank balance sheets. Why? Because apparently, those nerdy spreadsheets hold secrets even juicier than your aunt’s casserole recipe.

Central Bank Liquidity and Bitcoin: A Love Story ❤️💰

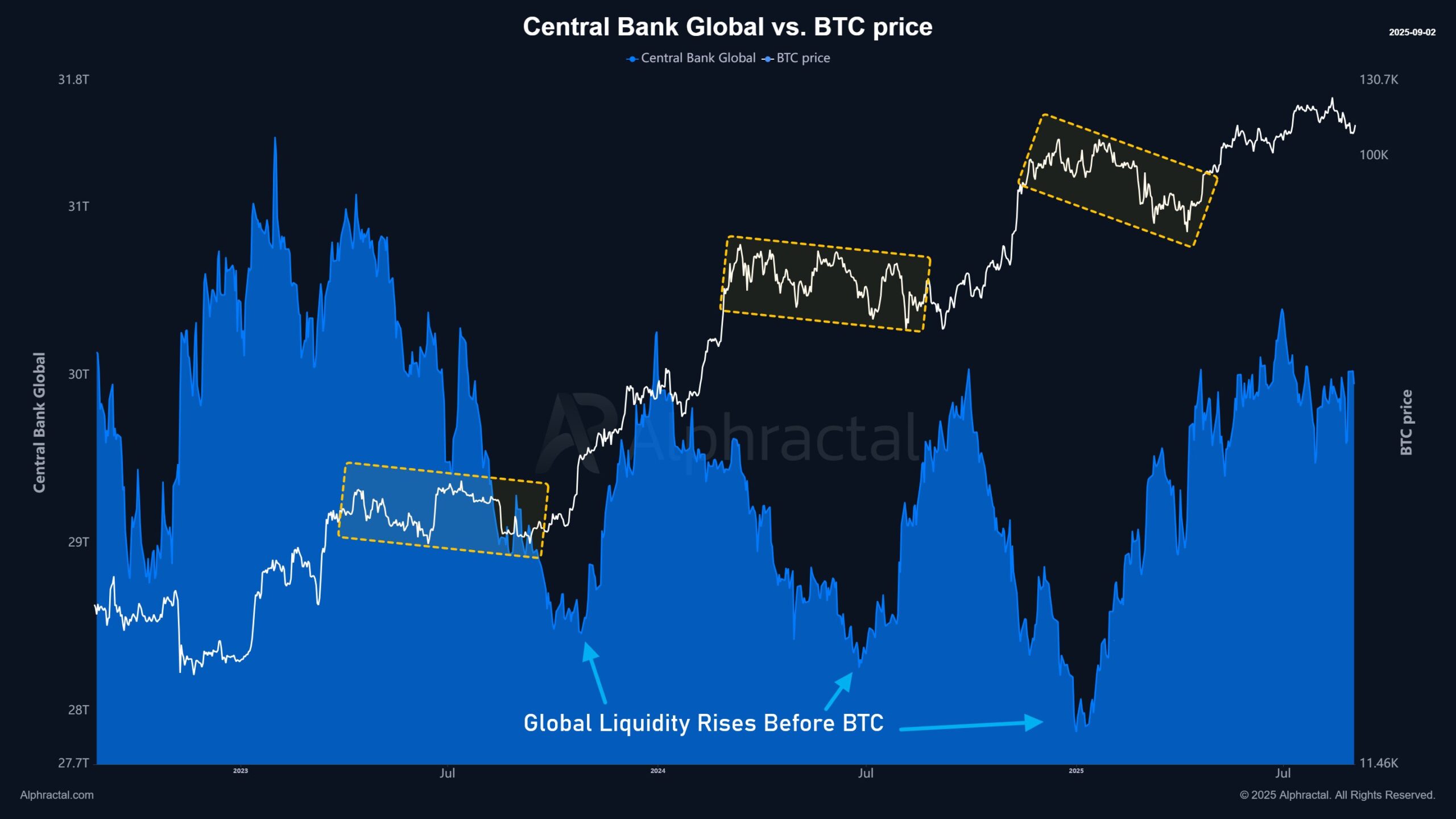

A recent study by Alphractal claims that when central banks pump liquidity into the economy, it trickles down faster than bad news at a family reunion-and guess what? Bitcoin is one of the lucky recipients. According to their data, every time central bank liquidity goes up, Bitcoin follows suit about two months later. Coincidence? Probably not. Conspiracy? Maybe.

From 2023 to 2025, global central bank liquidity bounced around between $28 trillion and $31 trillion, cycling through expansions and contractions like a moody teenager. Each surge in liquidity was followed by Bitcoin doing its thing-climbing higher or settling sideways depending on whether liquidity was rising or falling. “It’s science!” they say. Or maybe just really fancy graph reading.

“Central banks inject cash first,” Alphractal explained, “and then some of that cash sloshes into risk assets like BTC.” Translation: Bitcoin is basically the rebellious cousin who shows up late to Thanksgiving dinner after everyone else has already eaten dessert.

This pattern helps explain why Bitcoin hovered between $100,000 and $120,000 in Q3 while liquidity stayed below $30 trillion. Analyst Quinten pointed out that Bitcoin’s four-year cycle mirrors the ebb and flow of liquidity cycles since 2020. It’s almost poetic-if poetry were written by accountants armed with Excel sheets.

Debt vs. Liquidity: The Ticking Time Bomb ⏳💣

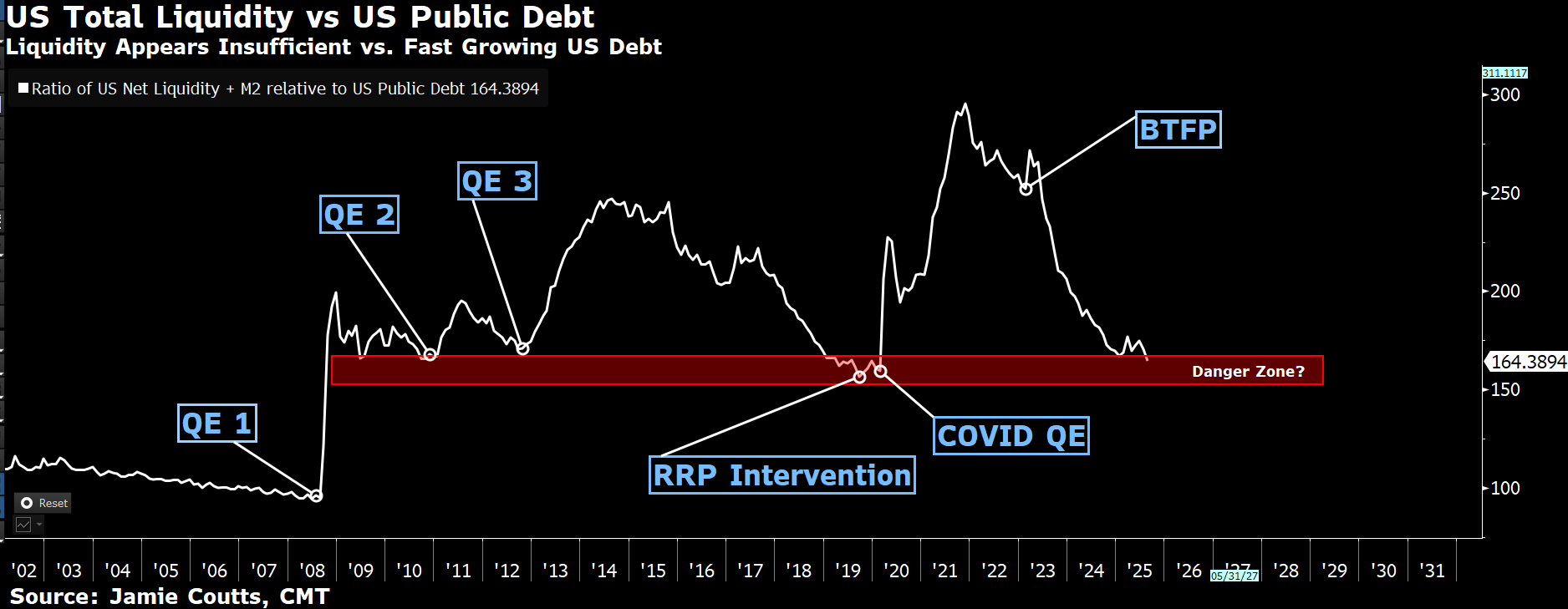

But wait, there’s more! Jamie Coutts, Chief Crypto Analyst at Realvision, decided to sprinkle a little doom onto this financial party. He warned that if debt grows faster than liquidity, things could get ugly. Like, “forgot-to-cancel-your-gym-membership” ugly.

Think of global liquidity as a hamster wheel spinning furiously to keep up with ever-growing debt. If the wheel stops? Collapse. Panic. Chaos. Dogs and cats living together! Okay, maybe not the last part, but you get the idea.

“When the ratio of liquidity to debt is high, inflation runs wild,” Jamie said. “When it’s low, funding pressures build, and risk assets tremble.” In short: too much debt + too little liquidity = potential disaster movie starring Bitcoin as the reluctant hero.

And let’s not forget Ray Dalio, billionaire extraordinaire, who chimed in with his own gloomy prophecy. He thinks U.S. public debt has reached catastrophic levels and might cause an “economic heart attack” within three years. His solution? Cryptocurrencies with limited supply could shine if the dollar tanks. So, yeah, cue the dramatic music. 🎶

While Alphractal focuses on history repeating itself (spoiler alert: it always does), Jamie and Ray are busy pointing out how today’s problems are… well, bigger. But hey, despite all the doom and gloom, Bitcoin still sits pretty in its golden throne. Experts agree-it might just come out ahead, because apparently, chaos loves company. 👑

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- How to find the Roaming Oak Tree in Heartopia

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-09-03 13:28