Bitcoin Cash (BCH) – yes, the “other Bitcoin” that people forgot about – has made an unexpected jump to $647, its highest point in 17 months. Just a few weeks ago, social media was practically drowning in tears, as the doom-and-gloom crowd lamented BCH’s future. You know, the usual “crypto is dead” rhetoric. But surprise! The market decided to throw a little plot twist our way, like a bad soap opera with fewer explosions.

Enter Santiment data, which, like your overly optimistic friend who always sees the glass half full, suggests that extreme negativity is often the precursor to a sharp rebound. It’s amazing how quickly market sentiment can go from “Everything is terrible” to “Everything is amazing!” A real emotional rollercoaster, if you will.

Bitcoin Cash Hits a Yearly High (And No One’s Sure How It Happened)

So, Bitcoin Cash hit a new yearly high of $647. Why? Well, the U.S. Federal Reserve cut interest rates by 25 basis points, and suddenly, everyone wanted a piece of the risk pie. Crypto markets, as usual, responded like an overeager puppy, with fresh buying interest all around.

But wait – there’s more! On-chain data showed BCH’s trading volume shot up by 155%, reaching a staggering $1.38 billion. This surge is the highest we’ve seen since December 2024. Apparently, everyone’s decided that BCH is the new hot thing, or maybe it’s just the next best way to spend those stimulus checks?

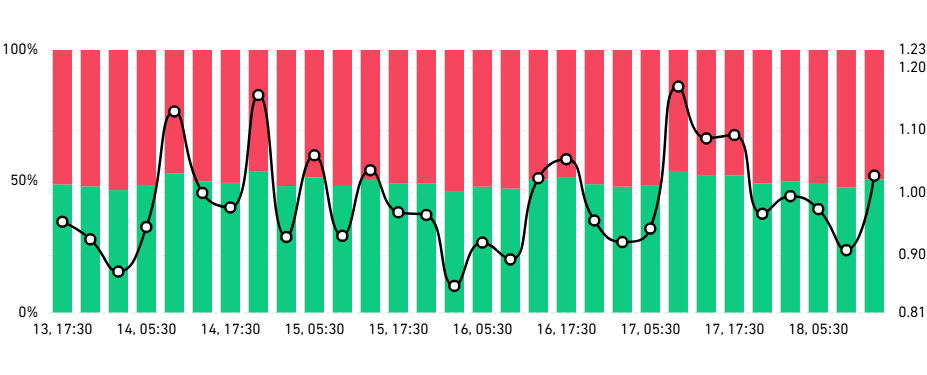

And if you think that’s impressive, let’s talk Coinglass. The BCH long-to-short ratio now sits at a solid 1.28 – the highest in over a month. Translation: more people are betting on BCH going up than down. Now, we’re all in for the thrill ride.

BCH Outshines Bitcoin for the Moment (Yes, You Read That Right)

And here’s the kicker: BCH has been outperforming Bitcoin. Yes, you read that correctly. While Bitcoin usually hogs the spotlight, BCH jumped 7% ahead of it. In a market that worships Bitcoin like it’s the financial equivalent of Beyoncé, that’s no small feat.

This is a classic case of traders hunting for short-term opportunities, rotating into altcoins like BCH whenever the retail crowd gets too enthusiastic about Bitcoin. It’s like that one person at a party who refuses to listen to the DJ and instead starts their own conga line.

Bearish Talk? Perfect Timing for a BCH Rally!

Bitcoin Cash’s recent rise came on the heels of a chorus of bearish voices. Social media was practically drowning in skepticism about BCH’s future, and Santiment’s data shows that when the negativity reaches a certain pitch, it can set the stage for a rebound. In other words, when everyone’s crying, that’s often when it’s time to buy.

History has proven that when people are too pessimistic, it can actually create some of the best buying opportunities. So, when the sentiment chart shows that positive comments dip below 0.13 for every bearish remark, it’s practically screaming “BUY!” Of course, too much optimism? That’s when you need to worry about corrections. It’s like the financial version of “Too good to be true.”

What’s Next for Bitcoin Cash? (Spoiler: It’s Uncertain, But Hopeful)

Bitcoin Cash’s recent surge is a shining example of how buying when fear is at its peak and selling when everyone’s giddy might actually work in crypto. So far, it’s been textbook, with BCH hitting its highest level since early 2024. Now, with BCH hanging on at $647, the big question is whether it can keep up the momentum and hit last year’s high of $719. Fingers crossed, right?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-09-18 14:57