Well, folks, it’s your favorite rollercoaster again-Bitcoin’s doing laps in the kiddie pool, barely teasing $114,400 to $117,300 while everyone mumbles, “Yawn.” Last week’s late rally fizzled faster than my motivation at 9 a.m., thanks to US Fed Chief Jerome Powell dropping just enough dovish whispers to keep traders yawning and ETFs crying into their coffee-$1.2 billion of outflows, no less. Talk about a bloodbath.

But hold your NFTs! Enter Michael Saylor, the man with more Bitcoins than most of us have socks, vaguely suggesting “Bitcoin is on Sale” in his latest cryptic tweet accompanied by a picture of his crypto treasure chest. Yeah, he’s basically waving a golden megaphone while sitting on an actual mountain of digital gold-629,376 BTC worth around $72.3 billion and climbing faster than your last obsession with a trend. Profits? Nearly $26 billion. Just casual billionaire stuff.

Bitcoin is on Sale

– Michael Saylor (@saylor) August 24, 2025

This could mean two things: either Saylor’s about to make it rain again, or he’s just showing off his Bitcoin collection (guess which is more likely). If he actually does start buying again, it might boost the confidence of traders who’ve been huddling like they’re waiting for the next ice age. The other possibility? Traders might jump in early, hoping for a quick Saylor positive surprise, which could add some liquidity and maybe, just maybe, give Bitcoin a little boost-because who doesn’t love a good pump?

Bitcoin Price Forecast: Will Bulls Break Free or Stay Stuck Listening to Resistance?

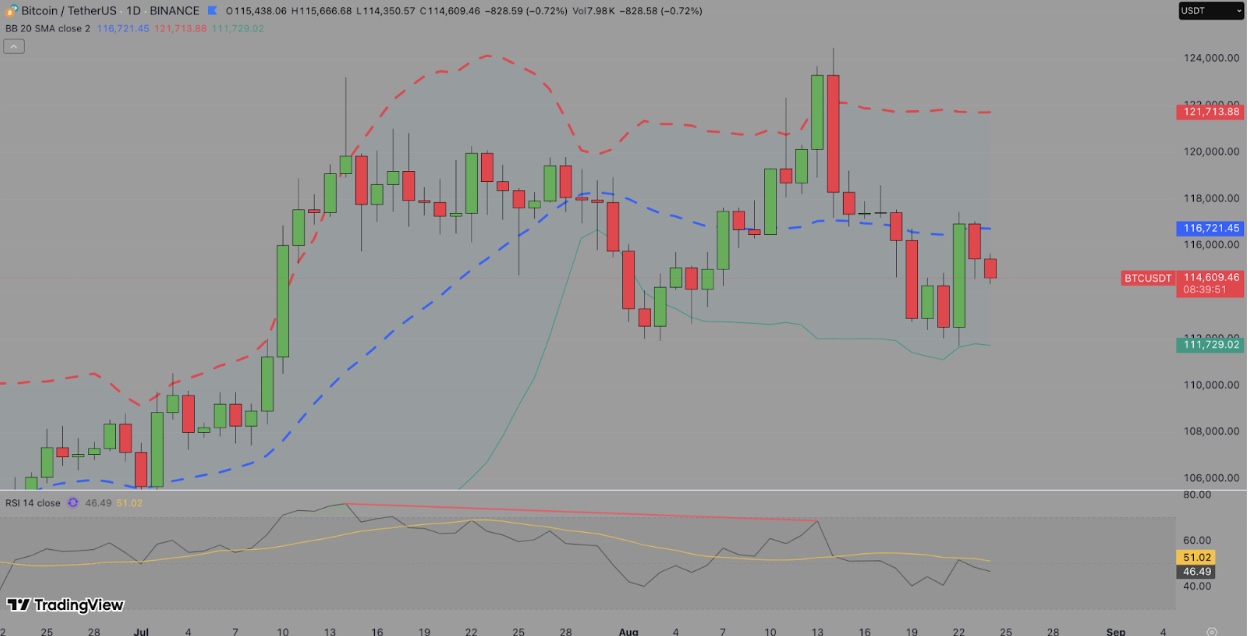

The new week kicked off with Bitcoin playing it cautious, hovering around $114,600, as if it’s pondering whether it should move or stay comfortably numb. Daily charts show BTC just shy of the middle Bollinger Band, chilling at around $116,722, with resistance looking like a giant wall at $121,713-basically a “not today” sign for bullish breakout fans.

The RSI is hanging out at 46.53-neither high-fiving nor crying-it’s just there, undecided. We’re truly in the land of “blink and you miss it,” with a slight nudge either way depending on whether buyers start throwing money or sellers start taking it.

Bitcoin price forecast | Source: TradingView

If Bitcoin can muscle its way past $117,800-where the shorts are thicker than grandma’s pie crust-things could get exciting, with potential runs to $121,700 and maybe even $124,000, which is like Bitcoin’s version of “last called” at the bar. All eyes on corporate demand and Saylor’s supposed shopping spree; if they muster up enough fire, we might see a trending “Bitcoin Breaks Out, Investors Toast Cheers.”

But tread carefully; if it dips below $111,700 (your friendly neighborhood lower Bollinger Band), expect a trip down to around $108,000, where we had some late July party remnants. Basically, we’re stuck in a range-bound drama-$114K to $118K-until something spicy happens.

Maxi Doge’s Wild Ride: When Bitcoin Plays Hard to Get

Meanwhile, as Bitcoin plays hard to get, some brave souls are eyeing Maxi Doge-your new favorite high-risk, high-reward token. Promising 1000x leverage with no stop-loss, it’s a tempting circus act for traders craving fireworks, risk be damned.

Maxi Doge Presale

Already scooping up over $1.27 million of people’s hard-earned cash against a $1.53 million target, at a piddling price of $0.000253 per token. With just two days left, some might say they’re gambling their future on a coin that’s basically the crypto version of playing 3D chess with a squirrel. Head over to the Maxi Doge website before they call last orders-or, you know, before reality hits harder than a bad haircut.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-25 03:43