For many moons, investors-those restless souls ever in pursuit of fortune-had convinced themselves that shares in Bitcoin treasury companies, such as MicroStrategy and Metaplanet, were a wiser, safer path to the golden halls of cryptocurrency riches. Like peasants dreaming of a tsar’s feast, they believed this shortcut would spare them the toil of direct ownership. Alas, as fate would have it, the bubble was but a fleeting illusion, destined to burst with the cruel inevitability of a Russian winter. ❄️

A new missive from the analysts of 10x Research reveals a sobering truth: retail investors, those ever-hopeful dreamers, have seen over $17 billion vanish into the ether-not from Bitcoin’s own fickle price, but from something far more humiliating: their own folly. 🤦♂️

The Great Fall: When Premiums Plunged Like Drunk Noblemen

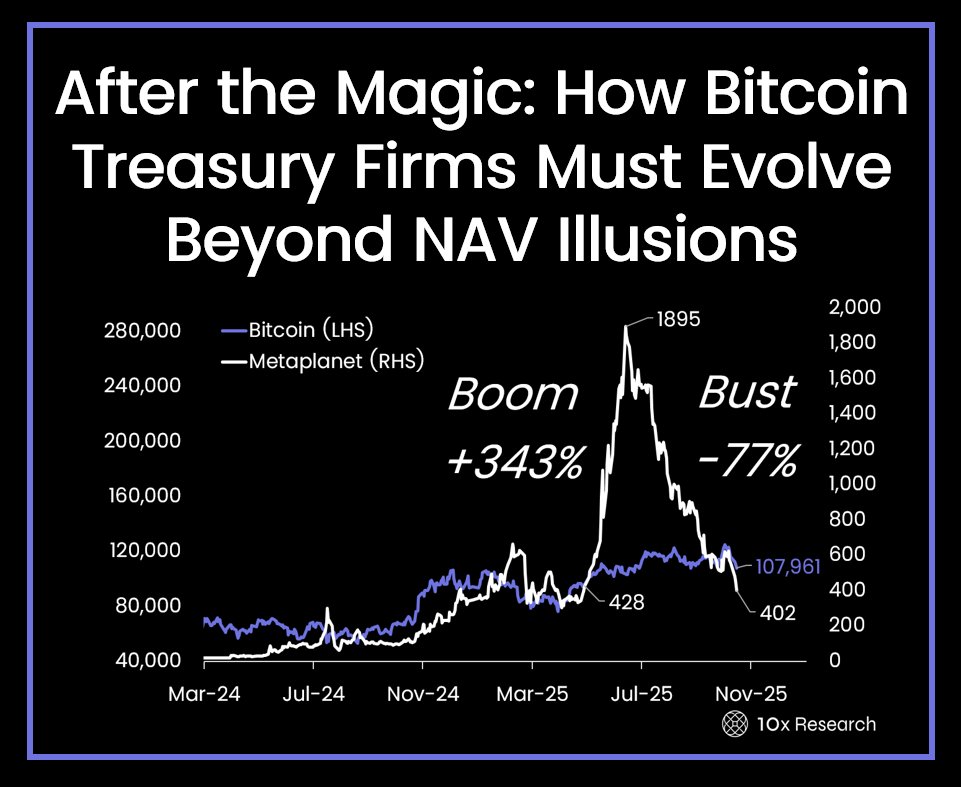

In the heady days of 2024 and early 2025, when Bitcoin’s institutional embrace was whispered about in hushed, reverent tones, investors paid three, even four times the net asset value for these treasury stocks-as if they were purchasing enchanted relics rather than mere shares. Such was their faith in leveraged crypto prophecies.

But lo! The winds of global markets shifted, and the specter of Trump’s trade wars with China cast a shadow of doubt. The once-lofty premiums collapsed to a pitiful 1.0-1.4× NAV, wiping out fortunes faster than a serf’s debts to the landlord. All this while Bitcoin itself remained near its gilded heights. Truly, irony is the cruelest of jesters. 🎭

Metaplanet & MicroStrategy: A Tale of Two Follies

Metaplanet, once hailed as “Asia’s MicroStrategy,” ceased its Bitcoin acquisitions in early October after its share price plummeted nearly 47% in mere weeks-a fall so swift it would make even Napoleon’s retreat from Moscow seem dignified. The company, now worth less than its own Bitcoin holdings, saw $4.9 billion evaporate into the void. Poof! 💨

MicroStrategy, that grand old patriarch of Bitcoin treasuries, fared little better. Its premium, once a princely 4× NAV, withered to a meager 1.4×-proof that even the mightiest oak may splinter when the storm is fierce enough. 🌳⚡

The Anatomy of a Financial Tragedy

10x Research declares this the end of “financial magic”-a phrase as hollow as the promises of a charlatan mystic. These treasury firms, once lauded for their bold Bitcoin gambits, must now justify their existence through actual revenue-lending, custody, arbitrage-or face the gallows of irrelevance. The choice is stark: adapt or perish. 🔪

The mathematics of ruin are simple: companies bought Bitcoin with overpriced stock or debt, and when the fever broke, those who bought at the peak lost roughly 67% compared to holding Bitcoin directly. A lesson in hubris, written in red ink. 📉

Now, the wise (or at least the chastened) flee to spot Bitcoin ETFs or direct holdings-where transparency reigns and premiums do not feast upon one’s returns like wolves upon a carcass. 🐺

And yet, 10x Research warns that the worst may still come. Another $25-30 billion could vanish by year’s end, further punishing speculative capital. To endure, firms must now conjure 15-20% returns through real yield-or face the final curtain. 🎪

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-10-18 11:38