Ah, Bitcoin, the gift that keeps on giving (or taking)! Once again, the grand beast tests the almighty $91,000 support, with a casual $3.4 billion in options expiry looming over its head on December 5. And what’s the response from our dear BTC? A 10% bounce from the weekly lows of $84,000. Well, that’s something, isn’t it? But hold your horses, my friend, bulls still need to take out that pesky $93,200 to prove the uptrend is real.

Now, let’s talk resistance. Yes, BTC continues to play it cool below the all-important $93,200. If you’re looking at the one-month chart, it’s like watching a tragic play where the price just keeps descending, much like a Shakespearean downfall-after the November highs, it’s all about that corrective structure. The sell-off last month? A real masterpiece of chaos.

But wait, there’s more drama! The latest Bitcoin price rebound stalled at a mere $93,500-oh, the tragedy! It formed another lower high, reinforcing the short-term downtrend. The momentum? As weak as a soufflé on a windy day, with intraday bounces losing steam faster than you can say “bullish reversal.” There’s simply not enough liquidity above current levels to make a real breakthrough. Classic BTC.

If the Bitcoin price takes a dive below $91,000, we’re headed straight for the next support zone at $90,000-$90,500. Don’t get your hopes up, bulls! On the upside, to break this depressing pattern of lower highs, BTC needs to reclaim that $93,200 to invalidate the near-term bearish structure. But, in the midst of all this drama, miners have quietly added $220 million to their reserves-because, why not?

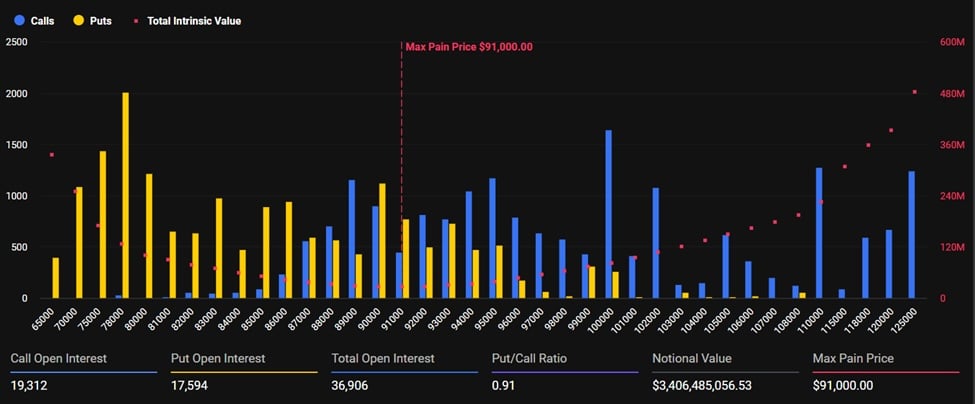

Now, let’s talk about today’s grand event: the options expiry! With roughly $3.4 billion in Bitcoin options about to expire, and 36,906 contracts open, everyone is on edge. The maximum pain point stands at $91,000-just a smidge below Bitcoin’s current price of $92,279. Will it be a soft landing, or a crash? Stay tuned!

Bitcoin options expiry | Source: Deribit

Now, for a little drama from the traders. The Put-to-Call ratio sits at 0.91, meaning the sentiment is nearly balanced-except that traders are more interested in hedging than taking a full-on bearish plunge. How terribly cautious! 🙄

As volatility steadily cools and more capital enters the space, traders are shifting from “5-10x flips” toward capital preservation + sustainable yield. On-chain products are rising to meet that demand – transparent, self-custodied, and built for real income generation. Oh, the sophistication!

“You can…”

– Deribit (@DeribitOfficial) December 4, 2025

So, what’s next for our beloved BTC? Despite the recent turbulence, market experts are still upbeat about Bitcoin’s price movement. Crypto analyst Javon Marks says Bitcoin’s price action still points toward an uptrend. Despite the noise in the broader market, BTC is holding another higher low-oh joy, the bullish structure lives on!

Forget the news, forget the fancy indicators. The greatest indicator of all? Price Action. Right now, BTC is holding a Higher Low, which means the uptrend is still intact!

– JAVON⚡️MARKS (@JavonTM1) December 4, 2025

According to Marks, this little pattern is pointing towards a grand price move to the all-time highs of $126,230. Who wouldn’t want to see that? 💸 But hold your applause-crypto analyst Michael van de Poppe is singing a different tune. If Bitcoin loses its current support, he says, it could fall to $85K once again. “But don’t worry,” he adds. “I think the correction is over, and we’re forming a bottom before shooting back up to the ATH.” Well, that’s reassuring, isn’t it?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-12-05 15:53