In a move that rivals a Second World War nostalgia auction, two corporate giants splurged over half a billion dollars on Bitcoin this Labor Day, possibly sparking Tuesday’s miraculous rebound. The market, ever the drama queen, seems to have decided to give us a little hope-and a lot of whiplash.

Institutional Buying Spree Sends BTC Back Above $111K – Cue the fanfares 🎺

While some poor souls lamented Bitcoin’s dip below $108K during the holiday festivities, Michael Saylor’s Strategy and Simon Gerovich’s Metaplanet seized the moment-a sort of financial bargain hunt, if you will-and bought a combined 5,057 BTC for a mere $562 million. Yes, you read that right-more than half a billion, just to lift the market’s ego. And lo, the brave digital coin rallied back past the magical $111K threshold on a Tuesday, as if to say, “Oh, you thought I was done for? Think again, peasants.”

This sudden resurrection hints at the demise of the so-called “four-year cycle”-a phenomenon that had the market on a predictable roller-coaster of peaks and crashes, almost as monotonous as a Dickens novel. Every four years, or roughly every 210,000 blocks, rewards for miners halve, and everyone expects a rally followed by a spectacular crash. But the recent antics of the SEC, which blessed the first wave of Bitcoin ETFs in January, seem to have thrown a spanner in the works-this cycle may have just become a quaint relic of a bygone era.

Following these regulatory shenanigans, Bitcoin’s peak in March, just before the April halving, now looks like a side note in a far more interesting story-one where institutional whales decide to buy and hold, rather than merely pump and dump. Monday’s hefty purchases by Strategy and Metaplanet seem to reinforce this new narrative: Bitcoin is evolving, much like a bemused old man refusing to be constrained by cycles.

As Jason A. Williams, co-founder of Morgan Creek Digital, cheerfully declares, “This is why the bitcoin 4-year cycle is over. Top 100 bitcoin treasury firms now hold nearly a million coins-probably just enough to buy a small island.” Because what better way to show confidence than hoarding a fortune like a dragon guarding its gold?

Market Metrics: The Numbers Game 🎰

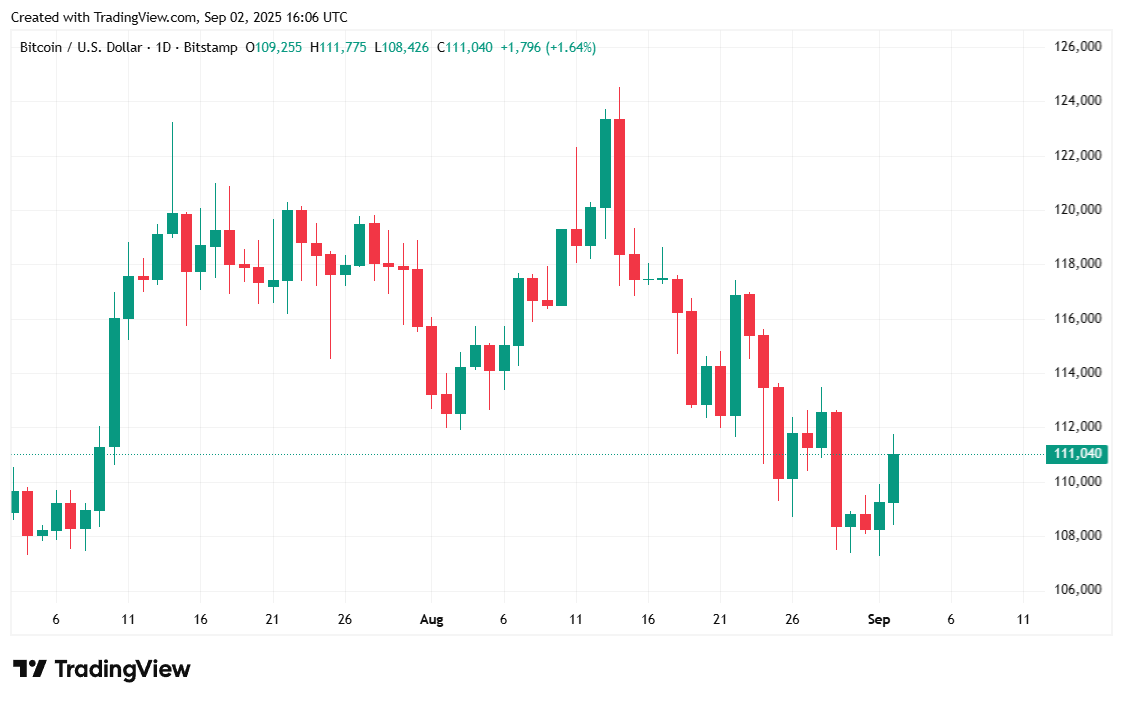

Bitcoin’s price at the moment is a neat $111,035.88-up 2.06% in the last 24 hours, offsetting the holiday gloom. It has been bouncing between $107,480.59 and $111,748.01-for those of you with better things to do than watch tickers-and boasts a weekly gain of 1.23%.

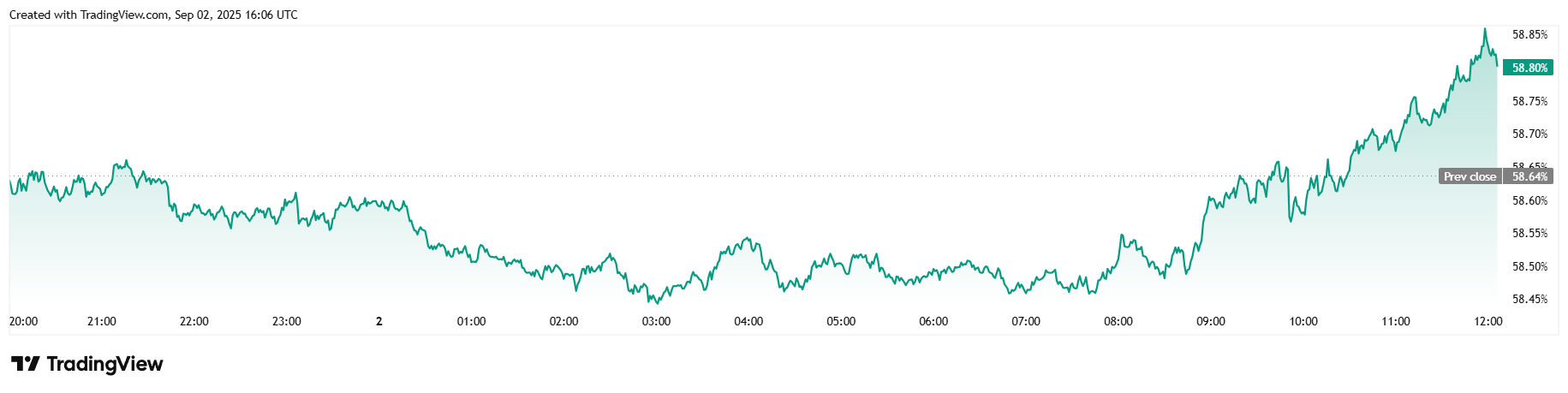

Trading volume has surged by 16.88%, reaching a staggering $72.66 billion, proving once again that everyone loves a financial soap opera. Meanwhile, market cap stands at $2.21 trillion, up 1.81%, because what’s money if not a game of numbers? Bitcoin’s dominance is now a modest 58.82%, creeping higher as if to say, “I’m still the boss in this digital jungle.”

The futures market is lively, with open interest up 2.35% to $81.92 billion. Liquidations on Coinglass hit $80.24 million, with both longs and shorts evenly splattered, indicating traders are about as confident as a cat at a dog show. Short-term sentiment? Balanced, like a tightrope walker in a hurricane-one misstep and it’s all over.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-09-02 20:28