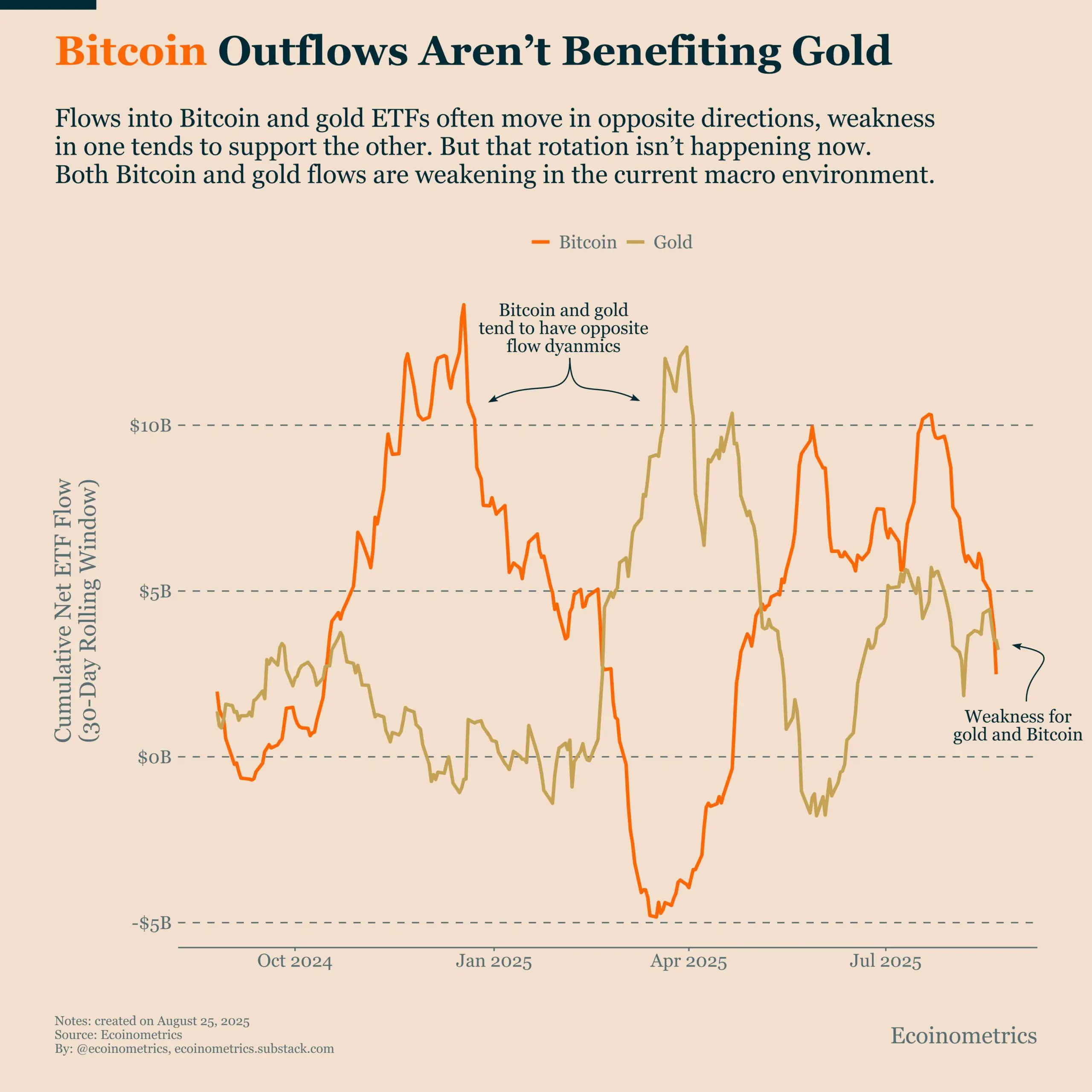

Oh, August, you saucy minx, you’ve truly outdone yourself this time. Instead of the usual tango between Bitcoin and gold-where one waltzes up while the other sashays down-both decided to throw in the towel simultaneously. How delightfully inconvenient! The culprit? A delightful cocktail of outflows and uncertainty in U.S. monetary policy that’s making markets twitch like a cat on a hot tin roof.

A Rare Synchronized Swan Dive 🦢📉

Bitcoin ETFs, those darling little divas of the crypto world, saw nearly $2 billion vanish faster than you can say “blockchain.” Six whole days of redemptions! And poor gold funds, usually the dependable lifeboats in stormy seas, weren’t spared either. Nearly half a billion dollars exited in just one week. It’s enough to make one reach for the smelling salts-or perhaps a stiff gin and tonic. 🍸

But wait, dear reader, there’s a twist! Toward the end of the month, both assets staged a minor comeback. Bitcoin ETFs enjoyed a four-day inflow streak, and gold funds bounced back like a champ. Yet, the peculiar alignment of their earlier exits suggests investors aren’t merely rotating-they’re retreating altogether. One might call it the Great Financial Hibernation. 🐻❄️

Macro Clouds Loom Large ☁️⚡

This synchronized exodus occurs against a backdrop of economic signals so mixed they could rival a poorly organized dinner party. Inflation remains as stubborn as a mule, while labor market data hints at a slowdown. This leaves the Federal Reserve in quite the pickle: should they keep rates high (and risk stifling growth) or cut them (and risk fueling inflation)? Truly, it’s like trying to choose between a rock and a hard place-but with more spreadsheets. 📊

Until the Fed makes up its mind, investors seem content to sit on their cash like misers guarding their treasure chests. Or worse, they’re flirting with higher-yielding instruments, leaving Bitcoin and gold looking rather lonely. Poor dears. 💔

The Crystal Ball Giveth…and Taketh Away 🔮

Both Bitcoin and gold have long been heralded as hedges against instability, but this month proved that even hedges lose their luster when policy signals are murkier than a London fog. The next Fed meeting will likely determine whether this pause in flows turns into a full-blown trend or merely a fleeting detour. Either way, buckle up, buttercup-it’s going to be a bumpy ride. 🎢

A friendly reminder, darling: this article is for informational purposes only. Coindoo.com doesn’t endorse any specific investment strategy or cryptocurrency. Always do your homework and consult a licensed financial advisor before making decisions. After all, no one wants to be the person who bet the farm on a bad tip. 🚜💼

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

2025-08-30 23:39