What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

Here we go again, folks! A new Bitcoin Improvement Proposal, BIP-110, seeks to purge the blockchain of spam-like data-those pesky Ordinals inscriptions that turn the ledger into a digital scrapbook of cat memes and JPEGs. But lo! Industry titans are up in arms, claiming this move might do more harm than good. What a time to be alive!

BIP-110, a “soft fork”-like tending a garden without uprooting the whole mess-aims to slap temporary limits on non-money data. Think of it as the blockchain’s version of telling your kid, “No more doodling on the walls with crayon… mostly.” It targets those Ordinals inscriptions that jam images, videos, and tokens into Bitcoin blocks like a sardine can at a family reunion.

If implemented, this could clear the clogged arteries of the network, making transactions cheaper for the average Joe. But let’s be real: who needs payments when you can send a dancing Shiba Inu GIF instead?

Enter Adam Back of Blockstream, who’s got a stick up his digital backside. He calls the proposal an “attack on Bitcoin’s reputation as reliable money.” To which we say, “Adam, dear sir, if Bitcoin’s reputation is so fragile, maybe it should wear armor!”

“It’s worse as it is an attack on bitcoin’s credibility as a store of value, it’s security credibility, and a lynch mob attempt to push changes there is not consensus for. spam is just an annoyance, it all definitionally fits within the block-size. the op returns are 4x smaller,” Back said on X. One might say he’s channeling the spirit of a 19th-century schoolmaster scolding children for drawing on the chalkboard with chalk.

Others chimed in, arguing the fix might hurt trust more than spam does. A philosophical debate, to be sure, while the market yawns and trades bitcoin between $67k and $70k like a sleepwalker at a poker table.

The CoinDesk Memecoin Index (CDMEME) is down 3% over 24 hours-because nothing says “fun” like a 3% drop in your digital confetti. Ether and BNB are also feeling the love (or lack thereof).

“The decline of the largest coins is an ominous sign for smaller ones, as it may soon pull them down with it at an accelerated pace,” said Alex Kuptsikevich, a market analyst. “To form a ‘true bottom,’ a peak in loss-taking and a complete exhaustion of selling pressure are necessary.” Sounds like a recipe for a midlife crisis.

In traditional markets, dollar shorts hit their highest level in over a decade. Meanwhile, the U.S. 10-year yield’s recent dip offers hope to battered bitcoin bulls. Stay alert, or don’t-the market doesn’t care.

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 1 of 3: ETHDenver

Market Movements

- BTC is down 1.03% from 4 p.m. ET Monday at $68,131.79 (24hrs: -1.28%)

- ETH is down 1.11% at $1,976.32 (24hrs: -0.57%)

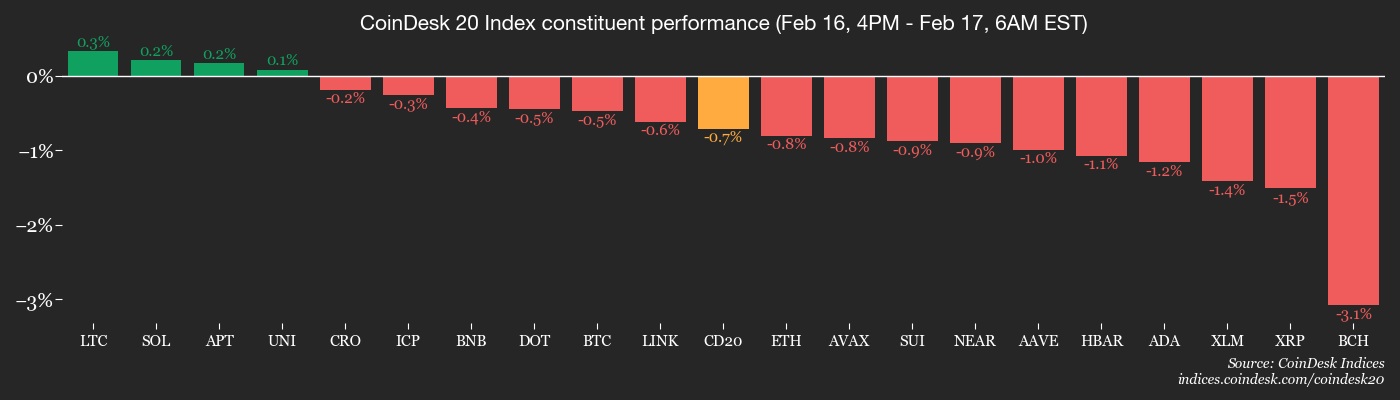

- CoinDesk 20 is down 1.28% at 1,978.56 (24hrs: -1.03%)

- Ether CESR Composite Staking Rate is up 6 bps at 2.84%

- BTC funding rate is at 0.002% (2.2119% annualized) on Binance

- DXY is up 0.21% at 97.12

- Gold futures are down 1.87% at $4,952.10

- Silver futures are down 4.19% at $74.70

- Nikkei 225 closed down 0.42% at 56,566.49

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 0.37% at 10,512.50

- Euro Stoxx 50 is up 0.15% at 5,987.94

- DJIA closed on Friday up 0.10% at 49,500.93

- S&P 500 closed up 0.05% at 6,836.17

- Nasdaq Composite closed down 0.22% at 22,546.67

- S&P/TSX Composite closed up 1.87% at 33,073.71

- S&P 40 Latin America closed on Monday down 0.64% at 3,717.23

- U.S. 10-Year Treasury rate is down 2.7 bps at 4.029%

- E-mini S&P 500 futures are down 0.20% at 6,836.50

- E-mini Nasdaq-100 futures are down 0.58% at 24,658.75

- E-mini Dow Jones Industrial Average Index futures are down 0.02% at 49,560.00

Bitcoin Stats

- BTC Dominance: 58.81% (-0.16%)

- Ether-bitcoin ratio: 0.02897 (-0.14%)

- Hashrate (seven-day moving average): 1,043 EH/s

- Hashprice (spot): $34.08

- Total fees: 2.22 BTC / $151,829

- CME Futures Open Interest: 118,450 BTC

- BTC priced in gold: 13.8 oz.

- BTC vs gold market cap: 4.53%

Technical Analysis

- The chart shows swings in bitcoin’s 30-day implied volatility index in candlestick format.

- Volatility has cooled significantly, reversing the early month pop to nearly 100%.

- The reversal indicates that panic has ebbed and traders are no longer frantically chasing options or hedging bets as in the first six days of the month.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $164.32 (+16.46%), -0.94% at $162.78 in pre-market

- Circle Internet (CRCL): closed at $60.04 (+6.02%), -0.35% at $59.83

- Galaxy Digital (GLXY): closed at $21.66 (+7.49%), -1.66% at $21.30

- Bullish (BLSH): closed at $31.73 (+0.06%), -0.66% at $31.52

- MARA Holdings (MARA): closed at $7.92 (+9.24%), -1.14% at $7.83

- Riot Platforms (RIOT): closed at $15.22 (+7.18%), -1.18% at $15.04

- Core Scientific (CORZ): closed at $17.84 (+2.06%)

- CleanSpark (CLSK): closed at $9.85 (+5.80%), -0.81% at $9.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $41.34 (+3.09%)

- Exodus Movement (EXOD): closed at $11.27 (+10.60%), -3.02% at $10.93

Crypto Treasury Companies

- Strategy (MSTR): closed at $133.88 (+8.85%), -1.60% at $131.74

- Strive (ASST): closed at $8.33 (+8.18%), -0.12% at $8.32

- SharpLink Gaming (SBET): closed at $6.85 (+4.74%), -2.34% at $6.69

- Upexi (UPXI): closed at $0.77 (+3.36%), +5.76% at $0.81

- Lite Strategy (LITS): closed at $1.12 (+8.74%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $15.1 million

- Cumulative net flows: $54.31 billion

- Total BTC holdings ~ 1.26 million

Spot ETH ETFs

- Daily net flow: $10.2 million

- Cumulative net flows: $11.67 billion

- Total ETH holdings ~ 5.71 million

While You Were Sleeping

Bitcoin remains under pressure near $68,000 even as panic ebbs (CoinDesk): Bitcoin is struggling to build any upward momentum, even as the key panic gauge pulls back from its early-month high and hints at renewed stability. Like a cat trying to climb a tree in reverse.

BofA survey flags dollar bearish bets at over a decade high. Here’s what it means for bitcoin (CoinDesk): Investors are most bearish on the dollar in over a decade, per Bank of America’s latest survey and that extreme bet could breed bitcoin volatility, just not the way crypto bulls have become used to. “Bearish” is just “opportunistic” spelled with more drama.

Pound and bond yields Fall as weak data Cements rate-cut bets (Bloomberg): The pound is falling below $1.36 after data showed wage growth slowed more than expected to 4.2% in December, while unemployment ticked up. A tale as old as time-or at least since 2023.

US and Iran begin nuclear talks in Geneva as threat of war looms (Reuters): Iran’s supreme leader warned that U.S. attempts to depose his government would fail, as Washington and Tehran began nuclear talks amid a U.S. military buildup in the Middle East. War? Pfft. Just another Tuesday in Geneva.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Overwatch Domina counters

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Gold Rate Forecast

- 1xBet declared bankrupt in Dutch court

- Breaking Down the Ending of the Ice Skating Romance Drama Finding Her Edge

- ‘Reacher’s Pile of Source Material Presents a Strange Problem

2026-02-17 16:20