Allegations have surfaced suggesting that Binance might be deliberately stifling Solana’s momentum to protect its precious BNB token, sending ripples through the crypto community. Oh, what a tangled web we weave in the world of crypto!

This adds yet another chapter to the saga of Binance, the undisputed giant of exchanges by trading volume, which has faced accusations of leveraging Wintermute, a market maker, to skew the market in its favor.

Is Binance Secretly Sabotaging Solana to Keep BNB on Top?

The mystery deepens as analyst Marty Party took to X (yes, Twitter, because who needs to communicate without drama?) to claim that Binance, in cahoots with Wintermute, has been suppressing Solana’s rise to prevent it from overtaking BNB’s market capitalization. He even offered up what he called “receipts.” It’s always nice when receipts are included-just like when you find a coupon for a free coffee after a year of saving them. 📜

🚨

Market Maker Update: @binance won’t allow @solana to pass $BNB market cap so they suppress it using @wintermute_t – here are the receipts. 1 hour ago.

Where are they getting this $SOL @CarolineDPham @SECPaulSAtkins when their proof of reserves says they have no $SOL other than…

– MartyParty (@martypartymusic) August 24, 2025

At the time of writing, Solana was trading at a hefty $203 with a market cap of $109.7 billion, trailing just behind BNB’s $865.97 price and $120.6 billion capitalization. Big numbers, big problems, folks.

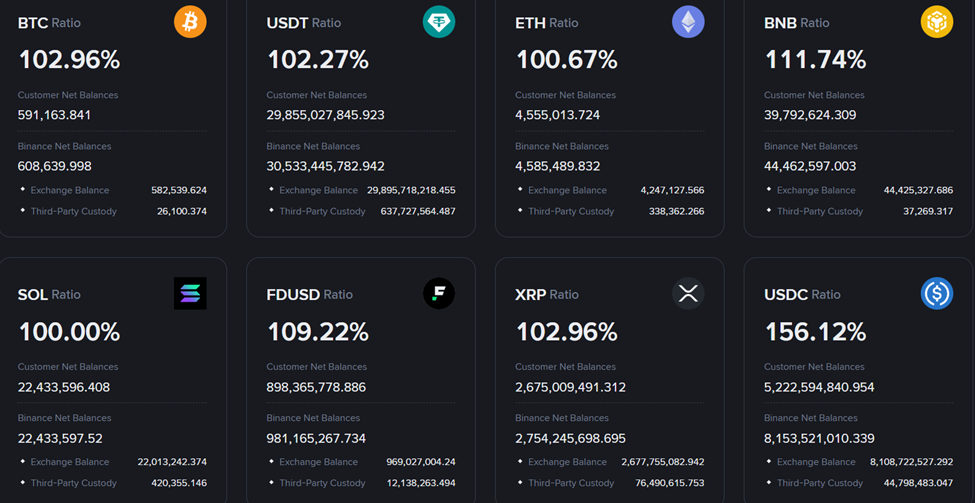

In Binance’s PoR, there’s no Solana to be found-except for the 22.433 million SOL tokens that belong to customers. Just your usual deposit situation: 22.013 million in exchange balance and 420.35 million in third-party custody. Nothing suspicious at all, right? 👀

This is not Binance’s first tango with Wintermute in the market manipulation waltz. Oh no, there have been past scandals too-like the Wintermute-led sell-offs that left smaller tokens, such as ACT, battered and bruised. And don’t forget the $20 million worth of crypto transactions tied to Wintermute that Binance was allegedly involved in seven months ago. It’s like the gift that keeps on giving! 🎁

BeInCrypto, always the busy bees, pointed out how this raises serious questions about the shady relationships between exchanges and market makers. They even questioned the role of market makers in maintaining liquidity versus allegedly manipulating market prices. How quaint. 🐝

Critics argue that if Binance is using Wintermute to throttle Solana’s rise, this would present a direct conflict of interest-shocking, right? They claim it could shake the very foundation of PoR frameworks and undermine the fairness of the so-called “open” markets. A bit like throwing a wrench in a delicate clockwork. ⏰

The Industry Calls for Action as the Market Faces a Tipping Point

The accusations have reignited concerns about Binance’s role in crypto markets, especially now that centralized exchanges are under intense scrutiny. Alan Knitowski, founder of NASDAQ-listed companies Cisco Systems and Phunware Inc., weighed in with his colorful opinion:

“So the ‘new system’ is even worse than the old system? Why are any of us accepting a system this fragile … corrupt … and manipulatable? When will Binance be involuntarily shuttered? Arrest them. Prosecute them,” wrote Alan Knitowski.

For those of us with popcorn, it’s easy to see the growing frustration among TradFi (Traditional Finance) veterans who were hoping blockchain markets would be a transparent utopia. Instead, they’re discovering that crypto may be just as murky as the old-school systems they sought to escape. Oh, the irony. 🙄

The accusations come at a time when Solana is soaring to new heights, gaining massive adoption in DeFi, NFTs, and meme coins. It has even positioned itself as a worthy challenger to Ethereum’s scaling supremacy-and now, apparently, to Binance’s BNB token too. A plot twist worthy of a Netflix series. 🍿

Whether these allegations are true or not, they mirror the fragile trust that underpins crypto markets. One side sees Solana as a promising network on the brink of mainstream adoption. The other sees a giant like Binance potentially engineering barriers to protect its own kingdom. The battle rages on. ⚔️

And so, regulators, investors, and developers continue to ask: how much power should centralized exchanges still hold over market outcomes? Good question, that. It’s one of those questions that may take a few more years, a few more scandals, and plenty of popcorn to answer. 🍿

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-25 02:23