- BERA’s price and its liquidity seem to be playing a game of tag, running in opposite directions, leaving investors scratching their heads and checking their pocket watches. 🏃♂️💰

- On the chart, there’s a hunch that BERA might just be gearing up for a big leap, eyeing a demand zone known to kick off rallies that’d make a steamboat jealous. 📈🚂

In the last sun’s journey ’round the Earth (or so they say), Berachain [BERA] took a tumble of10.72%, joining the ranks of the market’s biggest losers for the day, despite earlier hints of a rally that had folks a-tremble with anticipation.

But hold your horses, a rally ain’t outta the question yet! Sentiment indicators, particularly the way liquidity’s flowing and chart patterns, are whispering sweet nothings of a bullish bias. Though, it might need to dip its toes a bit lower first.

Liquidity flowin’ against the price tide

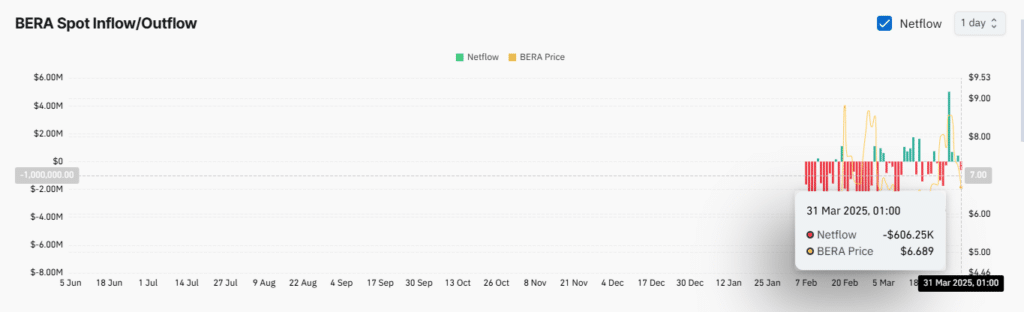

This24-hour dip, dragging BERA down to $6.69, swims against the current of liquidity pouring into its chain like whisky into a Mississippi riverboat gambler.

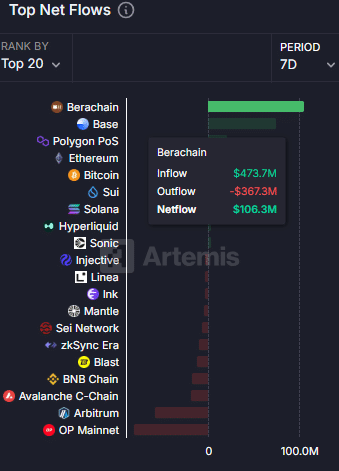

Over the past week, Berachain outdid Ethereum, Solana, and the rest of the highfalutin chains, raking in an extra $106.3 million into its network. Makes you wonder if they’ve struck digital gold or what.

Normally, after such a liquidity hoedown, prices tend to waltz upwards, or at least hold steady in a cozy range. But not today, it seems.

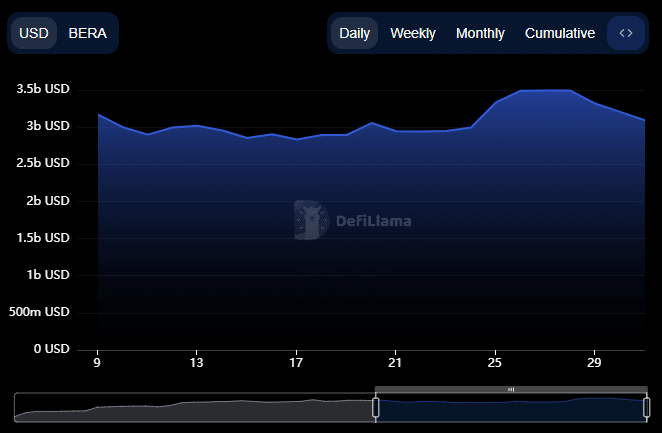

To get to the bottom of this price puzzle, one’s gotta peek at the Total Value Locked (TVL)—a fancy way of saying how much folks have stashed away in the network’s protocols. And lo and behold, TVL’s been slipping faster than a greased pig at a county fair.

Since March28th, Berachain’s TVL slid from a lofty $3.493 billion to a mere $3.144 billion, meaning $349 million up and vanished from its protocols in just three days. That’s enough to make any blockchain blush.

This liquidity exodus has surely played a part in the recent price nosedive. But fear not, for every cloud has a silver lining, or so they say. According to AMBCrypto’s crystal ball, this dip might just set the stage for BERA’s next grand act.

BERA tiptoeing towards key demand zones

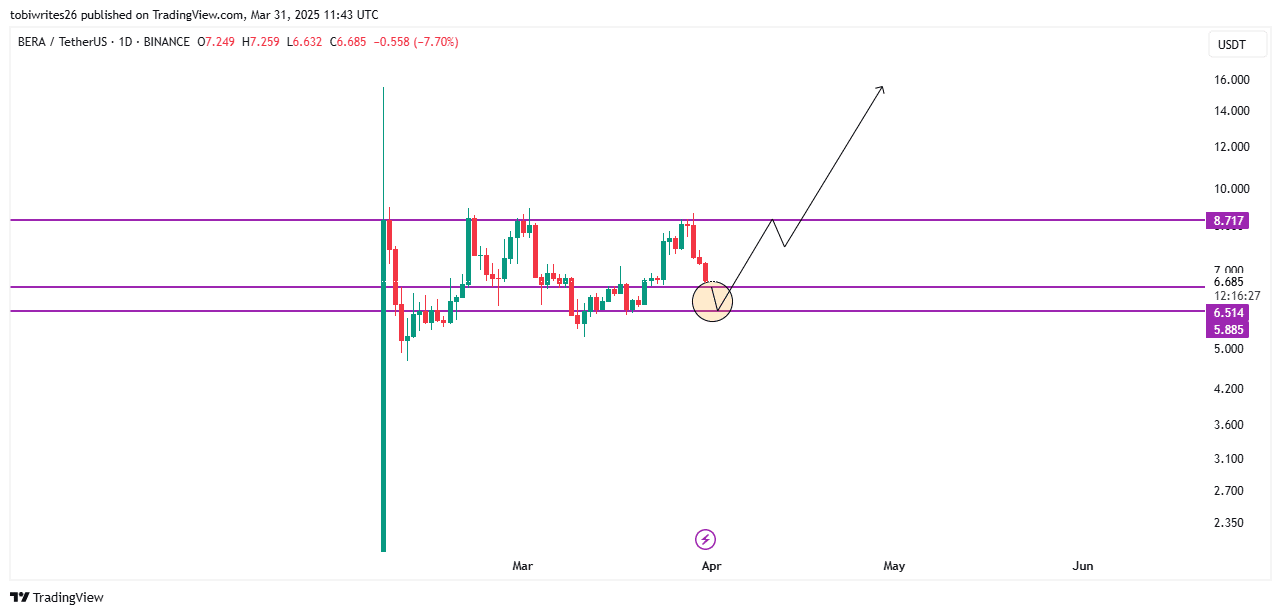

On the grand ol’ chart, BERA’s inching closer to a support level that’s been known to light the fuse for upward explosions in price.

If the downward pressure nudges BERA into the demand zone between $6.5 and $5.8 (highlighted on the chart like a beacon in the fog), it could rally up to at least $8.71, and who knows, maybe even gallop towards $15.

This rally dream could come true if BERA breaks through the $8.71 barrier, shaping up into a bullish flag pattern that’d make any trader’s heart skip a beat.

What’s more, there’s a renewed buying frenzy in the spot market after days of relentless selling. In the past24 hours, a cool $627,000 worth of BERA has been snatched up from exchanges, signaling a market that’s as lively as a frog in a frying pan.

When folks start buying even as prices dip, it’s a sign of a market as healthy as a horse. BERA’s dip is being seen as a golden opportunity to stock up before the potential price surge, especially if it saunters down to the marked demand zone.

Market sentiment: A tale of two cities

Over at Binance, traders are as bullish as a charging bull, with buying volumes dwarfing the selling. The long-to-short ratio has tipped over1, sitting pretty at1.0991.

Yet, the broader market tells a different yarn, with the overall long-to-short ratio languishing below1, hinting at a selling pressure that could squeeze a lemon dry.

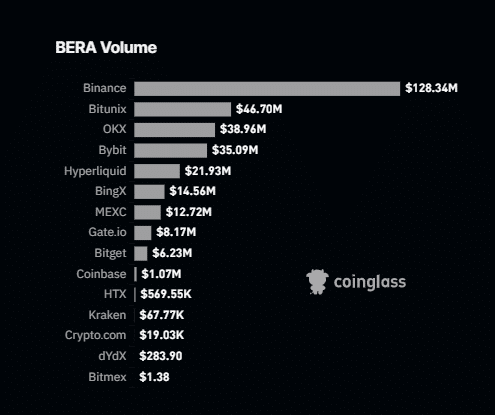

Binance traders, going long against the tide, might just slow BERA’s descent, considering Binance holds the lion’s share of BERA’s trading volume. It outpaces the next three exchanges combined by a cool $128.34 million, with their volume amounting to a mere $120.75 million.

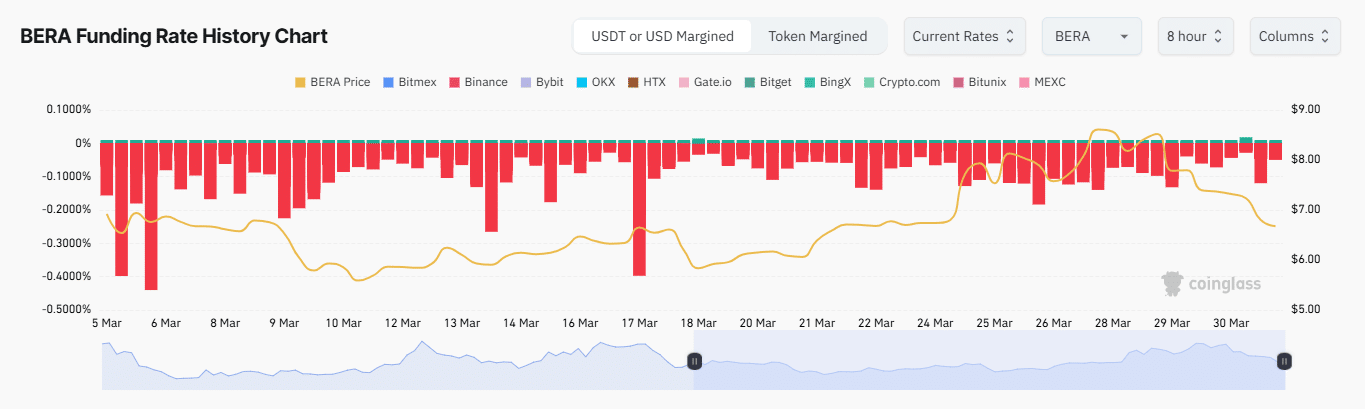

Moreover, BERA’s Funding Rate is at a chilly -0.0415%, meaning those betting against BERA are shelling out to keep their positions. This deep negative rate paints a picture of derivative traders with bearish convictions as strong as a mule’s kick.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- M7 Pass Event Guide: All you need to know

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-04-01 10:27