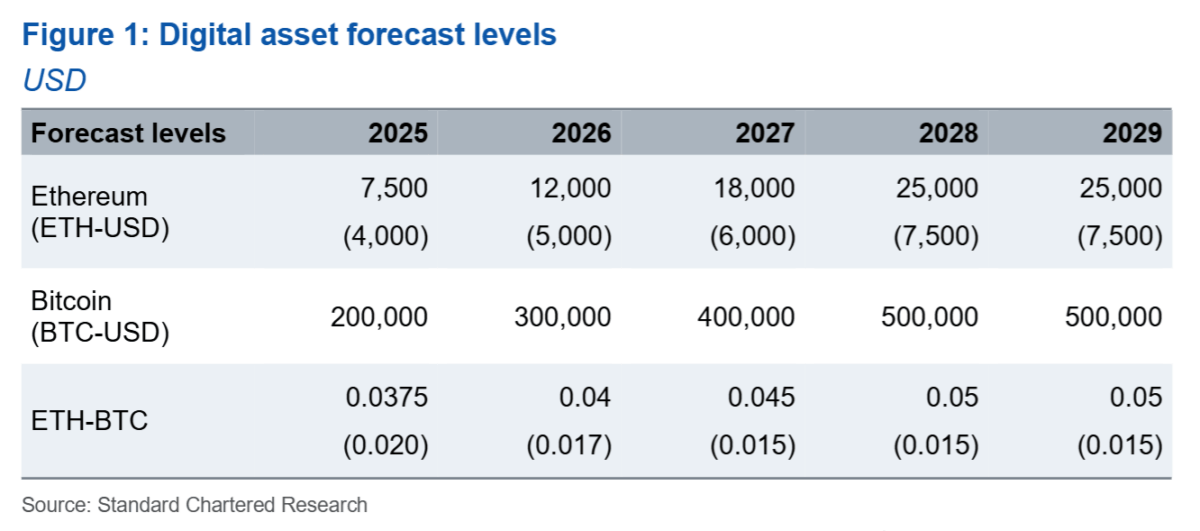

Well, well, well. Standard Chartered, bankers of impeccable taste and even more impeccable suits, have raised their 2025 Ethereum price target with all the grace of a flustered duchess discovering gin in her tea – up to $7,500! (One can only assume they popped some Champagne 🍾 or, failing that, dry martini upon arrival at this number.) Their previous forecast? A mere $4,000 – how terribly passé.

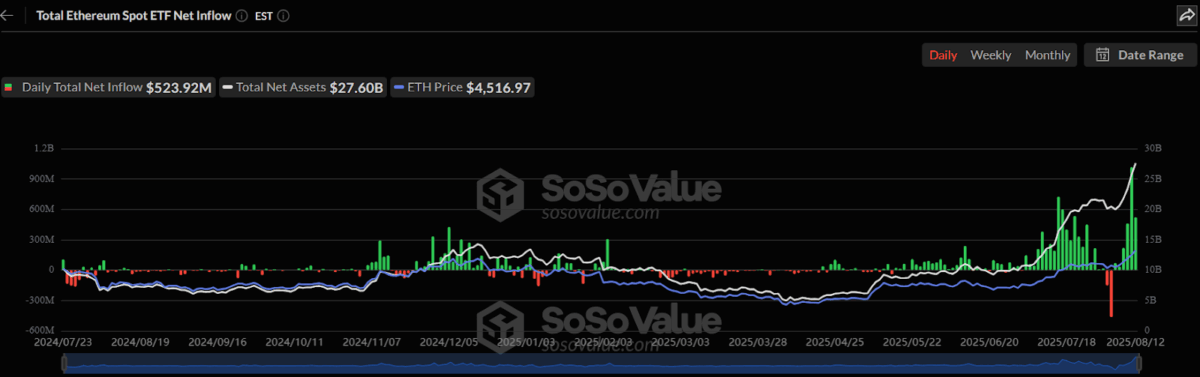

Apparently, the smart money is stampeding into ETFs and stablecoins with the ferocity of a cocktail party invaded by uninvited poets. Since June, Ether-besotted treasuries and ETFs have gobbled up 3.8% of the entire supply. This, according to Standard Chartered’s research team – who I suspect haven’t slept since the last halving – is almost twice as swift as Bitcoin’s recent accumulation in the heady froth of the U.S. election cycle. Demand is so hot, it’s practically scandalous. 🔥

A billion dollars in U.S. Ether ETF inflows and ETH prices inching perilously close to that decadent 2021 high. You know the bankers are starting to loosen their tie clips when tokens pull these sorts of stunts.

As if that wasn’t enough excitement for one luncheon, the July passage of the GENIUS Act has led to a regulatory environment so polite and accommodating, it’s practically serving canapés. Network activity is up, bulls are prancing, and everyone with a spreadsheet is quietly delighted.

The stablecoin spectacle is just the support act: poised, we’re told, to balloon to $2 trillion by 2028 (and if you don’t own a monocle yet, this is your cue). Ethereum, always eager to host the biggest soirée, lays claim to more than half of all stablecoin issuance. These digital darlings now account for 40% of blockchain fees-an arrangement that keeps ETH in exceedingly ripe demand.

Progress marches on as Vitalik Buterin, Ethereum’s own elusive magician, promises to make Layer-1 ten times speedier. High-value transactions will storm the blockchain while lesser, humdrum transfers are banished to Layer-2 purgatory on Arbitrum and Base. Voilà!

Not content to merely outpace itself, ETH is forecasted to trounce Bitcoin in the next twelve months, with the ETH-BTC rate leaping from 0.036 to 0.05. One can only imagine the caviar-stained handkerchiefs at Bitcoin headquarters. The long-term aspirations are deliciously outrageous:

- $7,500 by end of 2025 (fresh off the press)

- $12,000 by end of 2026 (enough to buy an island, or at least a decent wine cellar)

- $18,000 by end of 2027 (cue dramatic fainting)

- $25,000 by end of 2028 (call your decorator now!)

As for the present moment, ETH stands at a rather fabulous $4,692, up 50% in a month-a performance that would make even the most jaded debutante swoon. 💃

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-13 23:23