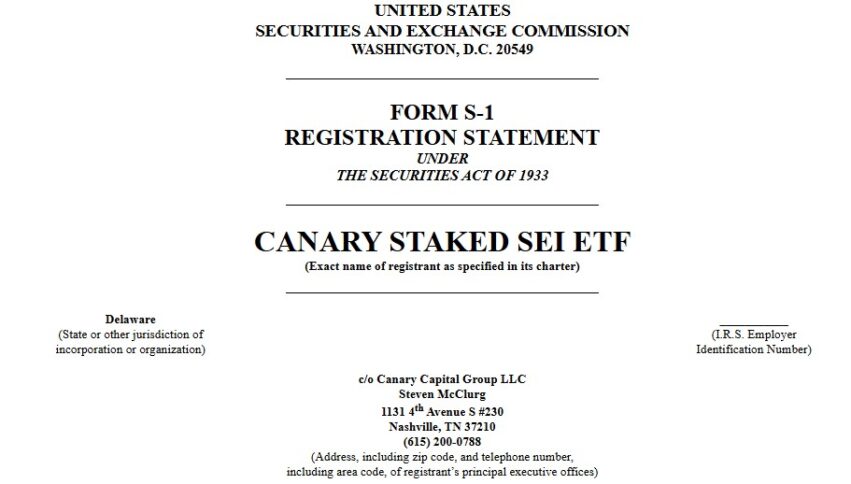

In a development destined to bemuse old Etonians and terrify anyone who remembers the crash of ’29, Canary Capital has performed the financial equivalent of taking tea with anarchists. The firm—heretofore known for polite irrelevance—has boldly petitioned the SEC to allow the listing of its very first Staked SEI ETF. One suspects Canary’s bespectacled analysts, reared on port and pessimism, are now debating the existential merits of “blockchain” between sips of tepid sherry.

Should this scheme be rubber-stamped (and, frankly, what’s stopping regulators from a spot of light mischief these days?), investors will have the unparalleled privilege of purchasing what is essentially the digital equivalent of betting on a pigeon race, in this case, with SEI, the vigorously named token of the Sei Network. Every evening, at the culturally significant hour of 4 PM New York time—presumably to allow brokers adequate opportunity for a restorative gin—the value will be determined by those high priests of modern finance, CoinDesk Indices.

In keeping with the spirit of “out with the old, in with the ludicrous,” the ETF spurns such jaded tools as derivatives. Instead, it shall cling resolutely to the actual SEI tokens with the tenacity of an Oxford don clutching tenure. Parade ground custodians BitGo Trust Company and Coinbase Custody Trust Company stand ready to shepherd these precious assets. The FDIC, predictably, wants nothing to do with this circus, but fear not—there are insurance policies. Just ask your friendly neighbourhood actuary if you can find one who doesn’t hyperventilate at the word “crypto.”

Long gone are the days when one required the daring of a cat burglar and the technical savvy of a Cambridge don to dabble in cryptographic treasures. Now, with the click of a button, even your great aunt Joan can invest—provided her broker hasn’t dozed off sorting the family silver. Private keys? Blockchain? Nothing to trouble your immaculate mind, darling investor.

But the pièce de résistance is the “staking” arrangement: the ETF will, rather like an ambitious butler, work behind the scenes to verify transactions and accrue additional SEI tokens as compensation. This not only flatters the investor’s sense of importance, but promises the thrill of passive income—a concept dear to all who wish to make money whilst horizontal.

Canary’s stately procession into ETF absurdity does not stop here. This follows on the heels of their application in the equally enigmatic TRX realm, further proof that the institutional imagination knows no bounds—except, perhaps, common sense. The SEC’s approval floats somewhere between the possible and the preposterous, but if granted, you too may soon hold tokens and staking rewards, all without the slightest inkling of how or why. Chin-chin, investor, and best of luck shepherding your flock in the digital wilds.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-05-01 09:43