My dear friends, gather ’round, for I have a tale to tell of a digital darling named Avalanche (AVAX). Market mavens are whispering of a delightful setup that could very well lead to a grand performance. After weeks of steady accumulation and a sudden surge in on-chain activity, AVAX has managed to pirouette above key resistance levels, hinting at a growing audience and a crescendo of momentum.

AVAX On-Chain Momentum Picks Up

Avalanche’s C-Chain is positively brimming with life, with weekly transactions leaping by 70% to a staggering 6.42 million and active addresses soaring nearly 30% to over 208K. This remarkable rise signals that the network is not only retaining its loyal patrons but also drawing in a fresh crowd. With Total Value Locked (TVL) crossing the $2 billion mark, it’s clear that liquidity and usage are dancing in perfect harmony, much like a well-choreographed ballet.

From an adoption standpoint, such on-chain growth in transactions and active wallets suggests that Avalanche is not only keeping its current audience entertained but also attracting new fans en masse. Strong on-chain performance often serves as a leading indicator for long-term momentum, reflecting genuine demand rather than fleeting whims.

AVAX Historical Patterns Favor Q4 Strength

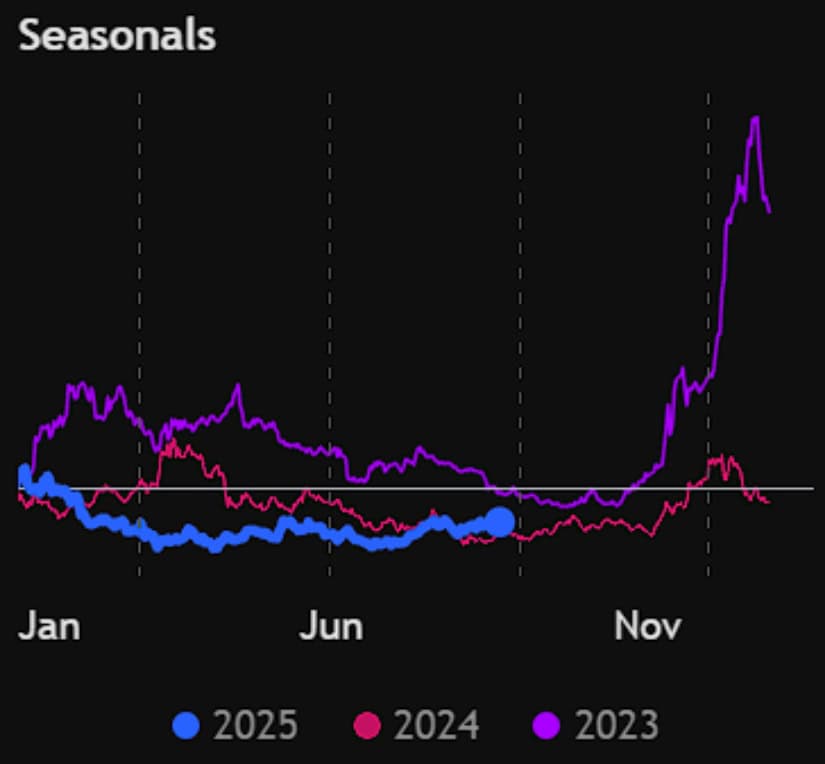

Let us take a stroll down memory lane, shall we? Over the past three years, Avalanche has demonstrated a penchant for a splendid encore in the final quarter of the year. The seasonal chart, courtesy of the ever-so-savvy LHBCrypto, illustrates how both 2023 and 2024 witnessed a dramatic rise in momentum starting in late Q3, with the excitement carrying well into November and December. And now, in 2025, AVAX seems to be rehearsing a similar act, gradually regaining its strength through the mid-year and setting the stage for a potential repeat of its historic end-of-year brilliance.

What makes this pattern particularly noteworthy is its consistency. It’s not just a one-off performance but a recurring theme that lends weight to the idea of Q4 being a favorable season for AVAX. If history is any guide, the next few months could witness a crescendo of buying pressure, especially as on-chain growth harmonizes with the technical rhythms of the season.

AVAX Price Structure Targets Higher Levels

Avalanche is displaying signs of strength, having gracefully broken above the $25 resistance zone and now holding firmly around $26.5. The chart reveals how the price has consistently honored higher lows since hitting rock bottom at $14.65, forming a robust foundation that hints at accumulation. The moving averages (MA7, MA25, MA99) are now aligned in a bullish formation, with the shorter-term MA offering support as momentum builds. Analyst Mentor has laid out a clear roadmap: a breakout, a retest of support, and then a spirited march toward a $37 target.

From a technical perspective, the $26 to $27 region remains the immediate pivot. A successful retest here would solidify it as new support, reinforcing the broader bullish trend. Volume has also been expanding on positive days, signaling confidence behind the move. Should the bulls hold this territory, the next milestones on the horizon are $33, followed by $37.

Avalanche DeFi TVL Breaks a Key Barrier

The DeFi ecosystem of Avalanche has reclaimed its throne, pushing its Total Value Locked (TVL) back above the $2 billion mark. Analyst Mash opines that this level may never be relinquished again. Current data shows TVL at $2.04B, bolstered by a $1.7B stablecoin market cap, robust chain fees, and over $500M in daily DEX volume. This recovery underscores how capital is steadily returning to the ecosystem, cementing Avalanche’s reputation as one of the more resilient Layer-1 networks in the digital realm.

AVAX Price Prediction: Weekly Breakout to Open $50 Target

Avalanche is poised against a critical weekly resistance zone near $27, a level that has repeatedly thwarted upward attempts in recent months. The chart, shared by the insightful DeFi Sabali, highlights how a confirmed breakout above this band could transform the structure into a bullish spectacle, with an extended target of around $50 in the wings.

From a technical angle, the $25 to $27 region is the key pivot. A weekly close above it would affirm the strength of the buyers and open the path toward $33 and $37 in the short term, with $50 as a medium-term aspiration. Volume has been steadily increasing on positive days, while momentum indicators remain neutral, leaving ample room for expansion.

Final Thoughts

Avalanche is orchestrating a symphony of bullish signals, with on-chain activity growing, DeFi liquidity expanding, and technicals painting a constructive picture. When fundamentals and charts move in harmony, it often marks the early phase of a stronger cycle. Holding the $25 to $27 range as new support could be the true turning point, transforming months of steady progress into the beginning of a sustained uptrend.

And let’s not forget, history favors AVAX, with Q4 rallies becoming a recurring theme over the past three years. If the same seasonal rhythm plays out, and it’s bolstered by the current wave of adoption and liquidity growth, Avalanche could be setting the stage for one of its most significant performances yet. 🌟💼

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-24 01:12