In a rather lively turn of events, the good people of the AVAX community are positively buzzing like a swarm of very enthusiastic bees. Speculation is afoot regarding the esteemed VanEck AVAX ETF, with a possible approval date of July 28 looming on the horizon like a particularly insistent raincloud. Coupled with a cheeky little breakout above some rather crucial resistance levels and some delightful open interest hitting the stratosphere, it appears we might just be on the brink of an AVAX season that makes summer look like a quiet winter night.

AVAX ETF Approval Buzz: Optimism Just Can’t Be Quashed

As the Avalanche ecosystem begins to make headlines like a gossiping tabloid, the whispers about the VanEck AVAX ETF are growing louder than a brass band in a library. REKTBuildr and Lonely Rooster, the dynamic duo of crypto analysis, are insisting that the approval may just be around the corner, set to dazzle market participants next week. While we might not have official confirmation just yet, the cacophony of chatter is ruffling plenty of feathers, stirring up anticipation faster than a bee on a sugar rush.

If by some stroke of good fortune, this approval does indeed go through, it would mark a big moment for Avalanche—one of the not-so-common altcoins that might just waltz into direct institutional exposure via an ETF. Why, this could make traditional investors prance right into the space, adding a sprinkle of legitimacy to the whole shebang! With the price of AVAX recently finding its feet like a toddler in a new pair of shoes, a regulatory green light could be just the nudge it needs for a grand rejuvenation of inflows.

Open Interest Surge: The Kind of Excitement Usually Found in a Raucous Pub

As the murmurs of ETF approval grow into a veritable symphony, fresh on-chain data shows that AVAX’s Open Interest has reached an all-time high. CW8900 has reported this surge isn’t merely a product of speculation, but a signal of a market participation revival that would make even the most ardent tea drinkers perk up. With both Open Interest and trading volume climbing, one can’t help but feel that demand for AVAX is starting to bubble like a well-stirred pot of water.

From a technical viewpoint—because who doesn’t love a good chart?—the Open Interest approaching $1 billion, coupled with rising prices, suggests that leverage is building in favor of bullish price action, rather than acting like a heavy fog on a clear day. Historically, moments like these have been precursors to explosive directional move, not unlike a firework show after a cozy picnic.

The Magnificent AVAX Price Breaks Free From Long-Term Chains

With the wind at its back from ETF speculations and open interest soaring like an overzealous kite, the price of AVAX has executed a daring jailbreak from a multi-month downtrend as if it were a character straight out of a thrilling adventure novel. Helin has been kind enough to point out that AVAX has successfully flipped the $25.5 resistance zone—a cap so stubborn it might have needed a pry bar to budge—into support, bedding down nicely in a double bottom structure. This kind of technical breakout is often the herald of a trend shift, akin to a glorious sunrise after a night of turmoil.

With the transactional volume now throwing its weight behind this solid structure shift, everyone’s eyes are pivoting towards the captivating zones of $32 to $35. If the bulls can keep the momentum going, one might as well prepare for a sit down and enjoy the show.

200-Day Moving Average: A Sign From the Crypto Gods?

In the universe of bullish narratives regarding AVAX, another technical whispering is making waves: AVAX has danced twice around and finally cleared its 200-day moving average (the orange line, no less!) for the first time in a while. As Honeybear has cheerfully pointed out, this carries historical weight. In fact, there have been but four occasions in Avalanche’s colorful past where a similar breakout above the 200MA led to unrestrained upside moves. Spoiler alert: each time, the price surged mightily!

This particular setup bears disturbing resemblance to the glorious year of 2021, when Avalanche was strutting its stuff and hitting all-time highs. The rhythm of consolidation patterns, the timing of breakouts, and the alignment of moving averages are mooching about looking quite familiar. Should this fractal choose to perform encore, the 200-day moving average may just become the ignition point for a fervent trend.

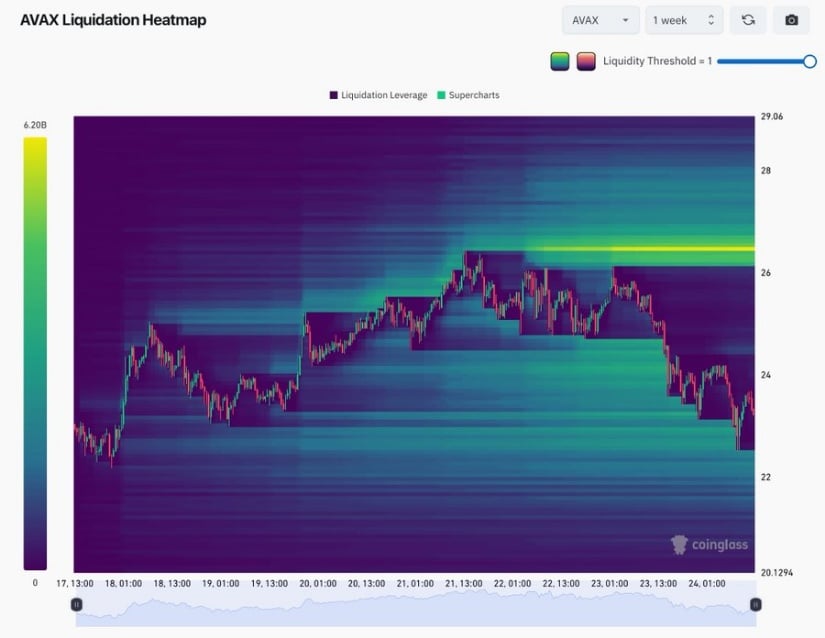

Liquidation Heatmap: The Good, the Bad, and the Key Zones

While the buzz about ETF approval and long-term trend shifts reign supreme in the realm of headlines, the AVAX liquidation heatmap reveals a riveting story of its own. A chart from the ever-mysterious Sandman has illuminated a thick band of liquidation activity snuggled between $26 and $28, with a vibrant splash of yellow peaking near $27.50. This level represents a dense concentration of leveraged short positions that, should the price take notice, could ignite panic-short covering faster than one can say “Oh dear!”

Conversely, the heatmap hints at light liquidation interest in the $22 to $23.50 zone, which aligns nicely with some recent price support. In short, it looks like the heatmap may serve as a rather handy tactical guide for AVAX’s next flamboyant pirouette.

Final Thoughts: Is AVAX Ready to Take the Lead in a Dazzling Rally?

Avalanche is starting to smoulder, looking less like just another altcoin bounce and more like a serious contender in the grand scheme of things. With ETF approval chit-chat heating up, open interest breaking records, and the price dislodging itself from the bounds of a downtrend, this setup is beginning to turn some heads. Toss in the 200-day moving average breakout—oh, the historical implications—and the stage is set for Avalanche to take a rather prominent role in the monumental altcoin run.

What makes this intriguing is the delightful combination of narratives and robust chart signals all aligning as if they were diligent cast members vying for the spotlight.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- All Boss Weaknesses in Elden Ring Nightreign

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

2025-07-25 02:26