tags, with the title inside

. Make sure the HTML is valid, with proper closing tags.Let me draft the HTML now, incorporating all these elements. Check character count for the title, ensure humor and sarcasm are present, images are in place, and no span tags. Also, add emojis where appropriate to match Bryson’s style.End of Thought (8.08s)

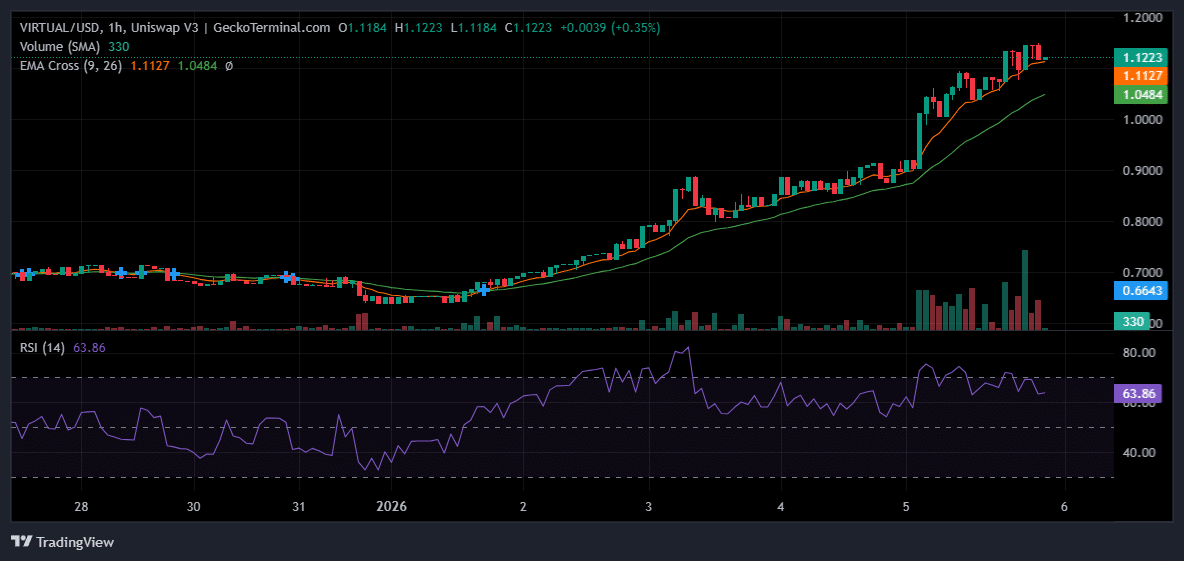

VIRTUAL, the token that’s currently on a wild rollercoaster ride, just jumped 27.84% in 24 hours, leaving investors either elated or wondering if they’ve accidentally joined a crypto circus 🎪. The token climbed from $0.89 to $1.14 as trading activity increased across AI-related tokens, which is about as exciting as watching a toddler build a tower of blocks… but with more potential for sudden collapse 🧱.

The token’s 24-hour trading volume reached $427.59 million, up by 172.62% compared to the previous day, a figure that makes your average rollercoaster look like a leisurely stroll 🎢. VIRTUAL currently trades 77.73% below its all-time high of $5.07 set in January 2025-a reminder that even AI can’t predict the future. Market capitalization stood at $740.13 million at the time of writing, which is roughly the GDP of a small island nation 🏝️.

VIRTUAL price 1H | Source: TradingView

Virtuals Protocol operates within the Base and Ethereum blockchain ecosystems and falls under the AI Agents category. The project recently integrated x402, a Coinbase payment system in October 2025, which sparked a price rally at the time, as reported by Coinspeaker. This is the crypto equivalent of finding a $20 bill in your old jeans-unexpected and slightly suspicious 💸.

The rally extends a strong week for the token, which has gained 64.56% over the past seven days. If this were a stock, it would have been delisted for being too volatile. But in crypto, it’s just another Tuesday 📅.

What’s Driving VIRTUAL Rally

According to some analysts, the gains reflect a broader shift into Base tokens and the AI sector, which has outperformed the broader market over the past week. The rally extended beyond VIRTUAL itself, with tokens built on the Virtuals Protocol platform also posting significant gains, suggesting buyers are targeting the entire ecosystem. It’s like buying a single candy bar and then realizing you’ve accidentally bought the whole store 🍬.

Top Virtuals Protocol Ecosystem Tokens by Market Capitalization | Source: CoinMarketCap

Trader @CryptoFaibik pointed to a chart pattern that often precedes price increases as confirmation of the move. Other analysts observed that VIRTUAL tends to move quickly once momentum builds, with limited pullbacks during rallies. It’s the crypto version of a sprinter who never slows down-until they trip over their own feet 🏃♂️.

$VIRTUAL #VIRTUAL +70% Profit so far since the Wedge breakout..🔥📈

– Captain Faibik 🐺 (@CryptoFaibik) January 5, 2026

Broader Market Conditions

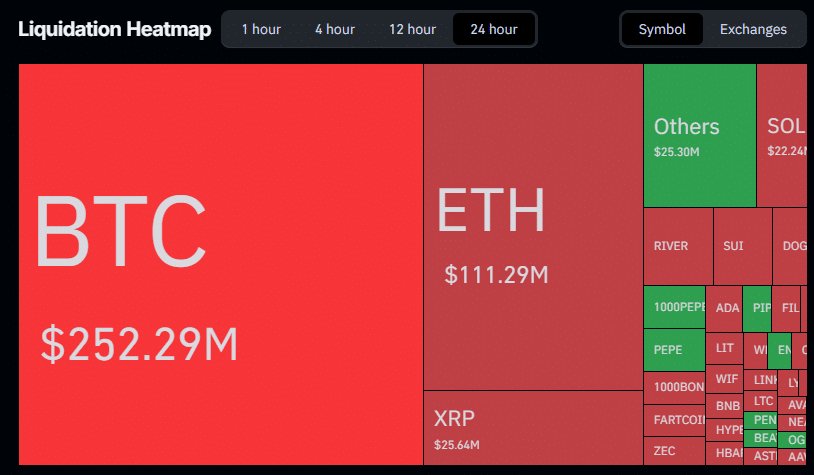

Data from Coinglass showed $522.26 million in forced selling across crypto markets over 24 hours. Traders betting on price drops accounted for $438.07 million of those losses, while those betting on gains lost $84.08 million. It’s like a casino where everyone’s losing, but no one’s leaving 🎰.

Crypto market liquidations | Source: CoinGlass

The Fear & Greed Index, which measures market sentiment on a scale of 0 to 100, registered 26. This reading indicates fear among traders, though it improved slightly from 25 the previous day. The broader crypto market added 1.83% to total market capitalization, which reached $3.27 trillion as the previous year wrapped up. A 1.83% increase is like winning a lottery ticket… but only if you’re a billionaire 🎉.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- M7 Pass Event Guide: All you need to know

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

2026-01-06 03:17