A disquieting murmuring has begun amongst those who concern themselves with the digital golden calf, Bitcoin. It seems the beast has stumbled, falling below the ninety thousand mark, and the so-called “onchain profits” – a curious measure, to be sure – have flipped to a most unpleasant shade of negative. One wonders if such things are truly worth the worrying they seem to inspire.

Bitcoin, that ethereal creation of our modern age, has indeed descended below $90,000, causing a veritable flurry of pronouncements regarding profitability – or, more accurately, the lack thereof. The market, it appears, is experiencing a period of… contemplation, marked by a distinct lack of enthusiasm. A rather dramatic turn of events, given the recent frenzy.

The learned analysts, those seers of the financial realms, claim this resembles the early stages of past downturns. As if history repeats itself in the realm of cryptographic speculation! Now they turn their attention to “support zones,” as if a mere line on a chart could truly hold back the tides of the market. Such faith in lines and numbers!

Onchain Metrics and the Shadow of Bears

The recent movements of the Bitcoin, like the shifting fortunes of a minor noble, reflect a change in the air. Data, as presented by those diligent scribes at TradingView, suggests a consolidation broken lower – a rather ominous turn of phrase. Investors, it seems, are beginning to reconsider the wisdom of their holdings, their profits diminishing like snow in springtime. A most fickle bunch, investors.

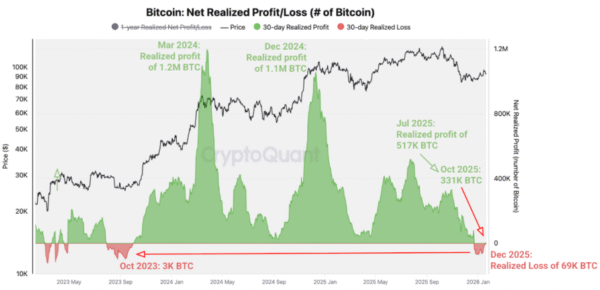

CryptoQuant, a name that now carries the weight of pronouncements, reports a curious development: Bitcoin holders have begun to lose money, for the first time in over two years! Imagine, losing money on this marvelous creation! Further, the net realized profit and loss have, tragically, turned negative. A most unsettling state of affairs indeed.

This “net realized profit,” a rather complicated calculation, has fallen to a mere 69,000 BTC over the last four weeks. A staggering sum, to be sure, but a diminishing one, suggesting that the fervor of the masses is beginning to wane.

A visual representation of waning fortunes, as depicted by CryptoQuant. One almost feels sympathy for the data.

The commentators at CryptoQuant, with the gravity befitting their position, observe that holders are realizing losses for the first time since October 2023. The peaks of profit are dwindling, hinting at a slowing momentum, like a grand carriage losing steam on a hill. The annual net realized profits have, predictably, fallen sharply.

The Loss of Cost Basis and Further Ominous Signs

The annual realized profits have dropped to a paltry 2.5 million BTC, a significant decline from the 4.4 million of October. Such levels were last seen in the dark days of March 2022, during a most unpleasant downturn. These onchain behaviors, the analysts pronounce, align with the early stages of a bear market. How original.

Past cycles, they claim, have shown similar patterns. One wonders, however, if these “patterns” are not merely the product of wishful thinking, a desire to impose order on the inherently chaotic nature of the market. A similar occurrence happened during the transition from boom to bust, in ages past. Profits peaked and then diminished, foreshadowing the inevitable decline.

Thus, several analysts now predict a further decline, a “broader bear market phase,” as they term it. Some even dare to suggest the coin could fall below $58,000! Such bold pronouncements! One suspects a delightful degree of hyperbole at play.

And to further darken the mood, technical signals have emerged, adding weight to the bearish expectations. A market commentator known as Titan of Crypto has spotted a “bear market signal” on the higher time frames. A rather dramatic conclusion based on lines and colors, wouldn’t you say?

A most gloomy chart, as presented by Titan of Crypto. One half expects a thunderstorm to break out simply from viewing it.

A “bearish MACD crossover” – a term lost on most sensible folk – supports this view. And historical data, ever eager to confirm existing biases, shows that similar setups have often preceded significant declines. A comforting thought, indeed.

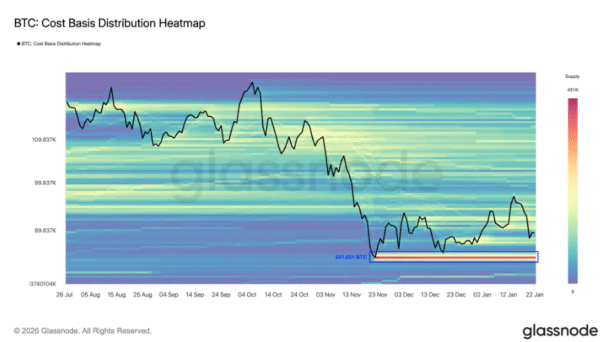

The relentless selling has already pushed Bitcoin down 9% from its recent peak. Key support levels have crumbled, like poorly constructed fortifications. And the 75th percentile cost basis, located near $92,940, has fallen. A most unfortunate turn of events.

The Search for Support in a Shifting Landscape

Glassnode observes that Bitcoin now trades below the cost basis of 75% of circulating supply. Such conditions suggest a rising tide of distribution, a fancy way of saying that people are looking to get rid of their holdings. Risk, they claim, has shifted downward, unless prices miraculously recover.

The technical traders, those devoted students of charts and patterns, are watching trendline support with bated breath:

- An analyst named Merlijn The Trader notes that Bitcoin is testing support between $89,000 and $90,000.

- A breach of this level could send the price tumbling to $84,000.

- Onchain data suggests significant buyer activity between $80,000 and $84,000, with 941,651 BTC acquired in that zone.

The well-worn paths of purchase, as mapped by Glassnode. Once can only hope the buyers possess deeper pockets than the sellers.

Many believe the current trading area around $89,000 to $90,000 represents the strongest support in the near term. But just below, near $80,000, lies another layer of defense, defended by roughly 127,000 BTC. Should Bitcoin fall below this level, a broader downtrend could resume, starkly declaring the end of optimism.

Analysts attribute these woes to weak demand for derivatives and the shedding of holdings by long-term investors. Rising transfers to exchanges may also exacerbate the situation, increasing the supply and potentially driving prices further down. A most disheartening outlook. What a predicament!

Read More

- VCT Pacific 2026 talks finals venues, roadshows, and local talent

- Lily Allen and David Harbour ‘sell their New York townhouse for $7million – a $1million loss’ amid divorce battle

- EUR ILS PREDICTION

- Will Victoria Beckham get the last laugh after all? Posh Spice’s solo track shoots up the charts as social media campaign to get her to number one in ‘plot twist of the year’ gains momentum amid Brooklyn fallout

- Vanessa Williams hid her sexual abuse ordeal for decades because she knew her dad ‘could not have handled it’ and only revealed she’d been molested at 10 years old after he’d died

- SEGA Football Club Champions 2026 is now live, bringing management action to Android and iOS

- The five movies competing for an Oscar that has never been won before

- Streaming Services With Free Trials In Early 2026

- Binance’s Bold Gambit: SENT Soars as Crypto Meets AI Farce

- Dec Donnelly admits he only lasted a week of dry January as his ‘feral’ children drove him to a glass of wine – as Ant McPartlin shares how his New Year’s resolution is inspired by young son Wilder

2026-01-24 07:19