In the grand theater of finance, where fortunes rise and fall with the whims of the market, a curious spectacle unfolds. Bitcoin, once the darling of the digital age, now languishes 29% below its October zenith, a mere shadow of its former self. Meanwhile, gold, that ancient relic of value, basks in the spotlight, leaving the faithful of cryptocurrency to grapple with a bitter truth: the shiny metal has stolen the show. Yet, the die-hards persist, whispering that Bitcoin’s moment is nigh, once gold’s luster fades.

Gold’s Triumph, Bitcoin’s Tribulation: A Tale of Two Assets

Across the digital squares of X, the faithful and the skeptical engage in a dance of words, each defending their chosen deity. Bitcoin, though trailing gold in the short term, still boasts a five-year gain of 189%, compared to gold’s modest 158%. Yet, silver, that oft-forgotten sibling, has outpaced them both, climbing 261% in the same span. A humbling reminder that the market is a fickle mistress.

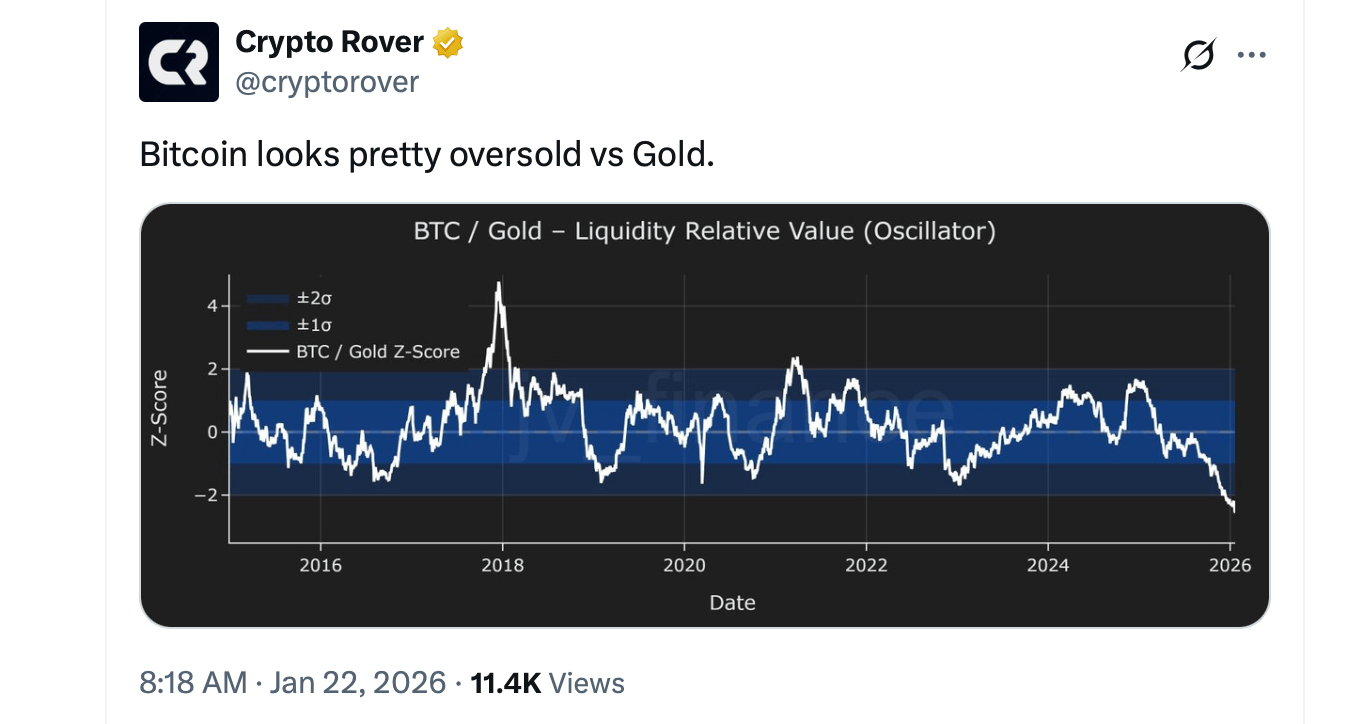

On a Thursday in late January, gold gleams at $4,833 per ounce, while silver stands at $93.53. Bitcoin, meanwhile, idles at $89,098, down 8% in a week. Its defenders, ever resilient, argue that this is but a pause, not a defeat. “Gold’s rise does not spell Bitcoin’s fall,” one declares, with the air of a philosopher pondering the ephemeral nature of capital. Another, more caustic, insists Bitcoin is “criminally undervalued,” a martyr in the making.

James Check, the sage of Checkonchain, observes with a wry smile that Bitcoin’s faithful grow restless when gold shines. “Their conviction melts like a snowflake in spring,” he quips, adding that both assets will rise as fiat crumbles. “Peter Schiff has waited 17 years for silver’s moment, his hair turning gray in the process. If you’re feeling bold, buy a gold coin-you’ll mark the peak, and we’ll return to our regularly scheduled programming.”

“Fiat has no bottom,” he concludes, with the gravity of a man who has seen empires fall.

This sentiment echoes through the digital halls, where one wit remarks, “Our grandchildren will laugh at how we dug up shiny rocks, guarded them with guns, and paid to hide them in safes. Like letter-carrying pigeons, a relic of a bygone era.”

Anthony Pompliano, ever the optimist, attributes Bitcoin’s woes to deflation, a force that gold seems to resist. “Deflation is the headwind,” he muses, while another observer adds, “Gold should face the same storm, yet it sails on. Perhaps its turn will come.”

For now, the standoff between Bitcoin and precious metals is a waiting game, a drama played out in the shadows of uncertainty. Gold and silver bask in their moment, while Bitcoin tests the faith of its adherents. Yet, among the long-time holders, there is no panic, only impatience-a quiet belief that the wheel will turn, and capital will flow once more.

Whether this faith is well-placed remains to be seen. But the debate itself reveals a deeper truth: in the battle of assets, time is the ultimate arbiter. To some, gold’s rise is a warning; to others, a prelude. And in the meantime, the memes fly, the arguments rage, and fiat remains the punchline of a very old joke.

FAQ ❓

- Why is Bitcoin underperforming gold right now?

Bitcoin trades below its October high as capital shifts to gold and silver. How long this lasts is anyone’s guess. - How has Bitcoin performed compared to gold over five years?

Bitcoin leads with a 189% gain, versus gold’s 158%. Silver, however, has outshone them both. - Why are some still bullish on Bitcoin?

Many believe Bitcoin’s slump is temporary, and capital will return once gold’s rally cools. A hopeful hypothesis. - What role does deflation play in Bitcoin’s price action?

Some argue deflation weighs on Bitcoin, though gold seems immune-for now.

Read More

- Will Victoria Beckham get the last laugh after all? Posh Spice’s solo track shoots up the charts as social media campaign to get her to number one in ‘plot twist of the year’ gains momentum amid Brooklyn fallout

- The five movies competing for an Oscar that has never been won before

- Vanessa Williams hid her sexual abuse ordeal for decades because she knew her dad ‘could not have handled it’ and only revealed she’d been molested at 10 years old after he’d died

- Binance’s Bold Gambit: SENT Soars as Crypto Meets AI Farce

- Dec Donnelly admits he only lasted a week of dry January as his ‘feral’ children drove him to a glass of wine – as Ant McPartlin shares how his New Year’s resolution is inspired by young son Wilder

- SEGA Football Club Champions 2026 is now live, bringing management action to Android and iOS

- How to watch and stream the record-breaking Sinners at home right now

- Jason Statham, 58, admits he’s ‘gone too far’ with some of his daring action movie stunts and has suffered injuries after making ‘mistakes’

- Streaming Services With Free Trials In Early 2026

- Top 3 Must-Watch Netflix Shows This Weekend: January 23–25, 2026

2026-01-23 03:07