In her latest missive on investments, our dear Lyn Alden suggests that the Federal Reserve has embarked on a little dance back to balance sheet expansion. It’s not the wild jubilation of yesteryear’s crisis-era stimulus; no, it’s more like a slow waltz, which she charmingly dubs a “gradual print.”

Alden’s Grand Revelation: The Fed’s Balancing Act and What Lies Ahead

According to Lyn Alden’s research note, hot off the digital press this Sunday, the Fed’s retreat from long-term balance sheet shrinkage is less about saving the economy and more akin to unclogging a very large financial toilet. Alden elaborates that liquidity shortages in the overnight financing markets have compelled the Fed to jump back into reserve management like it’s diving into a kiddie pool on a hot summer day.

Now, Lyn makes it clear: this isn’t a return to the good ol’ days of classic quantitative easing. Rather, the Fed is busy purchasing shorter-duration Treasury securities to ensure bank reserves remain “ample.” It’s a technical distinction that, much like arguing over whether you’re drinking champagne or sparkling wine, probably doesn’t matter when you’re just trying to get a buzz.

In her thoughtful analysis, Alden lays out the expectation of monthly purchases starting at about $40 billion as we navigate through the tax season, then settling like a well-cooked turkey at a baseline of $20 to $25 billion a month. Over the course of 2026, this hints at balance sheet growth somewhere between $220 billion and $375 billion-hardly the fireworks display some might expect.

To put things in perspective, Alden playfully compares these figures to previous QE episodes, pointing out that even a $750 billion expansion would be but a mere drop in the bucket compared to today’s $6.5 trillion balance sheet. In her words, “big prints” now need to be worth trillions to make a splash, not just a gentle ripple.

Lyn also connects the Fed’s activities to broader trends in bank deposits and fiscal deficits. With U.S. deposits swelling by hundreds of billions each year, one might say the Fed is somewhat obliged to expand reserves just to keep pace with the financial hamster wheel it’s running.

Looking across the ocean, Alden devotes considerable ink to Japan’s rising bond yields. While social media is abuzz with talk of impending doom, our intrepid Lyn counters that Japan’s central bank ownership of government bonds keeps systemic risks in check-even as those yields creep upwards like a cat burglar in the night.

Yet, Alden cautions that Japan is stuck in a sticky situation between higher interest expenses and a weak currency. Yield curve control can keep borrowing costs in check, but it dances perilously close to further yen depreciation-something that’s made all the more troublesome by rising energy prices and household inflation.

From an asset allocation viewpoint, Lyn Alden frames this “gradual print” as a gentle nudge for scarce assets and a slight poke in the ribs for the dollar. This backdrop, she argues, sheds light on the ongoing fascination with gold and bitcoin, even in the absence of those headline-grabbing stimulus parties.

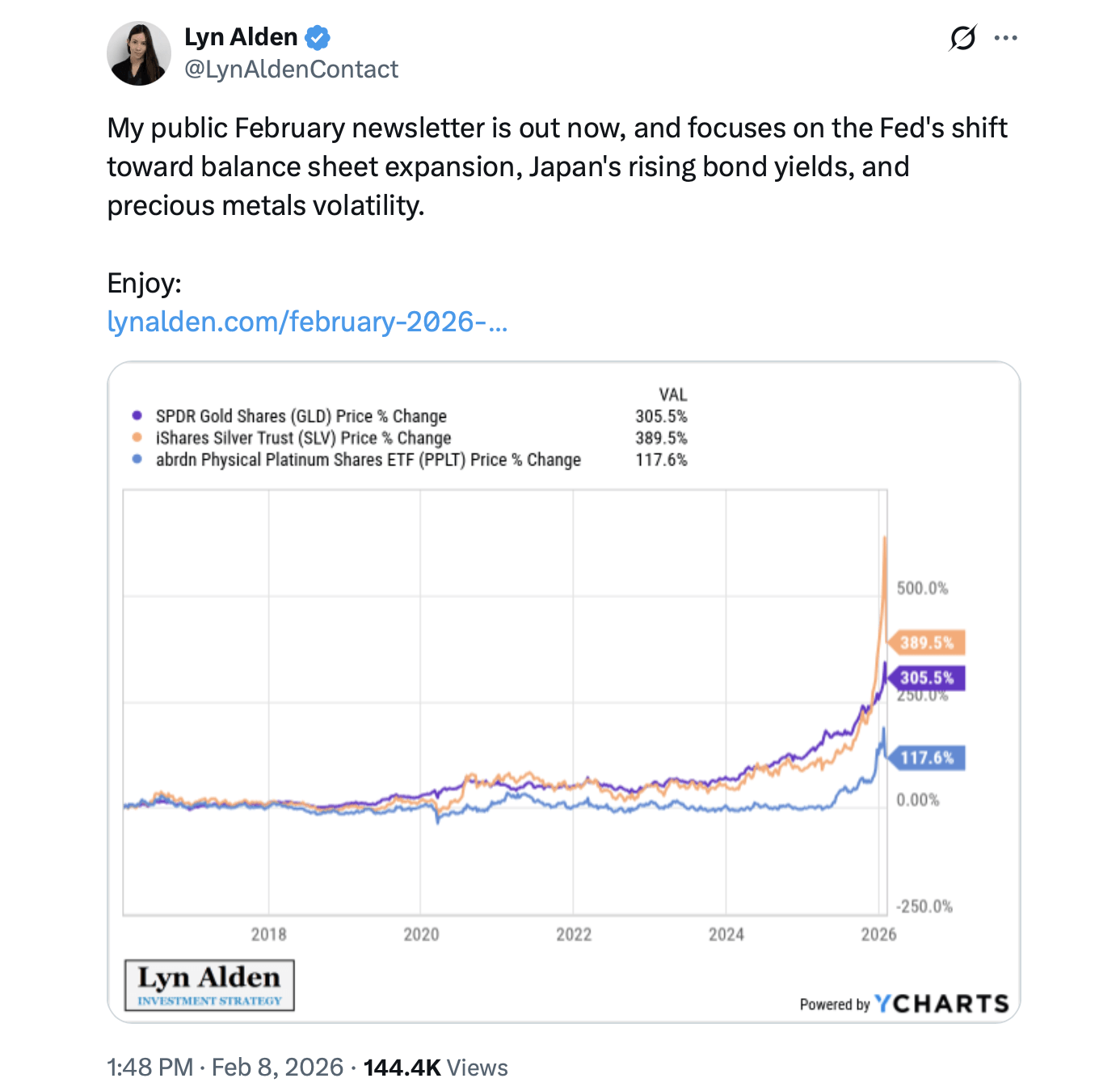

Alden does sound a note of caution, however, pointing out that not all scarcity trades are cut from the same cloth they used to be. Precious metals, once the belle of the ball, have mostly moved from being undervalued to fairly valued, making prudent rebalancing more critical than chasing after momentum like a dog after its own tail.

Ultimately, Lyn Alden’s research suggests that the era of dramatic policy shocks has waltzed off stage, giving way to a quieter, more structured approach to liquidity management. For investors, the takeaway is not about timing the next “big print,” but rather understanding why this steady expansion has become the default setting-like a thermostat stuck on a balmy 70 degrees.

FAQ ❓

- What does Lyn Alden mean by the “gradual print”?

- Lyn Alden uses the term to describe steady Fed balance sheet expansion aimed at maintaining liquidity, not emergency stimulus.

- Is the Fed doing quantitative easing again, according to Lyn Alden?

- Alden says no, noting the Fed is buying short-duration Treasurys for reserve management rather than long-term economic stimulus.

- Why does Lyn Alden focus on Japan in this report?

- Lyn Alden highlights Japan’s rising bond yields as a case study in how heavily indebted nations manage monetary stress.

- How does Lyn Alden view Bitcoin in this environment?

- Alden continues to see bitcoin as a scarce asset that benefits from gradual monetary expansion and long-term fiscal pressures.

Read More

- Gold Rate Forecast

- MLBB x KOF Encore 2026: List of bingo patterns

- Bianca Censori finally breaks her silence on Kanye West’s antisemitic remarks, sexual harassment lawsuit and fears he’s controlling her as she details the toll on her mental health during their marriage

- Outlander’s Caitríona Balfe joins “dark and mysterious” British drama

- Mystic Realms introduces portal-shifting card battles with legendary myth-inspired cards, now available on mobile

- Married At First Sight’s worst-kept secret revealed! Brook Crompton exposed as bride at centre of explosive ex-lover scandal and pregnancy bombshell

- How TIME’s Film Critic Chose the 50 Most Underappreciated Movies of the 21st Century

- Bob Iger revived Disney, but challenges remain

- Demon1 leaves Cloud9, signs with ENVY as Inspire moves to bench

- Wanna eat Sukuna’s fingers? Japanese ramen shop Kamukura collabs with Jujutsu Kaisen for a cursed object-themed menu

2026-02-10 04:28