Markets

What to know:

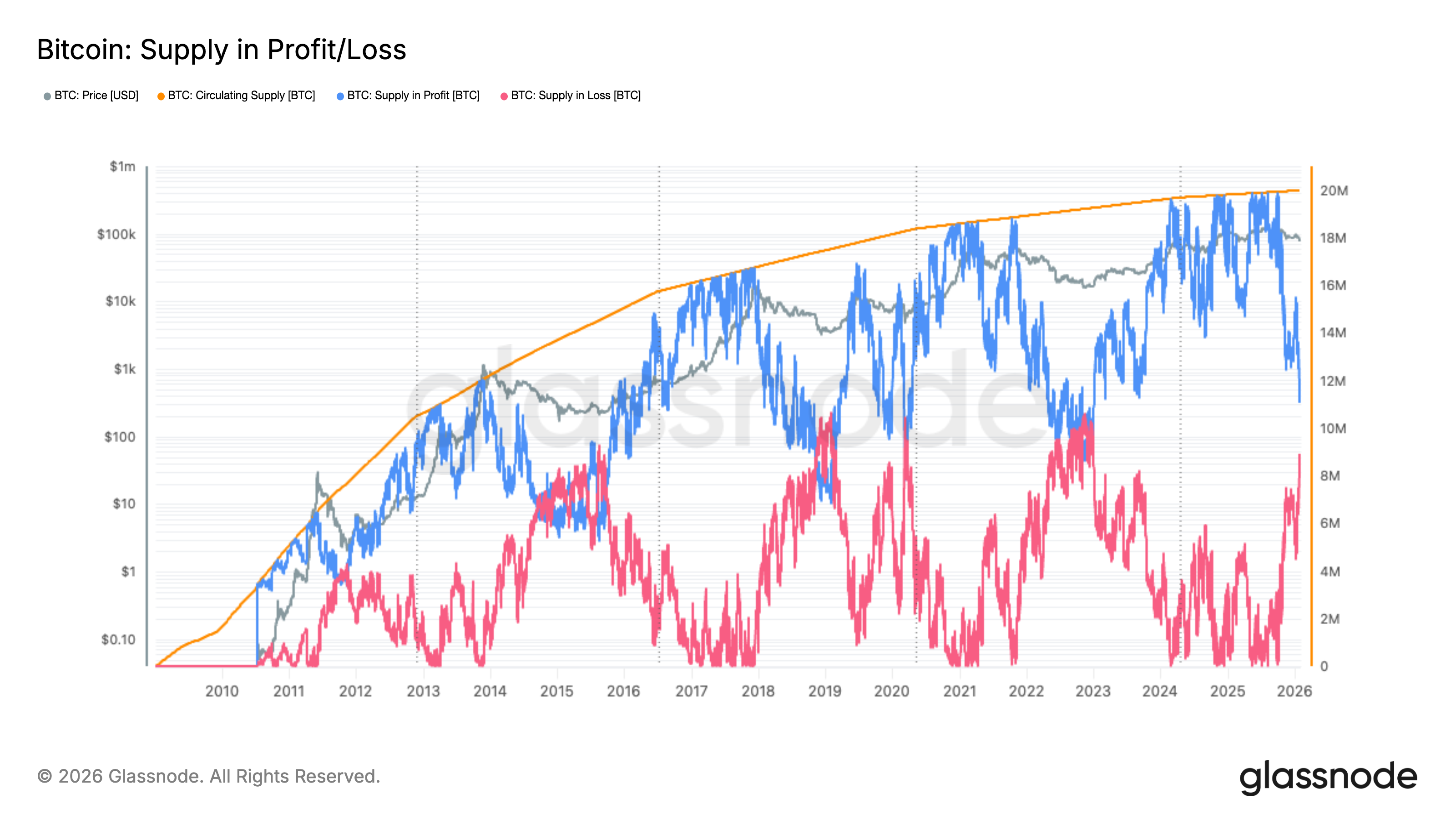

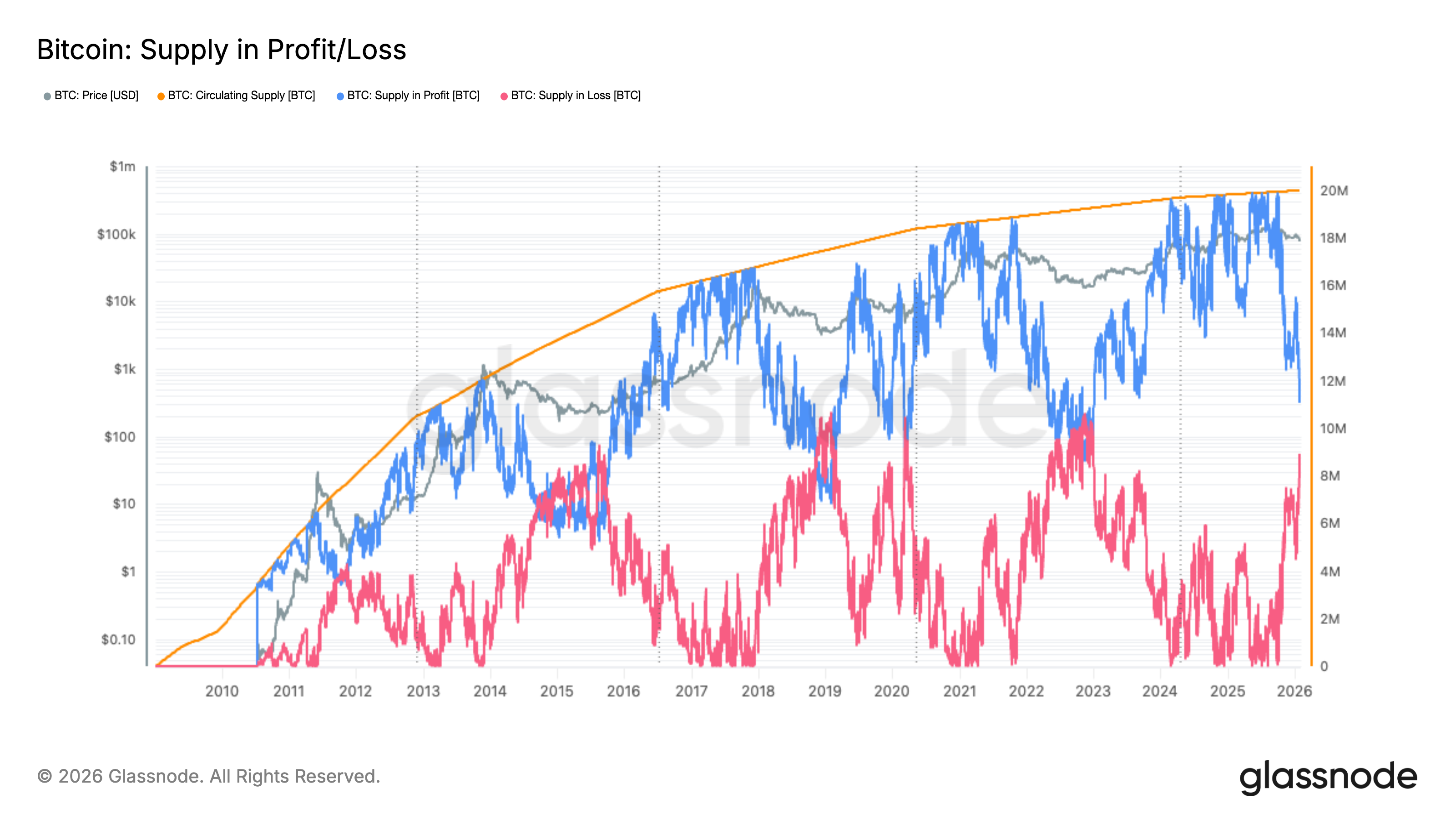

- Right now, we have a whopping 11.1 million BTC dancing in profit and 8.9 million BTC sulking in loss, with historical bottoms throwing a grand party when these two numbers decide to meet.

- If they do decide to converge at current cost levels, we might just peek at a price tag around $60,000, which is rather reminiscent of the bottom signals from our dear friends in 2015, 2019, 2020, and 2022.

Now, bottom-fishing sounds glamorous, doesn’t it? But let me tell you, it’s as delightful as trying to catch a slippery eel! If you’re up for the challenge, this trusty on-chain metric could be your guiding light in the stormy seas of the bitcoin bear market.

This marvelous little metric, known as BTC supply in profit versus loss, helps us measure how many bitcoin wallets are sitting pretty on paper profits compared to those that feel like they’ve dropped into a deep, dark hole. When these two start to balance out, history suggests bear markets are ready to throw in the towel, revealing a golden opportunity for the brave-hearted.

And guess what? To the sheer delight of all bulls out there, this scenario might just be knocking on our door soon, as the number of wallets grinning with profits and those frowning in loss appear to be inching closer together!

According to our pals at Glassnode, currently, we’ve got 11.1 million bitcoin swimming in profit. These lucky coins were bought at a bargain price, while a sad 8.9 million BTC are wallowing in losses.

Should these two factions decide to converge, we might see a bottom just like we did in 2022 and during the tumultuous years of 2018-19, as illustrated in the fabulous chart below.

The Glassnode chart-oh, what a beauty!-shows the volume of BTC supply held in profit, splashed in blue, and in loss, sulking in red, all relative to the circulating supply.

As spot prices play their cheeky games above or below the aggregate cost bases, coins shuffle between these two groups like kids trying to pick teams for dodgeball, giving us a peek into the market’s mood and investor jitters.

Historically speaking, these converging points have marked the grand finale of cycle bottoms. We saw this happen in November 2022 around $15,000 after the FTX fiasco, in March 2020 when bitcoin briefly plummeted below $3,000 during the covid-19 market chaos, in January 2019 near $3,300, and again in 2015 just above $200.

So, let’s keep our eyes peeled and see if history decides to play a repeat performance!

Read More

- Heartopia Book Writing Guide: How to write and publish books

- UFL soft launch first impression: The competition eFootball and FC Mobile needed

- Gold Rate Forecast

- Robots That React: Teaching Machines to Hear and Act

- Mobile Legends: Bang Bang (MLBB) February 2026 Hilda’s “Guardian Battalion” Starlight Pass Details

- UFL – Football Game 2026 makes its debut on the small screen, soft launches on Android in select regions

- Katie Price’s husband Lee Andrews explains why he filters his pictures after images of what he really looks like baffled fans – as his ex continues to mock his matching proposals

- Arknights: Endfield Weapons Tier List

- Davina McCall showcases her gorgeous figure in a green leather jumpsuit as she puts on a love-up display with husband Michael Douglas at star-studded London Chamber Orchestra bash

- Olivia Wilde teases new romance with Ellie Goulding’s ex-husband Caspar Jopling at Sundance Film Festival

2026-02-04 15:35