Once upon a time, in the not-so-far-away land of CryptoVille, bitcoin was on top of the world-flying high like a particularly exuberant kite on a windy day. Investors were frolicking in fields of golden ‘Uptober’ hopes, and the bull market was so dominant that it could have auditioned for a role in a blockbuster film about stampeding livestock.

Just a mere few months ago, our dear friend bitcoin was strutting around, confidently flaunting its six-digit price tag as if it were the latest fashion trend. It had just reached an all-time high that made even the most optimistic fortune tellers gasp in astonishment-over $126,000! Predictions were flying about $150,000 or even $200,000 by year-end, all based on historical performances that seemed as reliable as a weather forecast in the middle of a monsoon.

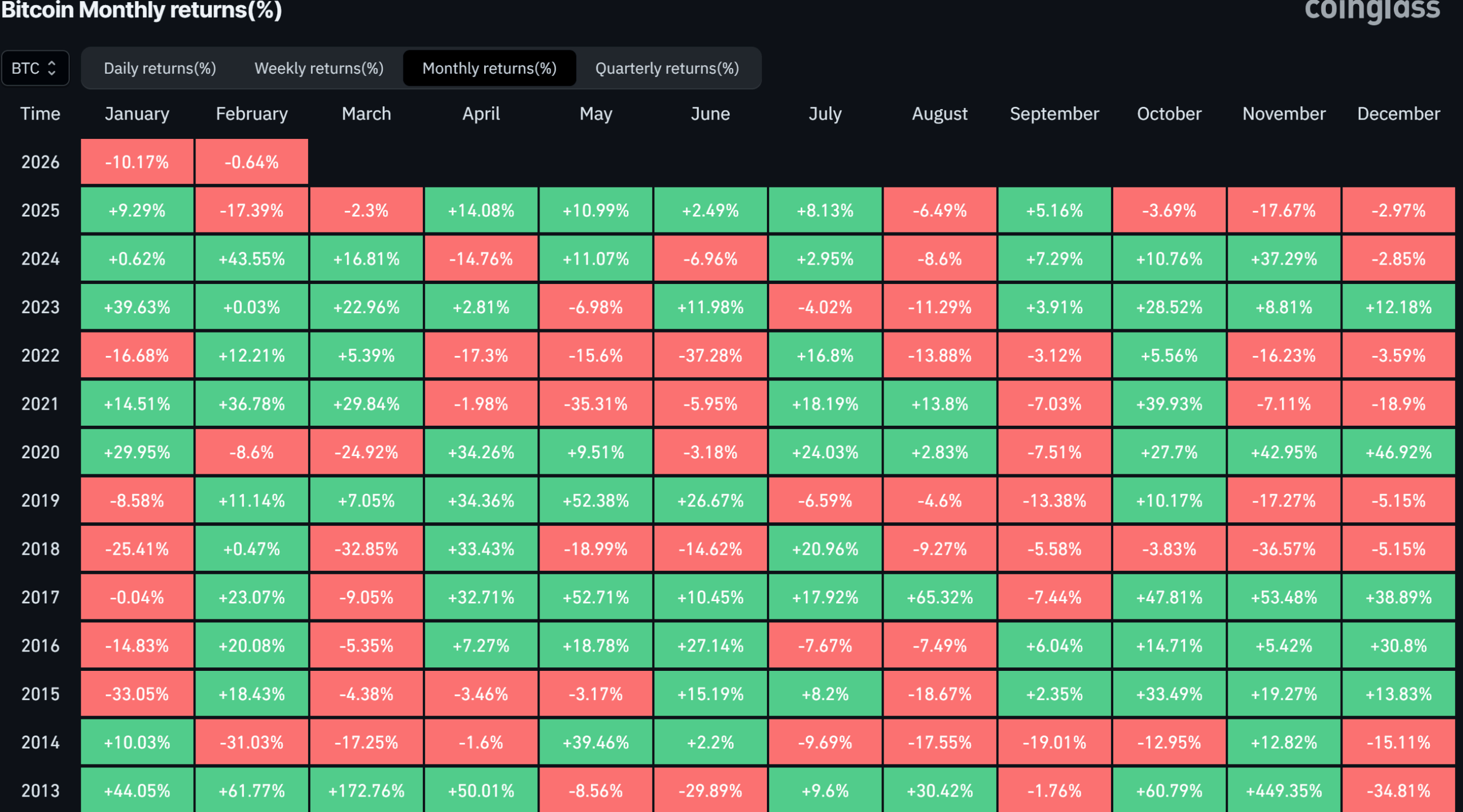

The Monthly Closures in Red

But alas! The fairytale took a turn for the tragic. In a twist worthy of a soap opera, bitcoin plummeted on October 10/11, resulting in a $19 billion wipeout. Talk about a bad hair day! After that fateful plunge, our cryptocurrency hero never quite recovered, closing out 2025 in a spectacularly red fashion for the first time in a post-halving year. Bravo, bitcoin! You’ve outdone yourself.

As the curtain raised on 2026, a fresh wave of optimism swept through the land. Hopes of a rebound danced in the air like confetti at a party no one wanted to attend. But mid-month, the optimistic vibe hit a wall when BTC found itself stuck at $95,000, then plummeting southward with the grace of a lead balloon. It dipped below $90,000, and rather than stopping there, it decided to take a scenic tour down to $81,000, only to bounce back briefly to $84,000 before the universe said, “Not today!” and sent it crashing to about $75,000-wiping out billions and knocking investors’ socks off in the process. In less than two weeks, it managed to lose a staggering $20,000. Bravo again, bitcoin!

According to the astute sages at CoinGlass, bitcoin closed January with a loss of 10.17%, managing to rebound slightly from its dismal low. This marked the fourth consecutive month of closing in the red, earning it the dubious title of the worst performance since November. At this rate, it might need to hire a therapist.

What Bull Market?

Meanwhile, the wise crypto analysts have been as divided as a pizza at a party of indecisive eaters ever since October. Is this a bull market, they pondered, or merely a bear in disguise? The data suggests that bitcoin is behaving more like a bear, which, ironically, is much less cuddly. The last time it had four consecutive months in the red was at the end of 2018, leading into a bear cycle so bleak it could make a gloomy day feel positively cheery.

Back then, bitcoin dug new lows with the enthusiasm of a child digging in sand at the beach, finally bottoming out in January after six consecutive months of heartbreak. If history decides to repeat itself, bitcoin might have a bit further to fall before staging a comeback worthy of a standing ovation.

However, there is a glimmer of hope shining like a distant star: if the past is any indication, bitcoin could be poised for a more favorable Q2 and Q3. And if we ignore history altogether, who knows? Good news might come as soon as February, as most analysts are now convinced the four-year cycle has gone out for coffee and won’t be returning anytime soon. Stay tuned, folks-it’s going to be a bumpy ride!

Read More

- Heartopia Book Writing Guide: How to write and publish books

- Gold Rate Forecast

- Battlestar Galactica Brought Dark Sci-Fi Back to TV

- January 29 Update Patch Notes

- Genshin Impact Version 6.3 Stygian Onslaught Guide: Boss Mechanism, Best Teams, and Tips

- Learning by Association: Smarter AI Through Human-Like Conditioning

- Mining Research for New Scientific Insights

- Robots That React: Teaching Machines to Hear and Act

- Nature’s GPS: AI Learns to Navigate Like an Insect

- Mapping Intelligence: An AI Agent That Understands Space

2026-02-01 11:06