My dear financial aficionados, gather ’round! Amboss Technologies, in a move as audacious as a Coward wit, has unleashed RailsX upon the world. This Lightning-native, peer-to-peer decentralized exchange made its grand entrance at the PlanB Forum in El Salvador on January 30, 2026. How utterly divine!

Unlike those dreary exchanges that insist on building separate protocol layers-how passé!-RailsX executes trades entirely via the Lightning Network. Transactions, my darlings, are a delightful waltz of circular self-payments, routing through existing channels, exchanging assets with atomic precision, and looping back to the sender. No custodial intermediaries, no cross-chain bridge risks-just the sheer elegance of Bitcoin’s security model. Bravo!

ANNOUNCING RailsX: The most powerful tool for financial access, advancing Bitcoin’s core principles of sovereignty and decentralization. How positively revolutionary!

RailsX empowers peer-to-peer (P2P) trading with Lightning, enabling KYC-free, trading P2P in self-custody. Lightning is now a DEX. ⚡️🧵

– AMBOSS ⚡ (@ambosstech) January 30, 2026

“RailsX represents the next unstoppable step in Bitcoin’s evolution, delivering true financial freedom to users worldwide through scalable P2P trading in self-custody,” declared Jesse Shrader, CEO of Amboss Technologies, with all the flair of a Coward leading man.

This masterpiece of innovation builds on five years of development, seamlessly integrating Amboss’s Magma liquidity marketplace with its Rails automated liquidity service. How marvelously efficient!

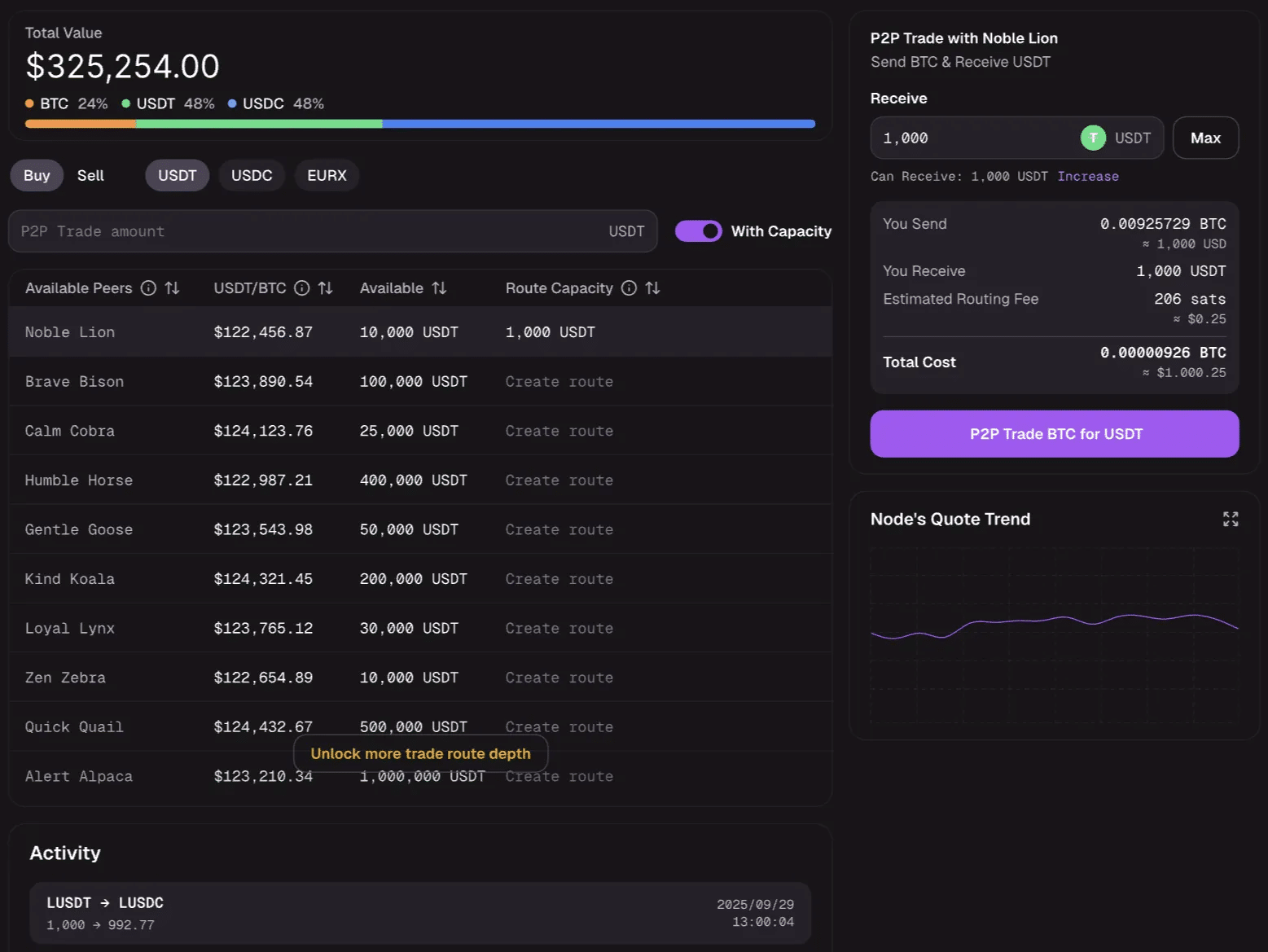

A first peek at the user interface for RailsX | Source: Amboss blog. Darling, it’s simply stunning!

Bitcoin DeFi: The Breakout Star of Recent Years

RailsX arrives on the scene as the Bitcoin ecosystem continues its dazzling ascent. Bitcoin DeFi total value locked surged a staggering 2000% in 2024, leaping from a mere $307 million in January to a glorious $6.5 billion by year’s end. Babylon, that darling staking protocol, drove most of this growth, accounting for over 80% of the sector’s TVL. Even in this bearish market, the Bitcoin DeFi ecosystem boasted nearly $6.11 billion in total value locked on January 30, according to DefiLlama. How positively resilient!

In June 2025, Lightning Labs released Taproot Assets v0.6, enabling multi-asset support on Lightning for the first time. Suddenly, stablecoins could glide through Lightning channels at a fraction of the cost of traditional transfers. Tether, ever the opportunist, seized the moment, committing to issuing USDT as a Taproot Asset and injecting $8 million into Speed1 to scale Lightning stablecoin payments. Speed already handled $1.5 billion in annual volume for 1.2 million users with instant settlement. How utterly convenient!

Bitcoin DeFi may still trail Ethereum’s $66 billion TVL, but the gap is closing, my dears. RailsX boldly connects Bitcoin-stablecoin pairs to the $9.5 trillion daily forex market, according to the company. Processing costs? A mere 0.29% in optimized configurations, though real-world fees depend on channel liquidity. How delightfully frugal!

Success, of course, hinges on whether Lightning can handle actual trading volume-something DEXs have promised for years but rarely delivered at scale. Will RailsX be the exception? Only time will tell, darlings. Until then, let’s raise a glass to this audacious venture and hope it doesn’t end in a financial farce!

Read More

- Heartopia Book Writing Guide: How to write and publish books

- Battlestar Galactica Brought Dark Sci-Fi Back to TV

- Gold Rate Forecast

- January 29 Update Patch Notes

- Genshin Impact Version 6.3 Stygian Onslaught Guide: Boss Mechanism, Best Teams, and Tips

- Beyond Connections: How Higher Dimensions Unlock Network Exploration

- Star Trek: Starfleet Academy Can Finally Show The 32nd Century’s USS Enterprise

- ‘Heartbroken’ Olivia Attwood lies low on holiday with her family as she ‘splits from husband Bradley Dack after he crossed a line’

- Robots That React: Teaching Machines to Hear and Act

- Learning by Association: Smarter AI Through Human-Like Conditioning

2026-01-31 02:09