So, Matt Hougan, the big shot CIO at Bitwise, is out here spouting nonsense-I mean, predictions-about Solana hitting $1,600 in five years. Yeah, right. Because nothing says “reliable” like a crypto guy doing math on a napkin. Apparently, Solana’s gonna be a trillion-dollar asset. Trillion. With a T. Like, who does this guy think he is, Elon Musk’s accountant?

On some podcast called When Shift Happens (catchy, I guess?), Hougan’s got this whole “two ways to win” schtick. Stablecoins, tokenized assets, blah blah blah. Like, sure, Matt, because everyone’s just dying to tokenize their grandma’s stamp collection. And Solana’s gonna beat out Ethereum? Please. Ethereum’s the incumbent. Solana’s the guy who shows up late to the party and spills his drink.

Why Solana Could Hit $1,600+ Within 5 Years (Apparently)

Hougan’s big argument? “Ease of use.” Oh, great. Because what the world really needs is another easy-to-use thing. Like, who cares about TPS or throughput? Not Matt. He’s too busy marveling at how Solana’s “dead easy to use.” Spoiler alert: so is a toaster, but I’m not betting my life savings on it.

And let’s not forget the staking yield. “Roughly 7% a year,” he says. Wow, Matt, you’re really selling me on this. Meanwhile, my checking account’s giving me 0.01%, but sure, Solana’s the future.

Then there’s the whole regulation thing. Apparently, institutions couldn’t build on Solana before because it was “outside the regulatory perimeter.” Now that it’s not, suddenly it’s the next big thing. Right. Because nothing screams “innovation” like playing by the rules.

Hougan’s also hyping up the ETF thing. “Small supply, big demand,” he says. Sounds like every crypto pump-and-dump scheme I’ve ever heard. But hey, what do I know? I’m just a guy who thinks $1,600 for Solana is about as likely as me winning the lottery.

Of course, he doesn’t give a hard price target. Just a trillion-dollar market cap. Because that’s totally easy to imagine. Not like it’s a number bigger than most countries’ GDPs or anything. And it all depends on stablecoins, tokenization, Congress, and crypto cycles. So, basically, it’s all up to chance. Great plan, Matt.

E156: @Matt_Hougan from @BitwiseInvest – $6.5M Bitcoin and the strongest Solana setup ever?

This might be the most bullish yet rational episode we’ve done on the future of crypto: why debasement, institutional flows & tokenization are just getting started.

Timestamps:

0:00…

– MR SHIFT (@KevinWSHPod) January 29, 2026

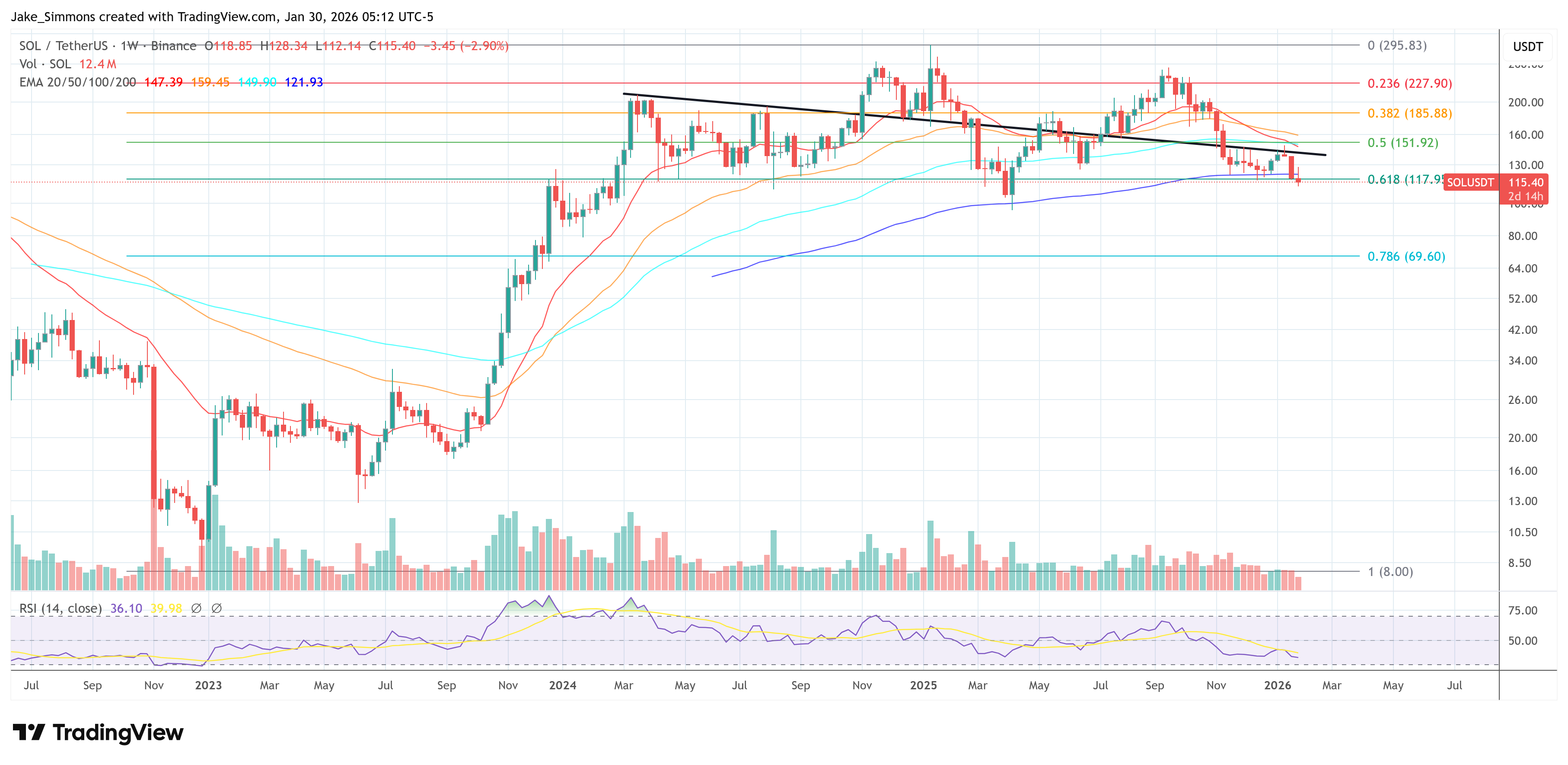

So, let’s do the math. $1 trillion market cap, 566 million SOL? That’s $1,766 per token. Or $1,615 if you use the fully diluted supply. Either way, it’s a lot of zeros. And SOL’s trading at $115 right now. So, yeah, only a 1,300% increase needed. No biggie.

Oh, and let’s not forget Bitcoin. Hougan’s got this whole “store of value” thing going on. Multi-million-dollar BTC? Sure, why not? While we’re at it, let’s predict dogs will start flying by next Tuesday.

Look, I’m not saying Solana’s doomed. But $1,600 in five years? That’s like saying I’ll finally finish that screenplay I started in 2012. Not happening. But hey, if it does, I’ll eat my hat. And maybe buy a SOL token. Maybe.

Read More

- Heartopia Book Writing Guide: How to write and publish books

- Genshin Impact Version 6.3 Stygian Onslaught Guide: Boss Mechanism, Best Teams, and Tips

- Gold Rate Forecast

- Battlestar Galactica Brought Dark Sci-Fi Back to TV

- January 29 Update Patch Notes

- EUR ILS PREDICTION

- Composing Scenes with AI: Skywork UniPic 3.0 Takes a Unified Approach

- ‘They are hugely embarrassed. Nicola wants this drama’: Ignoring texts, crisis talks and truth about dancefloor ‘nuzzling’… how Victoria Beckham has REALLY reacted to Brooklyn’s astonishing claims – by the woman she’s turned to for comfort

- Granderson: ‘Sinners’ is the story of our moment, from a past chapter of ‘divide and conquer’

- Robots That React: Teaching Machines to Hear and Act

2026-01-30 14:40