In the twilight of the digital bazaar, Bitcoin stands, a prima ballerina en pointe, her grace belying the tremor beneath. The weekend’s crescendo, a fleeting peak, has given way to a hesitant retreat, as the orchestra of investors, ever fickle, tunes its instruments to the discordant notes of tariffs and Asia’s slowing pulse.

Spot Market’s Whispered Soliloquy

Glassnode, that vigilant chronicler, observes a modest stir in the spot market, a murmur of activity, while the net buy-sell imbalance pirouettes above its accustomed bounds. A sign, perhaps, of sellers catching their breath, though the buyers remain a scattered chorus, their voices uncertain.

The market, they say, is piecing itself together after the late-2025 harvest, long-term holders clutching their treasures, reluctant to part with them at every fleeting rally. Thus, it consolidates, a dancer gathering strength, rather than collapsing in exhaustion.

Derivatives’ Tempest and the Sharp Retest

Yet, over the weekend, a sudden gust-Bitcoin’s descent by 3.2% from its zenith-sent ripples through the ranks, a retest of the $92,000 mark that startled even the most bullish of spectators. In its wake, $215 million in leveraged futures longs vanished, a dramatic flourish that set alarms ringing, portending deeper abysses.

Meanwhile, the derivatives market, once a bustling carnival, now wears a somber cloak, its lethargy a testament to cooling speculative fervor. Bitcoin, once the darling of hedges, finds itself adrift, its reliability as a shelter questioned.

Nasdaq futures, too, bowed under the weight of Trump’s tariff overtures, aimed at Europe‘s heart. Such macro tremors, like a sudden storm, drive traders from the precipice of risk.

Liquidity’s Echoing Cadence

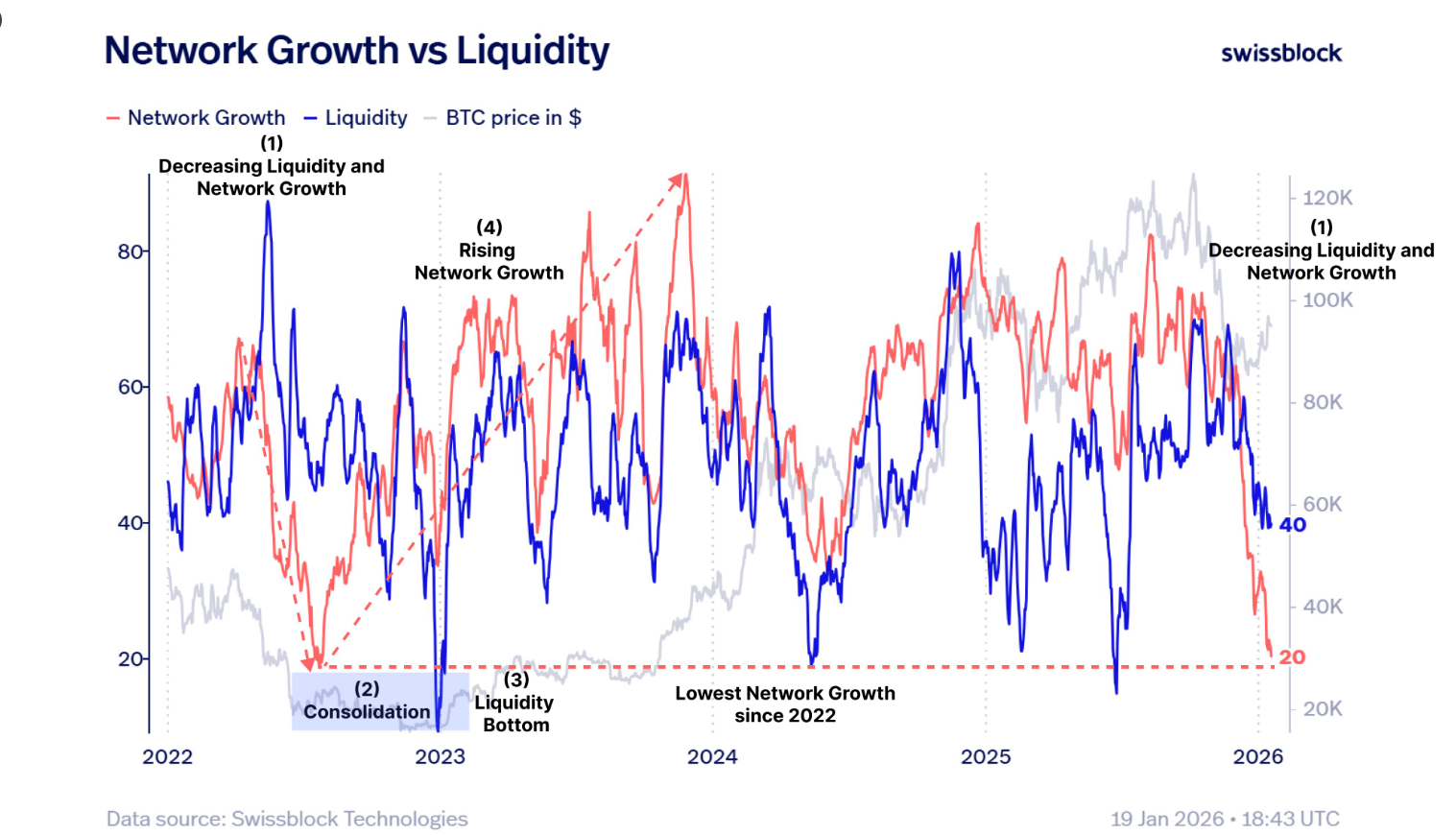

Swissblock’s analysts, with their keen eyes, trace a familiar melody-a decline in network growth and liquidity that echoes the days of 2022. Then, as now, low liquidity and a pause in growth ushered in a protracted consolidation, only to be followed by a surge, a symphony of price ascent.

Might history, that wily composer, repeat its refrain? If network activity revives and buy-side momentum gathers, could this be the prelude to another grand movement?

Network growth has sunk to depths unseen since 2022, liquidity ebbing like a receding tide. In 2022, such stillness heralded a $BTC consolidation, as growth began its hesitant return, even as liquidity lingered, weak and bottoming out.

History, they say, whispers its secrets…

– Swissblock (@swissblock__) January 19, 2026

The analysts, ever parsing the tea leaves, note ETF flows revealing institutions scooping up bargains, while long-term holders stand firm, unmoved by fleeting temptations. Gold, that eternal refuge, climbs past $4,650, its ascent accompanied by China’s softening growth, nudging some to view Bitcoin not as a fleeting fling, but as a steadfast hedge.

In the grand ballet of markets, the signs point to a slow, deliberate recovery rather than a triumphant leap. Buy-side dynamics, though improved, lack the vigor and breadth to herald a new uptrend. Volatility, that mischievous sprite, remains ever-present, and geopolitical whispers or policy shifts could yet widen the price swings.

For now, the market steadies, vigilant and watchful. A fuller recovery in liquidity, a clearer institutional resolve-these are the notes needed to transform this consolidation into a lasting advance. Until then, we wait, as the orchestra tunes its instruments, and the prima ballerina pauses, poised for the next movement.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- World Eternal Online promo codes and how to use them (September 2025)

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

- M7 Pass Event Guide: All you need to know

2026-01-20 13:21