Ah, the glorious world of XRP, where prices dance like a drunken wizard at a midwinter feast! 🥳 The year kicked off with a rally so sharp it could slice through a troll’s armor, soaring over 20% and leaving Bitcoin and Ethereum eating its dust. But, as is the way with such things, the momentum was as fleeting as a goblin’s promise. When Bitcoin sneezed, XRP plummeted from its lofty $2 perch to a mere $1.80 faster than you can say “Octarine light.” Luckily, the dip buyers-those brave souls with pockets deeper than a dwarf’s mine-stepped in to save the day. Yet, here we are, stuck in a tug-of-war between the bulls and the bears, with the near-term outlook as clear as a foggy Ankh-Morpork morning. 🌫️

The Liquidation Heatmap: Where Shorts Go to Die (Maybe)

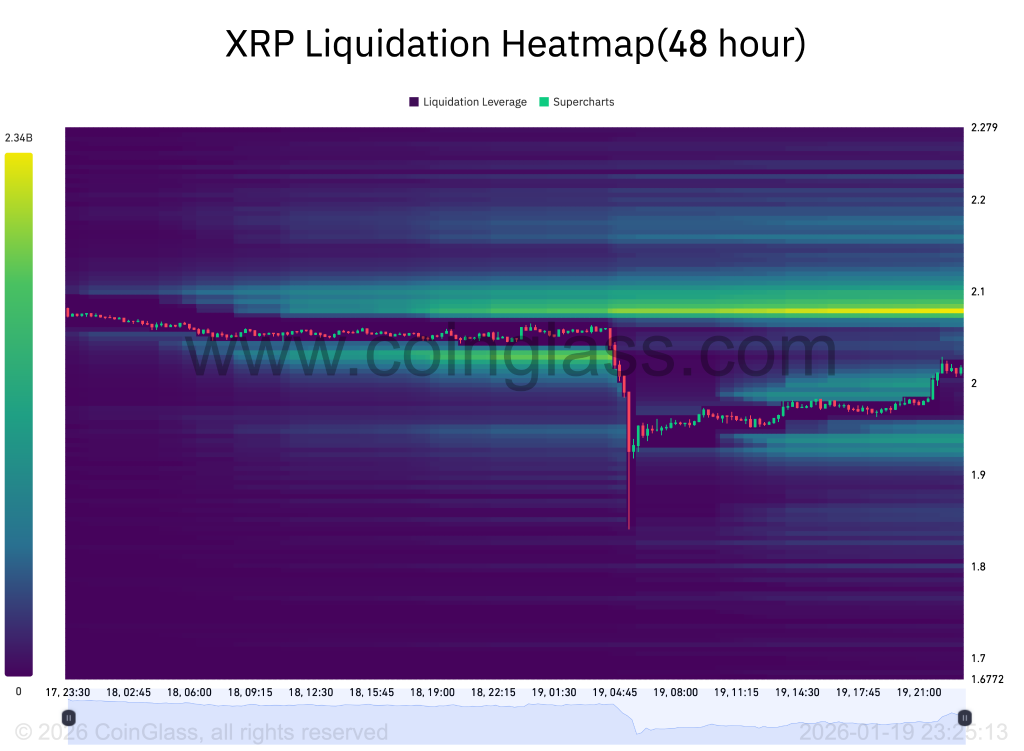

Behold, the 48-hour heatmap from Coinglass, a thing of beauty and terror! 🗺️ It shows a liquidation band thicker than a dwarf’s beard sitting just above the price at around $2.1. XRP, ever the drama queen, is currently lounging near $2.00-$2.02, waiting for its moment to shine. A push into $2.06-$2.10 is the “squeeze zone,” where shorts might get squished like a bug under a troll’s boot, and the price could zoom faster than a wizard on a broomstick. 🧙♂️🧹

Remember the last liquidation sweep? It drove XRP down to $1.70-$1.75, flushing out a chunk of downside leverage like a clogged drain. But if $2 fails again-and let’s face it, it might-the next liquidity pocket lurks around $1.90, followed by a deeper magnet zone near $1.80. Above $2.10? Higher odds of a fast wick/extension, like a firework on Hogswatch. Below $1.90? A path toward $1.80 opens up, hitting stops and late longs like a slap from Nanny Ogg. 😱

Open Interest: Leverage Takes a Nap, But It’s Waking Up

XRP’s open interest is still snoozing below its earlier peak, but recent sessions show a tiny dip. Traders are trimming leverage like a barber trimming a bad haircut-cautiously. This pullback is likely post-volatility deleveraging, where late longs either got booted or decided to cut their losses. It could also be profit-taking after XRP reclaimed the $2 handle, as short-term traders closed positions instead of chasing the dragon. Macro uncertainty and Bitcoin’s wild swings aren’t helping either, making high leverage as appealing as a date with a swamp dragon. 🐉

The impact? Two sides to this coin, like a double-headed haggle. On the bright side, lower open interest reduces “crowding,” which can limit liquidation cascades and help XRP stabilize. On the flip side, cooler leverage makes upside moves as explosive as a damp firework, turning rallies into a slow grind unless spot demand steps in. 🏗️

What’s Next for XRP? A Grind, a Squeeze, or a Plunge?

XRP’s derivatives setup points to controlled volatility, not a one-way breakout. Think of it as a carefully choreographed dance, not a bar brawl. The slight dip in open interest reduces crowding, helping the price base above $2. But the upside may be as slow as a tortoise with a hangover unless fresh leverage or spot bids return. From the liquidation map, the first upside magnet sits around $2.06-$2.10-a clean push through that zone could trigger a squeeze toward $2.15-$2.20, like a wizard’s spell gone right. 🧙♂️✨

However, if XRP keeps getting rejected near $2 like an unwanted suitor, breakdown risk rises. Slip below $1.90, and liquidation pockets could pull the price toward $1.80, with a deeper sweep into the mid-$1.70s if selling accelerates. It’s a game of cat and mouse, with the mouse being XRP and the cat being… well, everyone else. 🐱🐭

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2026-01-19 21:22