Arthur Hayes, BitMEX’s co-founder and virtuoso of financial mischief, insists Bitcoin’s dalliance with lassitude in 2025 was merely the consequence of a tightening purse-dollar liquidity squeezing like a corset at a debutante ball. A tragedy, or perhaps just a splendid plot twist with a dash of fate? 😂💸

To wit, the numbers parade in their velvet robes: Bitcoin hovering around $96,774, 24h volatility at 1.9%, market cap about $1.93 trillion, and 24h volume near $66.96 billion. It fell 14.4% last year as liquidity dwindled; gold pirouetted 44.4% in the same interval; US tech stocks pranced ahead, buoyed by state-backed capital flows rather than the pure caprice of free markets.

In a recent blog post, Hayes proclaimed that Bitcoin answers but one variable, namely the rate of fiat debasement. When liquidity contracts, BTC sulks; when it expands, it struts-like a debutante who has learned the art of rising with the orchestra. 💃📉📈

He forecasts that dollar liquidity will swell with dramatic flourish in 2026, driven by policies both clearer and more entertaining than any policy should be. He cites balance-sheet expansion at the Federal Reserve, looser mortgage conditions, and banks lending with zeal to government-backed, strategic sectors. A carnival of credit, if you will.

The BitMEX oracle also envisions that the US will continue its grand military production, a spectacle financed by credit creation through the banking institutions. Such exuberant expansion of credit, he argues, ripples through liquidity and lifts scarce assets like Bitcoin to attempted stardom. 🎭💸

Thus, a continuous expansion of money, like a well-placed quip at a dinner party, is alleged to be the condition sine qua non for Bitcoin to flirt with, or even breach, the $100,000 horizon. Hayes hazily suggests that 2026 may bear new, audacious highs for the grandest of cryptocurrencies.

Bitcoin Price Structure and Holder Behavior

As events unfold, Bitcoin is traded near $96,200, up roughly 11.5% in the past month. It has recently shattered the stubborn $94,200 resistance and flirted with $97,600 earlier on Jan. 15-quite the dramatic promenade.

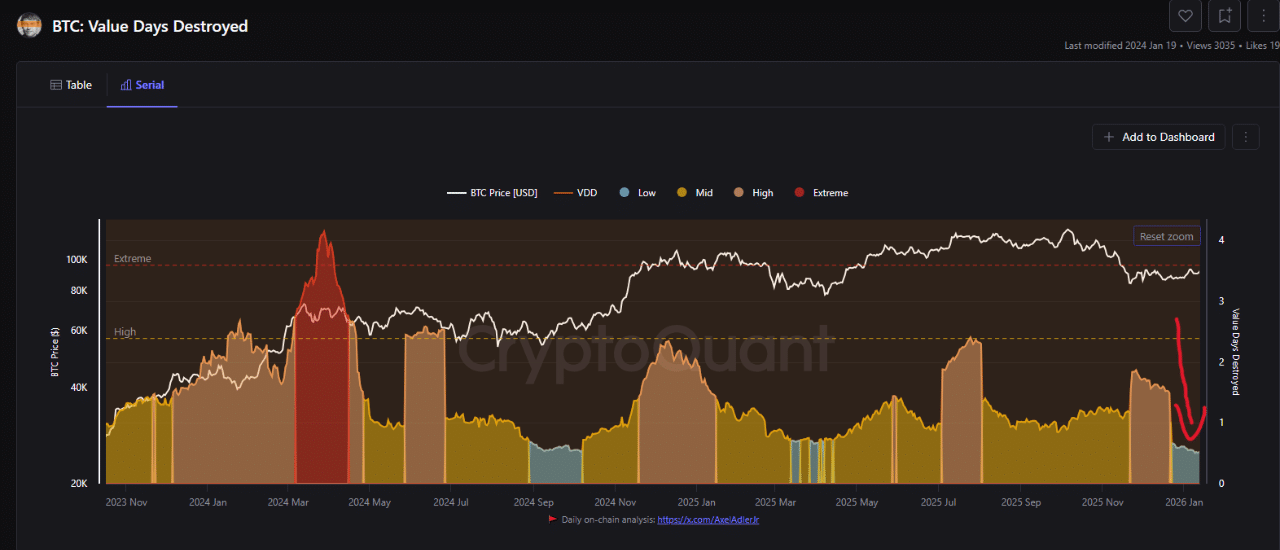

On-chain whispers from CryptoQuant suggest the Value Days Destroyed indicator hovers around 0.53 in early 2026, a remarkably low fashion for our ledger. 🧾

Bitcoin Value Days Destroyed | Source: CryptoQuant

This implies that the movers are mostly younger coins, while the venerable long-term holders remain idly seated. Such comportment hints at confidence among the shrewd investors-like a club where the new era bows to the old lamp, but with more liquidity and perhaps fewer tortoises.

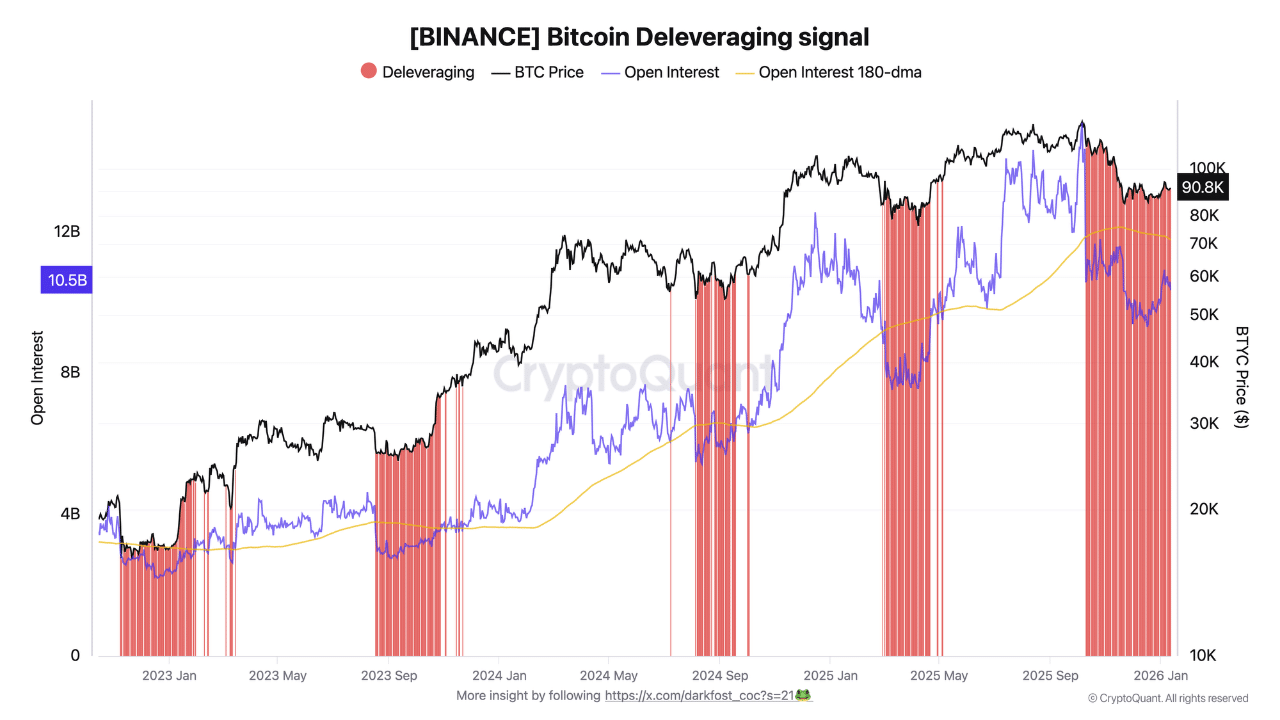

Meanwhile, the derivatives arena has undergone a grand deleveraging. Open interest has fallen more than 31% from its October 2025 peak of over $15 billion to around $10 billion, CryptoQuant reports. A prudent spring-clean, or a sign that last year’s carnival was merely rehearsal?

This follows a high-spirited year in which Binance futures volumes alone exceeded $25 trillion. A prodigious spectacle, indeed-enough to make any statistician swoon and any poet sigh. 💭💫

Bitcoin Deleveraging on Binance | Source: CryptoQuant

Historically, such reductions in leverage have a knack for resetting the stage, often accompanying the major bottoms. Many analysts now predict BTC could kiss $150,000 in the first quarter of 2026-an empire of digits and dreams, if not a flawless forecast.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2026-01-15 14:45