Crypto markets, ever the capricious beast, greeted the latest CPI print with a shrug, as though inflation’s stagnation was a mere inconvenience. Bitcoin, that old warhorse, pawed its way to intraday highs near $96,500, while Ethereum-ah, Ethereum!-galloped ahead of its peers, bursting through a consolidation band like a runaway train, its price soaring beyond $3,370.

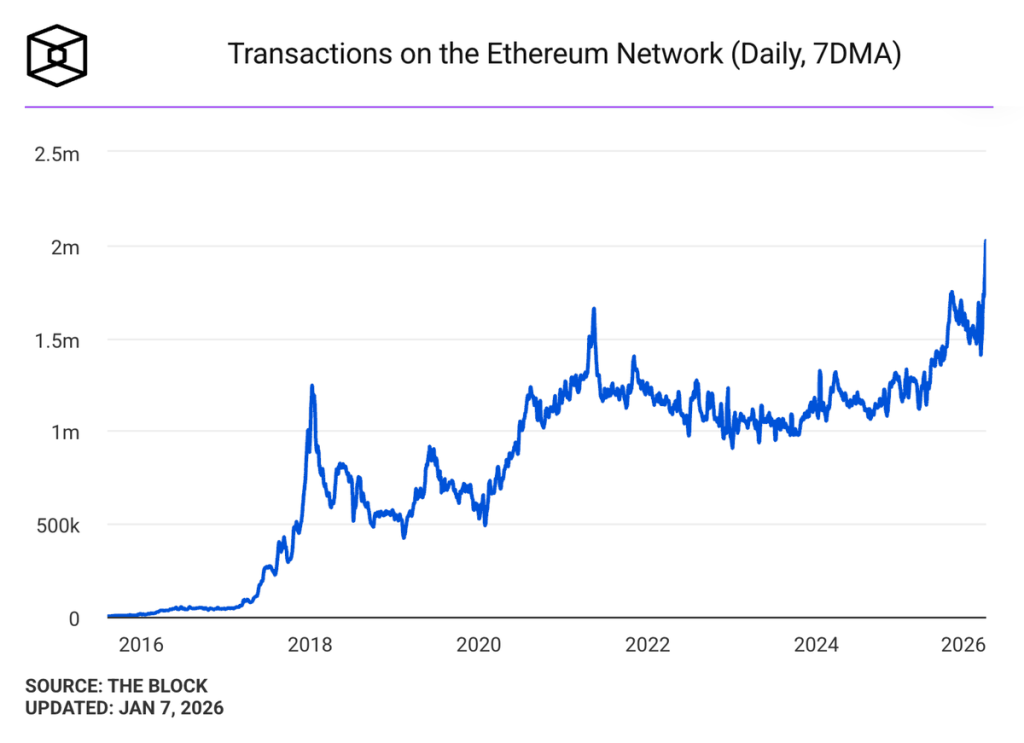

Meanwhile, Ethereum’s on-chain narrative thickened like borscht on a stove. Network activity surged to dizzying heights, with daily transactions exceeding 2 million for the first time. A sign, perhaps, that the masses are flocking to ETH like moths to a flame-or bots to a low-gas fee. Regardless, the confluence of macro tailwinds and burgeoning network fundamentals paints a bullish picture for ETH, raising the odds of it outpacing the pack in the sessions ahead. 🎨📈

Ethereum’s Activity Soars-Why Should You Care?

The ETH price, that stoic statue in the crypto bazaar, has remained unflappable even in the face of bearish onslaughts. Such steadfastness typically signals strong bullish backing and a token that hasn’t yet been flattened by volatility’s steamroller. And look-daily transactions (7-day average) have surpassed 2 million, a record-breaking feat. 🥳

Why should this matter for ETH’s price? Allow me to enlighten you:

- More activity = more demand. Basic economics, comrades. 📊

- Transactions require ETH for gas fees, so usage fuels buying pressure. 💸

- Sustained high activity means more fees, which could reduce supply via ETH burn. 🔥

But beware: not every transaction is genuine demand. Some are the work of bots or low-value shenanigans. The signal is strongest when high transaction volumes persist, and the price clings like a barnacle to key support levels. 🐚

ETH Breaks Out of Key Range-What’s Next?

The ETH price has emerged from its consolidation cocoon, fueling hopes of a bullish butterfly taking flight. On the daily ETHUSD chart, ETH’s price has been weaving a tightening structure-a multi-month compression with converging trendlines. Now, it’s pushing above the local range, challenging descending trendline resistance, and holding above mid-range support ($3,050-$3,120). 🦋

ETH is testing a breakout zone after clearing consolidation. Immediate resistance looms at $3,304-$3,322, and a daily close above the descending trendline and $3,320-$3,350 could confirm a bullish breakout. Upside targets: $3,500 and $3,875. Support to hold: $3,050-$3,120. Lose $3,050, and ETH could tumble to $2,850-$2,900. CMF hints at improving inflows, but a flat OBV suggests volume confirmation is still needed. 📉📈

This setup is common: price breaks first, volume confirms later. But if volume and OBV don’t follow, ETH might slink back into its range like a disgraced cat. 🐱

Ethereum Price Prediction 2026: $4000 or Bust?

Ethereum’s transaction count breakout bolsters the long-term usage narrative, suggesting a firmer floor for ETH. If network activity stays elevated, the price could maintain a strong ascending trend. But reaching $4000? That’s a Herculean task, my friends. 🏋️♂️

The markets are fixated on Bitcoin, whose dominance remains sky-high. Until this changes, Ethereum’s price may consolidate its gains but struggle to breach $3500 or $3800. But markets, like Moscow winters, are unpredictable. Once altcoins take center stage, ETH could lead the charge. 🌬️💎

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2026-01-14 11:54