Oh dear, oh my! The first trading week of January was like a rollercoaster ride at a fairground, complete with all the ups and downs that would make even the bravest of souls squeal! Our old pals Bitcoin and Ether decided to play a game of “who can bleed out the most” while Solana and XRP just grinned and kept on going, as if they were on a lovely picnic in the park. Investors were like children in a candy shop, but instead of gorging themselves, they seemed to be playing a rather cautious game of hopscotch!

Volatility Defines Crypto ETFs in Early January

The week kicked off with a bang of optimism, only to end with a whimper of caution. From Jan. 5 to Jan. 9 (ET), U.S. crypto exchange-traded funds (ETFs) were like a seesaw in a playground, swinging away from Bitcoin and Ether while giving a friendly pat to Solana and XRP. It seems investors were feeling a bit picky, like choosing toppings for their ice cream cones!

[bn_top-ad]

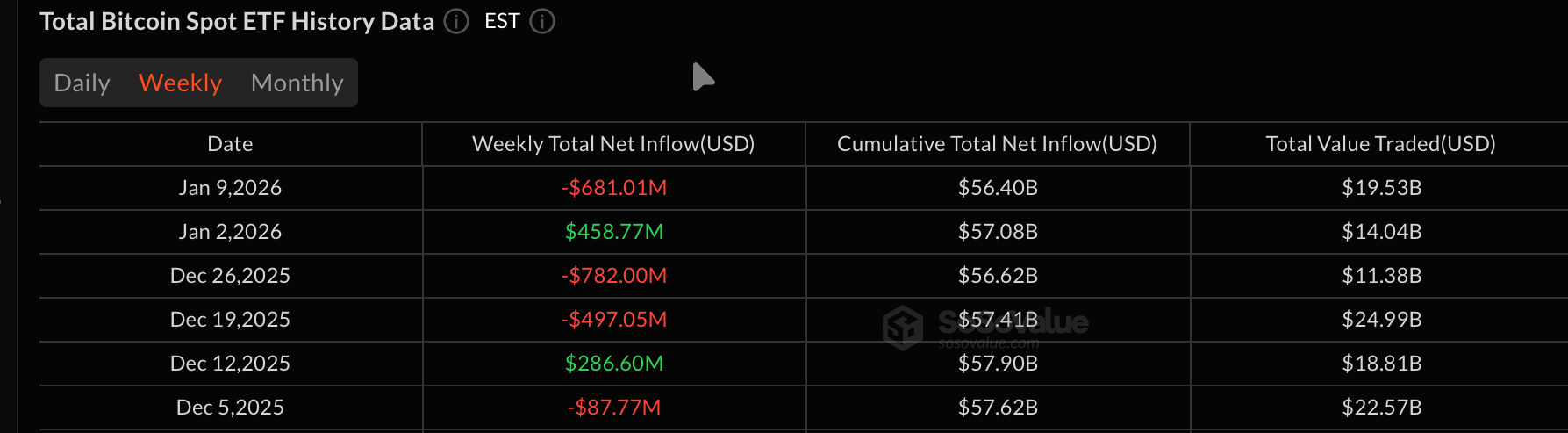

Now, hold onto your hats! Bitcoin ETFs had a weekly net outflow of a whopping $681.01 million. Talk about a dramatic plot twist! Blackrock’s IBIT was like a star performer on stage, pulling in $372.47 million on Jan. 5, followed by another $228.66 million on Jan. 6. But alas, the curtain fell hard with heavy redemptions later in the week-like a magician’s trick gone wrong-with $129.96 million on Jan. 7, $193.34 million on Jan. 8, and a staggering $251.97 million on Jan. 9.

Fidelity’s FBTC joined the party, swinging from a grand $191.19 million inflow on Monday to a series of dramatic exits totaling over $680 million from Tuesday to Thursday. And what was the cherry on top? A pitiful $7.8 million inflow on Friday-it was like trying to fill a swimming pool with a teaspoon! Grayscale’s GBTC and Bitcoin Mini Trust continued their sad song, shedding more than $200 million together, while Ark & 21Shares’ ARKB, Bitwise’s BITB, and Vaneck’s HODL ended up firmly in the red! Ouch!

Ether ETFs didn’t do much better, finishing with a net outflow of $68.57 million. The week began with a bit of pizzazz as ETHA absorbed $102.90 million on Jan. 5 and followed it up with a massive $198.80 million inflow on Jan. 6. But then, just like that pesky balloon that deflates too quickly, the momentum faded with a combined outflow of $198.07 million for the rest of the week.

Grayscale’s ETHE and Ether Mini Trust resumed their tragic outflows midweek, combining for over $195 million in exits across Jan. 6 and Jan. 8. Fidelity’s FETH and Bitwise’s ETHW slipped just a smidge, leaving the category slightly underwater by week’s end. Oh dear, what a predicament!

Solana ETFs, however, were shining bright like a penny in a wishing well! They posted a joyful weekly net inflow of $41.08 million. Bitwise’s BSOL led the charge, including $12.47 million on Jan. 5, $7.79 million on Jan. 8, and steady additions midweek. Fidelity’s FSOL and Grayscale’s GSOL also chipped in, keeping total net assets above the $1 billion mark and proving that Solana was still the toast of the town!

XRP ETFs extended their fresh but determined streak, recording a $38.07 million weekly inflow! Thanks to strong contributions from Bitwise’s XRP, Franklin’s XRPZ, and Grayscale’s GXRP earlier in the week, they managed to weather the storm of their very first daily outflow on Jan. 7, caused by a single large redemption from 21Shares’ TOXR. But by Friday, inflows had stabilized, keeping demand afloat like a buoy on a sunny day!

//www.binance.com/en/price/bitcoin”>Bitcoin

and Ether while selectively adding

Solana

and

XRP

exposure.

•

Why did Bitcoin ETFs end the week in outflows?

Early inflows were overwhelmed by a wave of redemptions as risk appetite took a vacation.

•

How did Solana ETFs perform compared to others?

Solana

ETFs shone bright, leading the market with steady inflows and keeping assets above the $1 billion mark. Bravo!

•

What does XRP’s performance signal for 2026?

Despite some bumpy rides, consistent inflows indicate growing confidence in

XRP

products. Hold onto your hats, folks!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2026-01-12 16:13