Now, listen here, folks. A seasoned oracle of the market waves a pointer, proclaiming that the winds might be shifting for that elusive creature known as Bitcoin after a tiresome bout of meekness compared to the stalwart gold. The scene unfolds as traders don their spectacles, pondering whether the dashing rise of the golden belle has chiseled cracks in Bitcoin’s once-heroic tale of sanctuary.

The Tale of the Bitcoin-to-Gold Ratio’s Plunge

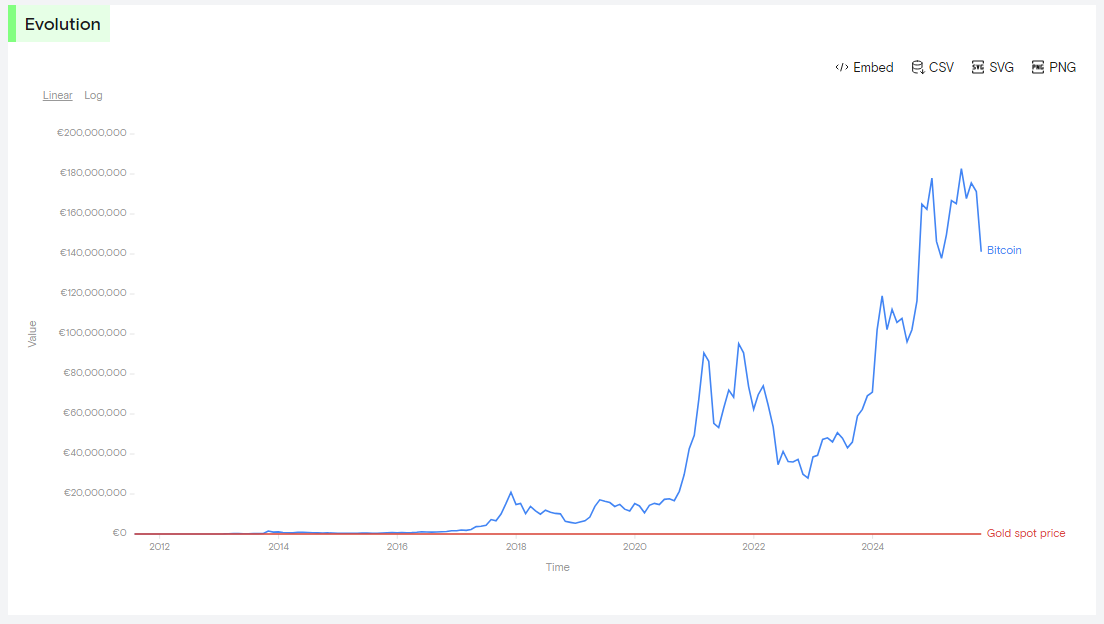

Picture this: back on the 5th of October, our young hero, the Bitcoin-to-gold ratio, was perched proudly at 32, only to tumble without a care to about 20 of late, shedding over a third of its stature. As the tale goes, if one had the gumption to buy a Bitcoin back then, they could have pocketed 32 ounces of gold. Now that’s down to a humble 20. Alas, the ratio’s descent picked up the tempo as the gold rose to its pedestal, and poor Bitcoin found itself drooping below the firm grip of its own magical levels.

Mark the calendars: on the 21st of November, this peculiar pair swooned to a lowly 20, while its RSI-oh that whimsical RSI-stood at 21.30. A curious event followed on the first of December with a meeker low of 26.83, followed by another dip to 19 by Christmas, yet lo and behold, the RSI low gallantly climbed to 32.21.

There it is, folks-a veritable dance of bullish divergences on the daily stage for our pair, BTCUSD versus Gold. Makes one wonder, “Where will this venture take us come 2026?”-ringing words from Michaël van de Poppe (that’s @CryptoMichNL for those scrolling the cyber paths) on the very last day of the old year, 2025.

This messiah of the markets, a certain Michaël van de Poppe, dubs this spectacle a “robust” bullish divergence upon the grand chart, a sign eagerly sought by any trader worth their salt, for it hints that selling pressures abate even as prices saunter lower.

A Chilly Gaze Upon the Selling Pressures

Looking through the lens of the weekly chart deepens our insight. The weekly RSI for our dynamic duo-BTC and gold-lies precariously at about 31.85, a position trodden during the dismal days of the November 2022 sell-off, an echo from when the FTX did tumble. Tales tell of this level marking the nadir in that tragic cycle.

Curiously, similar RSI lows have graced our history books back in 2015 and 2018. Together, the daily divergence and this weekly RSI stand as an enigmatic couple, suggesting that perhaps the downtrend’s stride is faltering, though fortune remains as fickle as ever.

A Clash of Investor Sentiments

Ah, but let me tell you of gold’s dramatic ascendance. It soared by over 70% in the annals of 2025, whilst Bitcoin saw fit to slither backward by 7%, at least by some reckonings. At the hand of current times, Bitcoin fetches but $87,750, suffering a 4.8% loss over the span of the year.

The unraveling of this Bitcoin-to-gold romance, coupled with Bitcoin’s unwavering modesty below the $100,000 mark, ignites renewed skepticism over Bitcoin’s title as “digital gold.” Meanwhile, gold struts to historic highs.

Short-term investors, smart as whips, heap their bells and coins on gold for keeping their bankrolls snug. They snuggle against the metal as it climbs, while long-term dreamers continue to tout Bitcoin’s hefty potential once the tides of adventure and risk sweep back in.

Come hither, for the crystal ball remains murky. As our tale unfolds, much rides on whether this BTC/GOLD ratio and the dance of prices manage to vault above their enchanted numbers. Until such grand leaps are seen, our signals will dance as timidly as a debutante at her first cotillion.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2026-01-01 16:37