Bitcoin has spent the last day trading like it’s stuck in a bubble bath of indecision, oscillating between $87,418 and $90,307. On the surface, it’s the crypto equivalent of a nap-calm, cozy, and slightly suspicious. But beneath this yawn-inducing range? A derivatives circus. Futures and options markets are busy building a Rube Goldberg machine of positioning for 2026, like traders are prepping for a crypto Olympics nobody invited them to.

Bitcoin Derivatives Markets Show Intent as Spot Price Treads Water

While spot bitcoin refuses to pick a direction (probably waiting for a motivational TED Talk), futures and options markets have been hard at work during the holiday lull. Think of them as the overachievers in the crypto classroom-grading themselves with glitter while everyone else is napping. These instruments? They’re the diviners of trader intent, like a psychic hotline for 2026.

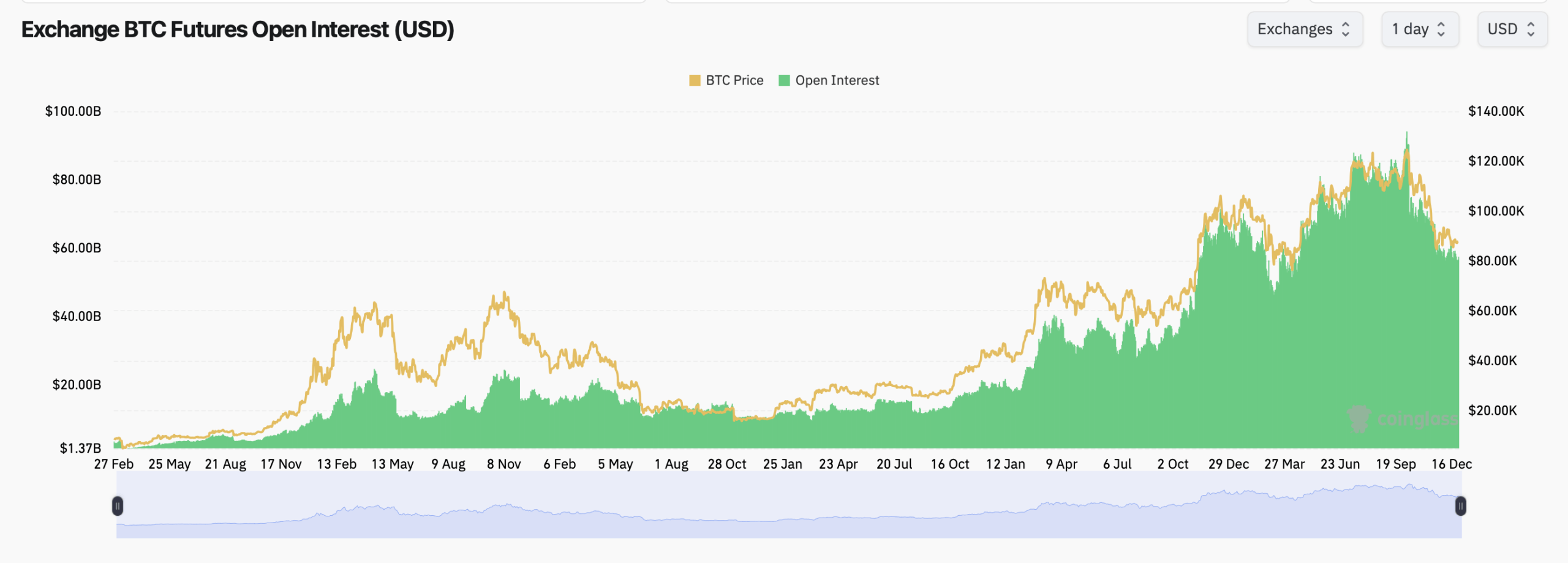

Data logged by coinglass.com shows aggregate bitcoin futures open interest sitting at a sprightly $57.45 billion. That’s not exactly “panic buy” territory, but it’s the financial equivalent of a slow clap. Traders are stacking contracts like pancakes, but with the grace of someone who knows they’re not in a hurry to burn the kitchen down.

CME, the Wall Street toddler of crypto, is holding $9.87 billion in open interest, or 112,380 BTC, which is 17.18% of the global total. Meanwhile, alt-derivatives platforms are doing the cha-cha of volume dominance, but CME’s there like, “Institutional participation? I’m here, bby.”

Binance leads the pack with $11.05 billion in OI, followed by Bybit ($5.26B) and OKX ($3.23B). Kucoin and Bitget? They’re playing the “I’ll show up later with a bigger stack” card. Open interest changes? Modest, like a shy librarian at a rave. Leverage is being managed like a toddler with a juice box-carefully, and with one hand tied behind your back.

Bitcoin Options Lean Bullish, but Max Pain Looms

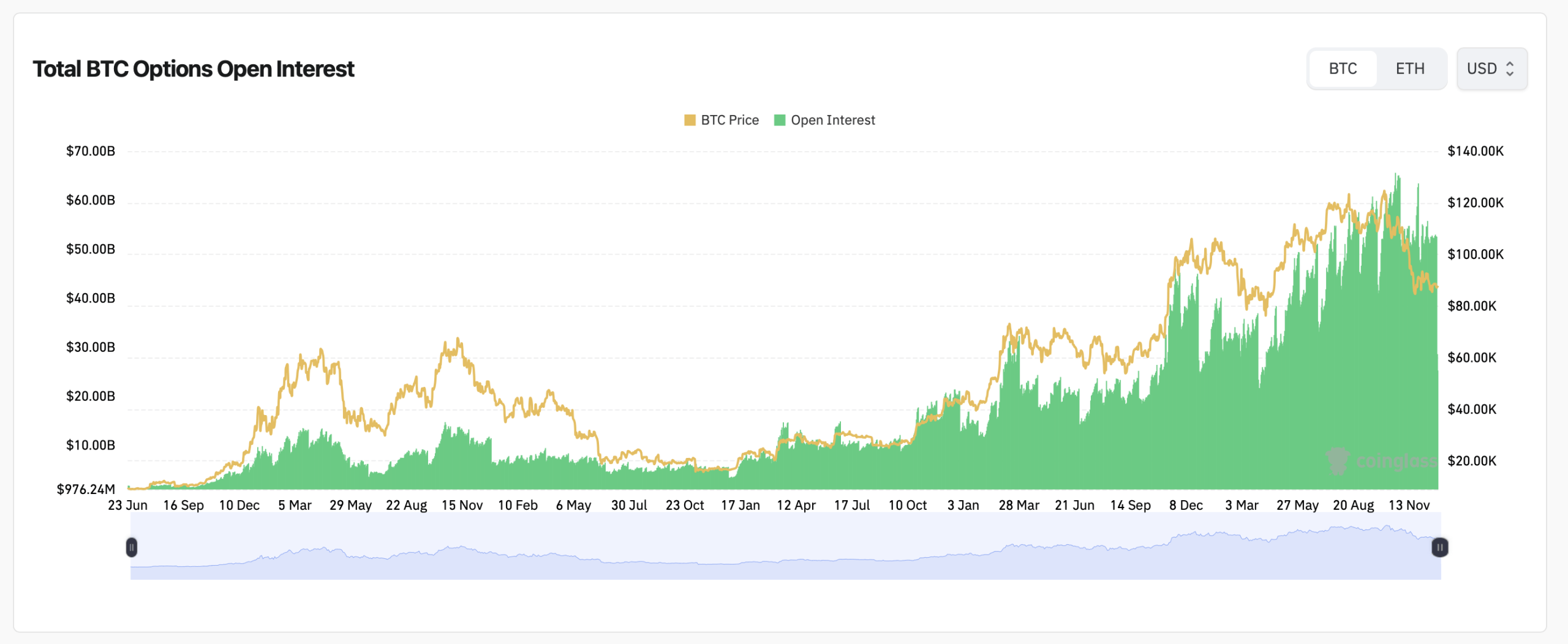

If futures are the commitment phobia of crypto, options are the full monogamy. Total options open interest is climbing like a squirrel on a caffeine IV, with calls making up 56.83% of the fun. Puts? They’re the awkward cousin at the family reunion. Traders are betting on the upside like it’s a Black Friday sale they don’t want to miss.

Call volume represents 54.15% of traded contracts, because why not hedge your bets like you’re playing chess with a bear? CME’s options market is the Switzerland of derivatives-balancing calls and puts like a tightrope walker with a third eye. Max pain levels? They’re the crypto version of a bad breakup: $90,000 on Deribit, slightly below spot on Binance. Price points where options expire worthless? They’re the gravitational pull of derivatives drama.

Bitcoin’s trading just under those thresholds like it’s playing a game of chicken with expiration dates. Long-term taker ratios? Neutral as a Swiss bank vault. Buyers and sellers are meeting like two strangers at a bar who both ordered the same drink-no eye-rolling, just mutual respect.

What This Means as 2026 Approaches

Futures and options data scream: “We’re ready, 2026. Bring it.” Open interest is elevated, calls are winning, and expirations are stacked like a Jenga tower of expectations. Max pain levels and neutral taker flows are the crypto world’s version of a reality check: “Yes, we’re excited… but also, we’ve seen this movie before.”

Bitcoin may be consolidating like it’s waiting for a sequel, but derivatives traders are building the next chapter. Whether it’s a bull run or a bear trap, they’ve got spreadsheets for that.

FAQ ❓

- What is bitcoin futures open interest?

It’s the total value of futures contracts still hanging around like an ex who won’t stop texting. - Why do bitcoin options calls exceed puts?

Because traders are betting on the upside like it’s a free buffet and the downside is a salad. - What does max pain mean in bitcoin options?

It’s the price where options expire worthless, like a bad haircut and a broken toaster. - Why does CME activity matter for bitcoin?

Because institutional participation is crypto’s version of a parent checking your phone.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Wuthering Waves Mornye Build Guide

- All Brawl Stars Brawliday Rewards For 2025

2025-12-29 19:08