Launched in the latter months of 2025, these…Solana exchange-traded funds – a curious invention, indeed – promptly began to attract capital. A rather robust initial influx, coupled with a passable degree of liquidity and a seemingly respectable growth in assets, suggests they may linger in the financial landscape through 2026. One almost feels pity for those who missed the initial fervor. 🙄

A Delayed Arrival, Yet All the Fuss: Solana ETFs in 2025

Solana ETFs, arriving not with the spring of a new year but the chill of autumn, found themselves amidst a world already captivated by the tales of Bitcoin and Ether. One could hardly blame them for feeling a bit…late to the party. And yet, what followed was a most hurried year-end, revealing both the capricious appetite of investors and a growing acceptance – one might even say a resignation – to dabble in these…altcoins.

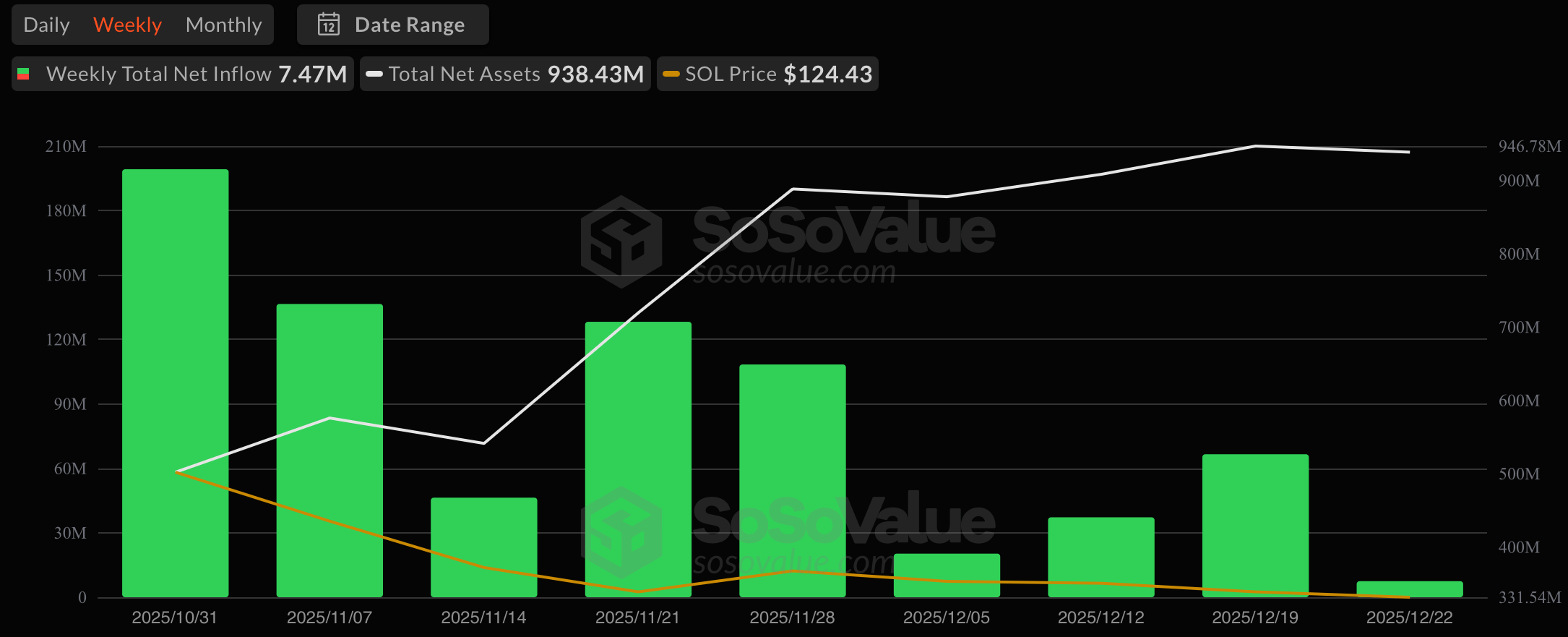

The very first week set the tone, a flurry of activity that suggested a desperate need to have some, even if no one could quite articulate why. By October 31st, these solana ETFs had gathered a respectable, though hardly astounding, $199.21 million. Net assets reached $502 million – a sum that, while significant, buys remarkably little peace of mind in these uncertain times. Trading was, shall we say, animated, with some $255 million changing hands. It wasn’t merely experimentation, it was…enthusiasm. A peculiar and perhaps slightly unsettling enthusiasm. 😂

November saw this trend…accelerate. Over four weeks, more than $419 million flowed in. The week of November 7th was particularly frantic, with $136.5 million poured in alongside $260.9 million traded. By mid-month, assets had surpassed $700 million, then practically scurried towards $900 million as even the most skeptical institutions succumbed to the siren song of potential profits. Such haste! Where is the measured contemplation of a bygone era?

Liquidity, that elusive phantom of the market, was present. Trading volumes hovered between $180 million and $295 million each week. This suggests these solana ETFs were used for… tactical maneuvers, rather than the tranquil slumber of long-term investment.

December offered a slight respite from the frenzy, though the inflows continued, albeit at a more measured pace. An additional $161.5 million found its way into these funds. The week before mid-month saw a surge, with $66.55 million entering alongside a brisk $270.75 million in trades. By December 22nd, totals reached $938.43 million, tantalizingly close to the symbolic $1 billion mark. How very dramatic. 🙄

Remarkably, not a single week saw capital fleeing these ventures. Even as the broader crypto markets experienced turbulence, these Solana ETFs held firm. A sign of confidence, perhaps? Or merely a lack of other, more pressing concerns? 🤔

The tale of Solana ETFs in 2025 is, at its heart, a story of opportune timing. Arriving after investors had become accustomed to the novelty of spot crypto ETFs was…convenient. The market understood the construct, the risks, and the potential rewards (or, more accurately, the hope of rewards).

As we approach 2026, the pivotal question is one of endurance. With nearly $1 billion in assets and a modest level of liquidity, solana ETFs enter the new year with a certain…momentum. But will it last? Future inflows will hinge on whether solana can sustain itself as something more than a high-risk gamble within those carefully constructed institutional portfolios. One suspects many will discover, with a sigh, that it cannot.

FAQ 🚀

- When did these U.S. Solana spot ETFs finally make their grand entrance?

On October 28, 2025, they arrived, fashionable latecomers to a party already in full swing. - How much wealth did these Solana ETFs manage to accumulate in 2025?

A nearly $1 billion hoard, gathered within two months, through consistent inflows and a remarkable absence of outflows. - What peculiar characteristic defined the trading of these Solana ETFs?

A robust liquidity, suggesting active trading rather than patient, long-term holding. - What fortunes will dictate the fate of Solana ETF performance in the year 2026?

Their sustainability will depend on the performance of the network, the growth of its ecosystem, and, ultimately, whether solana can offer something truly compelling.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-12-28 20:09