Hyperliquid Labs, with the solemnity of a Shakespearean tragedy, denies insider trading allegations after blockchain sleuths spotted a suspicious wallet playing financial peekaboo with HYPE tokens.

The timing couldn’t be more poetic-like discovering your ex is dating your neighbor right before your birthday party. The decentralized exchange faces this storm just as validators prepare to vote on incinerating $1 billion worth of HYPE tokens. 🔥

Walletgate: A Tale of Crypto Intrigue and Terminated Employees

The plot thickened faster than oatmeal left overnight when traders noticed a wallet (allegedly connected to Hyperliquid) shorting HYPE during token unlocks-because nothing says “team spirit” like betting against your own project. 😏

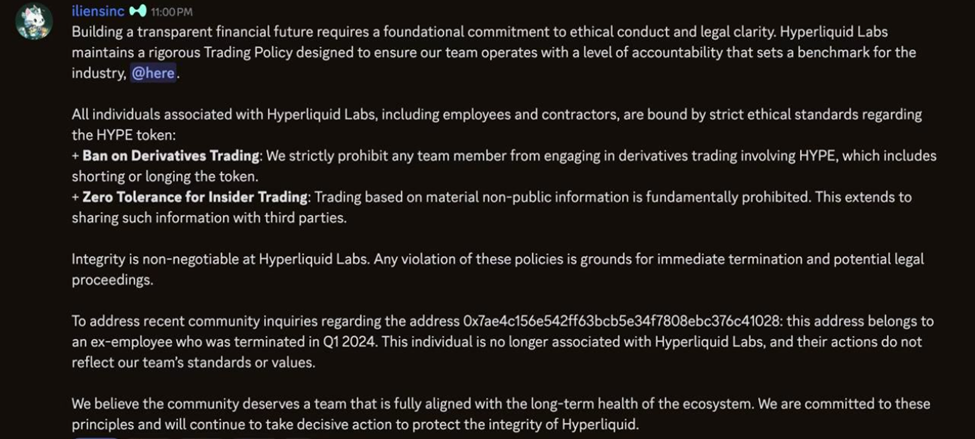

Hyperliquid insists the wallet (0x7ae4c156e542ff63bcb5e34f7808ebc376c41028) belongs to a former employee fired in Q1 2024-conveniently before December’s drama. Because in crypto, timing is everything… like accidentally tweeting “HODL” during a flash crash.

“Building a transparent financial future requires ethics… and maybe a few NDAs,” Hyperliquid Labs declared, with the gravitas of a corporate press release. “Our team wouldn’t trade HYPE derivatives if you paid them in Lambos.”

Their statement included a trading policy so strict, it bans team members from even thinking about shorting HYPE-though enforcement remains as tricky as spotting a Satoshi in a Bitcoin whitepaper. 🤷♂️

“Integrity is non-negotiable,” Hyperliquid added, presumably while side-eyeing the rogue wallet. “This individual’s actions reflect their own poor life choices, not ours.”

The exchange framed this as “ecosystem stewardship,” which in crypto-speak means: “Please ignore the man behind the curtain-we’ve got a $1B burn vote to hype!”

The $1B Question: To Burn or Not to Burn? 🔥

Meanwhile, Hyperliquid’s validators face a decision straight out of a dystopian novel: Should they ceremoniously torch $1B in HYPE tokens, removing them from circulation like a magician’s disappearing act-except with fewer rabbits and more volatility?

The Hyper Foundation proposes burning Assistance Fund HYPE tokens-because nothing says “deflationary” like setting money on fire. 🔥

The vote ends December 24. Festive!

– Hyper Foundation (@HyperFND) December 17, 2025

The Assistance Fund automatically converts fees into HYPE and locks them in a wallet with no private key-a system so secure, even the developers can’t access it. (Unless, of course, someone “accidentally” hard forks it. 🤫)

“$1B HYPE could vanish overnight,” wrote Coin Bureau analysts, “reducing supply by 10% and theoretically making everyone’s bags heavier-unless the market shrugs and dumps anyway.”

Hyperliquid’s defenders point to its anti-VC ethos, massive airdrop, and $3.4T trading volume-achieved with a team smaller than a Telegram group chat. Efficiency! Or sleep deprivation. Hard to say.

As the burn vote collides with Walletgate, Hyperliquid’s future hangs in the balance-like a trader deciding whether to FOMO in or panic-sell. Will credibility prevail? Or will this saga become another crypto cautionary tale? Stay tuned. 🍿

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

2025-12-22 11:38